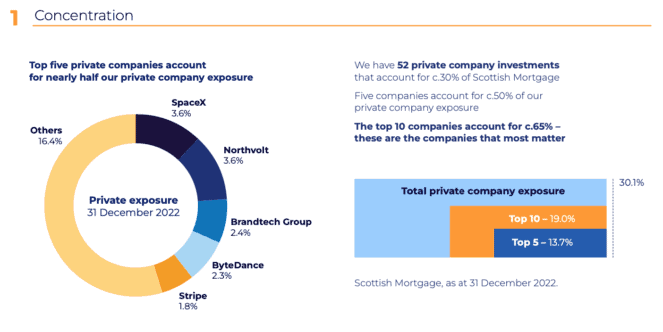

Scottish Mortgage Investment Trust (LSE: SMT) has made headlines recently after a non-executive director of the trust flagged concerns over its exposure to unlisted companies. Last year, these accounted for more than 30% of the portfolio.

This has some investors wondering whether SMT could be going the way of Woodford Investment Management (which ran into problems several years ago on the back of its exposure to unlisted businesses).

Could Scottish Mortgage be the next Woodford? Let’s discuss.

Scottish Mortgage versus Woodford

Looking at Scottish Mortgage today, I see several key differences between this trust and Woodford’s flagship investment fund, which shut down in 2019.

Firstly, SMT is a growth product and its manager, Baillie Gifford, has made it very clear the trust invests in unlisted companies. By contrast, Woodford’s flagship fund was an ‘equity income’ product. Ultimately, the Woodford fund was meant to be investing in dividend stocks to generate income for investors. When the fund diverged from its strategy, this upset people, leading to large withdrawals.

Now, the Woodford Equity Income fund was an ‘open-ended’ fund, meaning it had to manage inflows and outflows. And big outflows became a problem. To meet redemptions, it needed to sell investments, which caused major challenges.

SMT is unlikely to face these kinds of challenges however, as it is a ‘closed-ended’ investment company. This means it has a fixed amount of capital to invest. As a result, it doesn’t need to worry about selling investments to meet withdrawals.

Large businesses

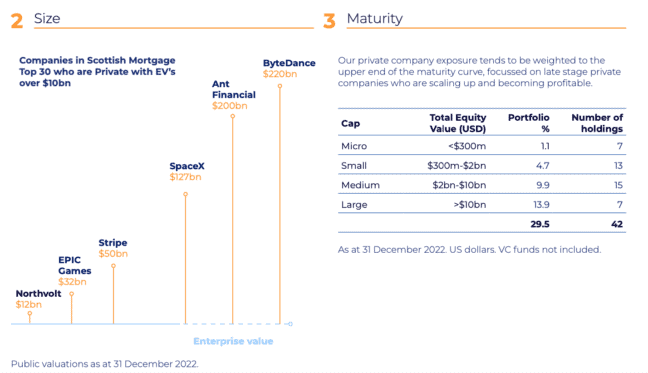

Another big difference between Scottish Mortgage and Woodford is that the former tends to invest in larger, unlisted businesses while the latter was invested in smaller companies. Most of Scottish Mortgage’s unlisted companies are worth $2bn+. Some of its largest unlisted businesses are so big that they would rank in the top 20 companies in the FTSE 100 index by market-cap.

One company, ByteDance, has a valuation of around $220bn. The fact SMT’s unlisted businesses are generally more mature means risk levels are lower compared to Woodford’s unlisted investments.

Our private company exposure tends to be weighted to the upper end of the maturity curve, focussed on late stage private companies who are scaling up and becoming profitable.

Scottish Mortgage Investment Trust

Transparency

Finally, SMT provides more information on its unlisted company holdings than Woodford did. For example, here is some data from a recent factsheet on its unlisted holdings. This kind of data should help to ease investors’ nerves.

Source: https://www.bailliegifford.com/literature-library/funds/investment-trusts/scottish-mortgage/scottish-mortgage-private-companies/

My take

Putting this all together, I don’t think SMT is likely to go the same way as Woodford Investment Management. Ultimately, it’s in a very different situation.

Having said that, investors should acknowledge the risks here. Given that 30% of the trust can be invested in unlisted businesses, this is very much a higher-risk product.

Those invested in the trust should ensure they are comfortable with their exposure and that they own plenty of other investments for diversification.