Plenty of FTSE 250 shares offer attractive dividend yields. With passive income on my mind, I’ve been looking through the UK’s mid-cap index for high-yield stocks to invest in.

One dividend stock that looks appealing is NextEnergy Solar Fund (LSE:NESF), a renewable energy investment company that owns a portfolio of diversified solar infrastructure assets and complementary technologies, such as energy storage facilities. At present, the stock yields 6.9%.

Here’s my take on the outlook for this green energy business.

A stock for the future

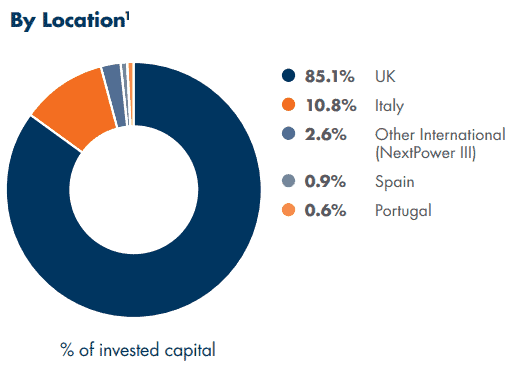

NextEnergy Solar Fund has around £1.2bn assets under management, which comprise 99 solar investments. It’s a great pick for an ESG-conscious investor like me due to the company’s sustainable ethos and positive climate impact. The firm’s operating portfolio is largely concentrated in the UK, but it also has a notable presence in the Italian energy market.

Energy security and climate change are two major global challenges. Disruption in commodities markets caused by the war in Ukraine has required significant government intervention to cap energy prices. In that context, home-grown power sources have never looked more attractive. I believe the fund stands to benefit from this tailwind.

The company’s green credentials are strong. For the year ended September 2022, the business estimates that 266,500 tonnes of CO₂ emissions were avoided due to its solar operations. In addition, its assets produced enough energy to power 354,274 UK homes.

A key risk facing this FTSE 250 stock is the possibility that electricity generation could fall below expectations. Another challenge is the new UK windfall tax on renewable energy providers, levied at 45% from 2023 to 2028. If this translates into reduced investment in the sector, it could limit the company’s growth prospects.

Earning passive income from dividends

The NextEnergy Solar Fund share price is up 5% on a 12-month basis. But the dividend yield is the most compelling reason to invest in this company in my view. After all, the fund’s stated aim is to provide shareholders with “an attractive income, principally in the form of regular and reliable dividends“.

The latest news on the dividend front is positive. An interim dividend of 1.88p per share for the quarter to 31 December 2022 represents a year-on-year increase compared to 1.79p in same period in 2021.

To illustrate the point, if I had £1,000 to invest, I could earn over £69 in passive income each year at today’s dividend yield. That’s more than I could expect from the vast majority of FTSE 100 and FTSE 250 stocks.

Granted, forward dividend cover is a little low at 1.3-1.5 for 2023. I’d like this to be higher. Nonetheless, I think it should be sufficiently stable to rely on the fund as a handy passive income generator, particularly if growth exceeds expectations.

Why I’d buy this FTSE 250 share

NextEnergy Solar Fund shares stand to benefit from long-term demand for renewable energy solutions. As a long-term investor, I think this company looks like a good buy-and-hold opportunity for my portfolio.

With a market-leading dividend and a price-to-earnings ratio below five, if I had some spare cash, I’d invest in this stock today.