Value shares were all the rage last year as global stock markets struggled. However, following the sell-off in the more speculative areas of the market, many growth stocks look cheap to me at present. I’m considering adding some to my long-term investment portfolio as a result.

I’ve been browsing the FTSE 100 and FTSE 250 to identify shares with strong potential, and settled on two that I think could be good buys for me in March.

Let’s explore each in turn.

Scottish Mortgage Investment Trust

Scottish Mortgage Investment Trust (LSE:SMT) is a cornerstone of my growth stock portfolio. Unfortunately, that hasn’t worked out so well as my position is deep in the red.

That said, I’m a long-term investor, so I’m not too preoccupied with short-term volatility. I think the current Scottish Mortgage share price dip could be a golden opportunity for me to invest more in this growth share focussed fund.

The FTSE 100 investment trust has a truly global portfolio, with over 54% of its equity holdings located in North America, 24.5% in Europe, and 15.3% in Asia. It has stakes in 52 private companies, representing over 28% of the total portfolio.

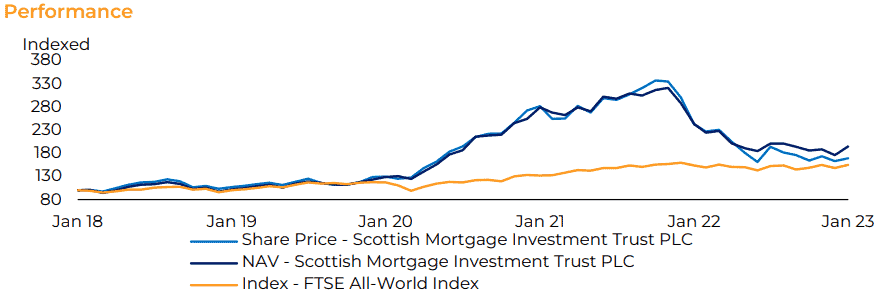

Despite the share price slump, Scottish Mortgage is still outperforming the FTSE All-World Index, which the trust uses as a benchmark.

There are notable challenges facing the fund. A possible US recession is perhaps the most obvious. Interest rate risk is another. If the Federal Reserve continues to pursue monetary tightening, bonds and cash savings will look increasingly appealing, which could drive investors away from riskier assets.

Nonetheless, I’m still bullish on the fund’s top holdings in the long term. After all, Scottish Mortgage owns some of the most innovative companies in the market.

| Stock | % of the Scottish Mortgage portfolio |

|---|---|

| Moderna | 9.4% |

| ASML | 7.3% |

| Tesla | 4.1% |

| MercadoLibre | 3.9% |

| Illumina | 3.6% |

Today’s share price of 718.6p represents a 15.9% discount relative to the net asset value of the fund’s investments. That looks like a buying opportunity to me.

Kainos Group

Turning to the FTSE 250, Kainos Group (LSE:KNOS) is another growth stock on my watchlist. This Belfast-based business provides information technology services, software, and consulting solutions to a variety of companies and organisations.

The Kainos Group share price has struggled in 2023 so far, slumping 11%. But I think this could be a good time for me to take a position in the company.

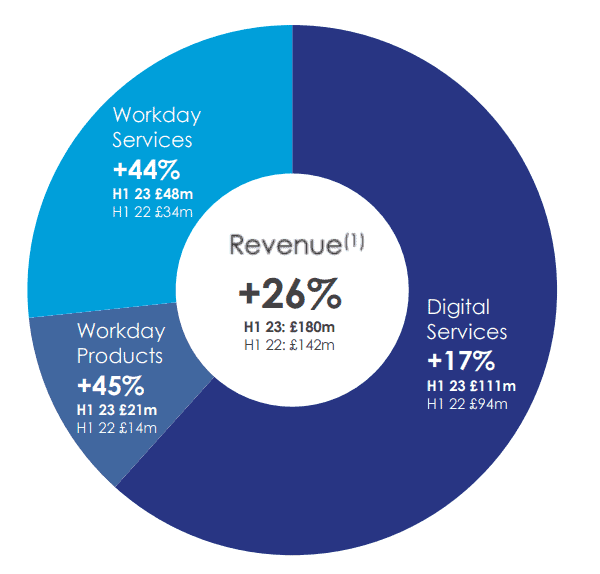

The interim results for half-year 2022 showcase the ongoing strength of the company’s partnership with US software vendor Workday. Revenues for this division were particularly encouraging.

Elsewhere, Kainos should benefit from robust demand for its artificial intelligence and SaaS solutions.

Inflation is a key challenge facing the business. The firm’s operating expenses increased 35% to £56.8m in H1 2022, which was higher than the company’s revenue growth.

Another consideration is cybersecurity. A successful cyberattack could cause significant reputational damage considering Kainos operates in sensitive areas, such as NHS digital infrastructure.

Nonetheless, the company is debt-free and its growth prospects look attractive. If I had some spare cash, I’d buy Kainos shares today.