British banking stocks have been under pressure in recent days, arguably victims of ripples (or perhaps waves is a better analogy) from events across the pond.

So we asked two Fools to name their favourite shares in the sector right now, and why. As ever, note that returns are not guaranteed and past performance is not a reliable indicator of future results.

Lloyds can withstand downturns better than most

John Choong: Buying bank stocks is a risky affair, in my opinion, given how quickly they can collapse. As such, investing in a bank with ample liquidity and a robust balance sheet is paramount, especially after the recent events surrounding the collapse of Silicon Valley Bank.

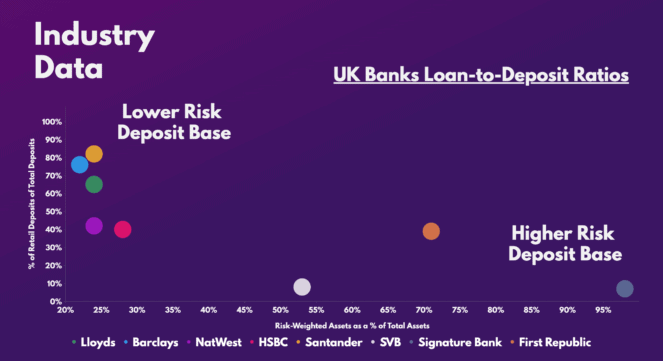

Unlike their US counterparts, UK banks aren’t as heavily exposed to risk-weighted assets. So the likelihood of a liquidity crisis stemming from a bank run is unlikely. Therefore, I believe Lloyds (LSE: LLOY) presents the best risk-to-reward proposition, boasting a vigorous balance sheet while being able to generate healthy returns.

Data source: Lloyds, Barclays, NatWest, HSBC, Santander, SVB, Signature Bank, First Republic

While there’s no shying away from the fact that some of its UK-based competitors have healthier financials, it’s worth noting that the Black Horse bank still trumps its big four peers in having better countercyclical buffers. In other words, Lloyds is a much stronger bank in being able to withstand potential losses during economic and market downturns. This is evidenced by its stronger CET1 (which compares a bank’s capital against its assets), CCLB (countercyclical leverage ratio buffer), and CCyB (countercyclical capital buffer) ratios.

| Metrics | Lloyds |

| CET1 ratio | 15.1% |

| CCLB ratio | 0.3% |

| CCyB ratio | 0.9% |

Although Lloyds isn’t the cheapest alternative among the FTSE banks, it’s worth noting that its shares are still reasonably valued versus the industry average.

| Metrics | Lloyds | Industry Average |

| P/B value | 0.7 | 0.7 |

| P/E ratio | 6.4 | 9.2 |

| FP/E ratio | 7.0 | 6.3 |

More lucratively, despite the lower outlook in net interest margins provided by the British-centric lender, its return on tangible equity (ROTE) is still expected to trump the other lenders at 13%. This means that I’ll be getting a higher return on my investment. Pair that with the long-term growth prospects of the housing market in the UK, and investing in the nation’s biggest mortgage lender certainly seems more lucrative, especially given the recent dips.

John Choong has positions in Lloyds Banking Group Plc.

Barclays on an unmissable valuation

Alan Oscroft: If you’d asked me for my favourite UK bank stock a few weeks ago, I’d have picked Lloyds. But after recent events, I now think Barclays (LSE:BARC) edges it in the value stakes.

In the US, the collapse of Silicon Valley Bank — owned by SVB Financial Group — put the wind up Wall Street. Then the failure of Signature Bank led to large scale panic.

Now, investors on both sides of the Atlantic are scared of a major banking crisis. What’s it got to do with Barclays?

Barclays is the only UK bank that really embraced international commercial banking after the big financial crisis. So it has considerable exposure to the US banking world, unlike Lloyds.

That’s a significant risk, and I can understand shareholders dumping their stock. But does it justify a such a big sell-off? I don’t think so.

In the grip of panic, the markets have pushed Barclays shares down to a price-to-earnings (P/E) multiple of only five, based on 2023 forecasts. I think that’s a crazy over-reaction.

Barclays is subject to FCA regulation, and that’s among the world’s strictest. Gone are the days of free-for-all with risk and liquidity. It’s very different to the US, where regulations have been eased (allowing what looks like recklessness at Silicon Valley).

Barclays looks to me as if it’s valued to go bust. But, though I do see significant short-term risk, I reckon there’s slim to no chance of that happening.

Alan Oscroft has positions in Lloyds Banking Group Plc.