On the back of a disappointing set of full-year results, Barclays (LSE:BARC) shares are down almost 10%. Nonetheless, the recent dip could present a buying opportunity for those seeking some passive income.

Having its wings clipped

Like other high street banks, Barclays was expected to perform well in 2022 as a result of higher interest rates. This was the case for its top line, as total income improved by 14%. However, a number of factors offset these gains, leading to a decline in net profits, which was why Barclays shares took a dive.

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Total income | £24.96bn | £21.94bn | 14% |

| Net interest margin | 2.86% | 2.52% | 0.34% |

| Impairment charges | £1.22bn | -£0.65bn | 288% |

| Net profit | £5.02bn | £6.21bn | -19% |

| Return on tangible equity (ROTE) | 10.4% | 13.1% | -2.7% |

First and foremost, its investment banking division came to a halt in 2022, as financial markets took a tumble. This was the main culprit behind the decline in ROTE. Second, higher impairment charges forced the Blue Eagle bank to set aside more of its profits to cover bad debts. And to make matters worse, Barclays shared that it had to set aside an additional £1.59bn for litigation charges, which impacted its bottom line further.

Dovish prospects?

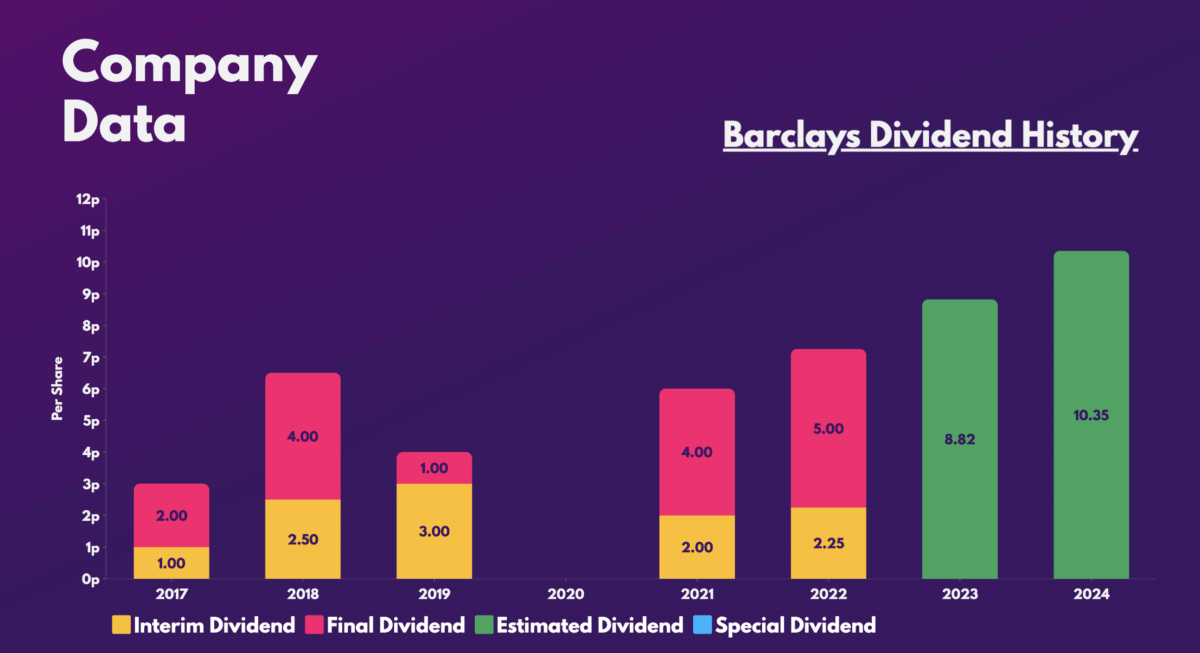

Despite the negatives though, the lender is still dishing out a 21% increase in its dividends, to the delight of passive income investors. And to make things sweeter, it also announced plans for another stock buyback programme worth £0.5bn, enriching shareholder value. This makes a solid case for investing in Barclays shares for both its passive income and growth potential.

After all, the company is guiding for a better 2023. The conglomerate is anticipating its net interest margins to be higher than 3.2%, while targeting at least a 10% ROTE. As such, analysts are forecasting a forward dividend yield of 5.1% and 5.9% over the next two years.

Finding its balance

Nonetheless, it’s worth noting that such strong forecasts will be heavily determined by the health of the economy, as well as the outlook for interest rates moving forward.

On the one hand, an easing of rates could see a rebound in the firm’s investment banking activity. This would provide a huge boost to its overall income. However, Barclays will also see net interest margins come down, which could affect the lucrative payouts. On the other hand, higher rates will allow the group to continue accumulating net interest income without costs. But this will come at the expense of potentially higher impairment charges.

Either way, investing in Barclays shares isn’t a bad idea for generating a source of second income. Its payouts are well covered at 4.2 times, and its CET1 ratio (which compares a bank’s capital against its assets) remains strong. Hence, it’s no surprise to see JP Morgan, Citi, and Goldman Sachs all have bullish ratings on the stock, with an average price target of £2.46. This presents a 42% upside from current levels.

Its valuation multiples are cheap, and it certainly has passive income potential. That said, its consistent issues with the law are off-putting and add a tinge of unreliability to its bottom line and future shareholder returns. Even so, I think the stock looks too cheap to ignore at current levels, and is why I’m planning to start a position.

| Metrics | Barclays | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.4 | 0.7 |

| Price-to-earnings (P/E) ratio | 5.5 | 9.8 |

| Forward price-to-earnings (FP/E) ratio | 5.5 | 6.8 |