Long-term investors in Sainsbury’s (LSE: SBRY) shares can taste the difference in the supermarket’s returns this year after a difficult 2022.

The company’s share price has climbed 15.5% since the beginning of January, which means it’s now only down 6% on a 12-month basis. In addition, index-beating dividend distributions make the FTSE 100 stock an attractive choice for passive income seekers.

If I had some spare cash, here’s how I’d invest in the UK grocery chain for a £300 annual yield.

Dividend investing

As I write, the Sainsbury’s share price stands at 260.10p. At today’s price, the dividend yield on offer is 4.66%.

To target £300 in passive income per year, I’d need to buy 2,500 shares. That would cost me a total of £6,502.50. I could expect a little over £303 in dividends from my initial investment if I held the shares for a year.

Some caution is required here, as a number of City analysts expect the dividend will fall to 11.5p per share next year. They anticipate it won’t rise above 12p per share in 2025 either.

Dividend forecasts aren’t always correct, but it’s worth noting yields can fall and distributions can be cut or suspended at any point.

If the supermarket’s profitability comes under pressure due to consumers tightening their purse strings in the cost-of-living crisis, shareholder payouts could be trimmed.

Nonetheless, at today’s yield, Sainsbury’s looks like a handy passive income generator to add to my stock market portfolio.

The outlook for Sainsbury’s shares

I think there are several reasons to be positive on the growth prospects for the Sainsbury’s share price.

The company’s recent Q3 trading update revealed total retail sales growth of 5.3%. Encouragingly, the business delivered quarterly sales growth across all key areas, namely: grocery (+5.6%), general merchandise (+4.6%), and clothing (+1.3%).

The grocery industry is notoriously competitive. In that regard, it’s good to see Sainsbury’s outpacing its rivals across several metrics. Customer satisfaction is higher than at Tesco, Asda, and Morrisons. In addition, Sainsbury’s beats the trio on checkout speeds and colleague availability.

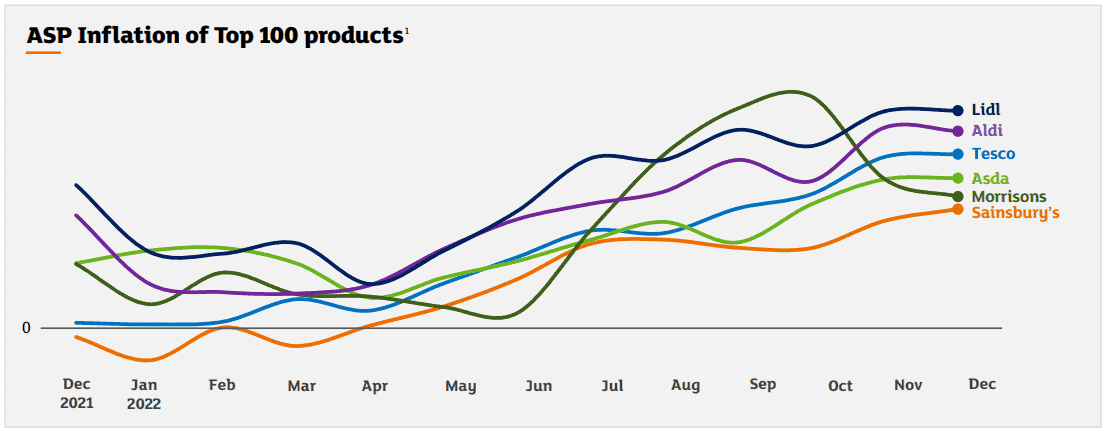

Crucially, inflation in the company’s top 100 products is behind all major competitors. This includes the British brands, as well as low-price chains Aldi and Lidl.

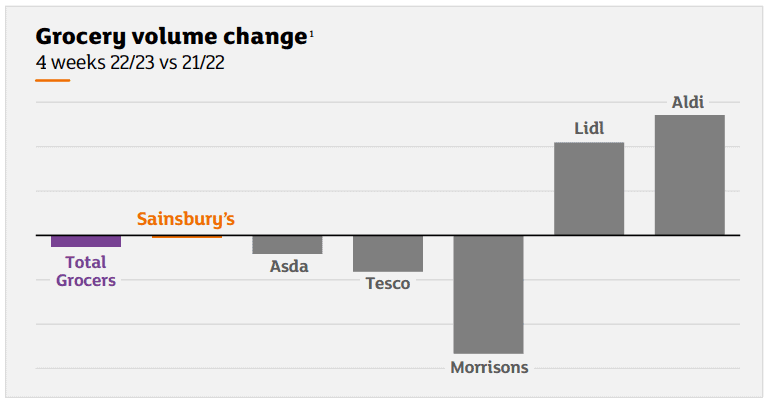

However, the German challengers continue to make inroads in the sector. In the four weeks to Christmas, both Lidl and Aldi secured big increases in their grocery volumes, whereas Sainsbury’s was left treading water.

Competition remains a risk to Sainsbury’s shares, as it forces the supermarket to trim its margins. So too is the inflationary environment, which could continue to weigh on the firm’s profitability. Nevertheless, I think it has sufficient size and brand strength to ride out a tricky macro environment.

One interesting development is recent news that Britain’s second-largest wholesaler, Bestway, has built a 4.47% stake in the business. A takeover could lift the Sainsbury’s share price higher this year, although this is only a speculative possibility at this stage.

Despite some risks, Sainsbury’s shares look cheap to me currently. If I had some spare cash, the company would be on my shopping list to target a regular passive income stream.