With just £25 a day, I could build a passive income worth £2,500 a month. That is what the average worker in the UK earned in 2022. In my case, once I’d built up my savings pot, I could pay myself the same for doing sweet nothing-at-all.

Of course, it would take time and consistency. I’d also need to think carefully about where to invest my money. I’d want to be well positioned for everything the global economy might throw at me over the next 30 years.

The golden butterfly portfolio

Finance geeks have back tested hundreds of portfolio allocations, sharing their results on the internet.

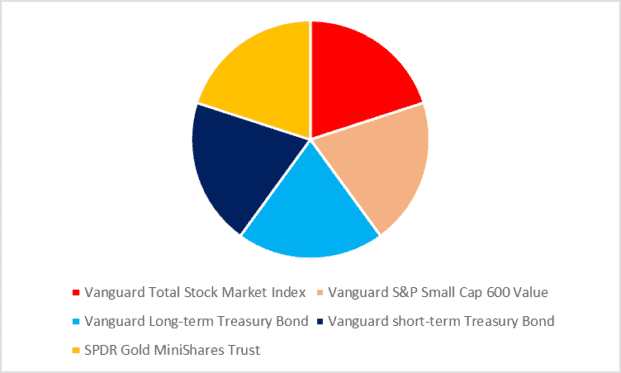

One option I’ve seen is the golden butterfly portfolio. This is a simple strategy, which involves investing 20% in a total US stock market exchange-traded fund (ETF), 20% in a US small cap ETF, 20% in US short-term bonds, 20% in US long-term bonds, and 20% in gold.

When represented on a pie chart, the allocation looks somewhat like a butterfly (if you tilt your head and squint). In the diagram’s legend, I’ve given examples of low-cost ETFs I could use to get exposure to the market segments I want to target.

The beauty of the golden butterfly portfolio is that it sets me up for three scenarios. In the event of economic growth, its 40% equity allocation (red and pink in the chart) will race ahead. If, on the other hand, recession hits then the value of bonds (light and dark blue) will likely go up as investors flee into these “safe-haven” assets. Meanwhile, gold traditionally comes into its own during times of inflation.

Results from 152 years of testing

According to back-testing conducted by website Best Retirement Portfolio, the golden portfolio had the following historical performance:

- Between 1871 to 2023, the portfolio granted a 6.94% annualised return;

- The most it fell in a single year over that period was 50.14%;

- In the worst-case scenario, you could have withdrawn 3.6% a year of your pot (adjusting for inflation) and not run out over 30 years.

Fattening up the portfolio

How much should I “feed” my golden butterfly?

I could put in £25 a day, or £9,125 a year. I could assume – based on 152 years of data – that it would grow by 6.94% a year.

After 10 years, I’d have £126,000. A decade later I’d have built up £372,000. And after 30 years of scrimping, I’d have £853,000.

Based on the past 152 years of market history, I could expect to withdraw 3.6% a year from my fully fattened-up golden butterfly and not run out of funds for at least 30 years.

| Years of saving | Size of retirement pot | Permitted draw-down amount per month (>30 years) |

| 10 | £126,000 | £378 |

| 20 | £372,000 | £1,116 |

| 30 | £853,000 | £2,559 |

Risks

Past returns are no guarantee of future performance. Although my calculations are underpinned by 152 years of history, that still leaves room for error. What if, for example, the US turned into a complete economic basket case over the coming decades? I’d regret having chosen such American-centric funds.

I might offset that risk by choosing international ETFs, although I’d have to review my assumptions about growth and drawn-down rates, as the available data refer only to the US experience.

I plan to do more research into how the golden butterfly portfolio could be re-worked to make it more global in its exposure before pulling the trigger. That said, I remain a confident shareholder of multiple UK-listed stocks and will remain so for many years to come!