Despite a disappointing set of earnings results last week, Apple (NASDAQ:AAPL) stock continued its strong start to the year. Shares in the world’s most valuable company are still up by more than 20% this year, but I think the upside potential for the near term may be limited.

The numbers

Despite the already negative sentiment surrounding the stock, the tech giant still somehow managed to come up short of analysts consensus. Supply disruptions in China saw iPhone sales drop for the first time since 2019. Additionally, Mac sales disappointed as shoppers were squeezed by the rising cost of living, redirecting their purchases to the cheaper iPads instead.

| Metrics | Consensus | Q1 2023 | Q1 2022 | Growth |

|---|---|---|---|---|

| iPhone revenue | $68.29bn | $65.78bn | $71.63bn | -8% |

| Mac revenue | $9.63bn | $7.74bn | $10.85bn | -29% |

| iPad revenue | $7.76bn | $9.40bn | $7.25bn | 30% |

| Accessories revenue | $15.26bn | $13.48bn | $14.70bn | -8% |

| Services revenue | $20.67bn | $20.77bn | $19.52bn | 6% |

| Total revenue | $121.19bn | $117.15bn | $123.95bn | -5% |

| Diluted earnings per share (EPS) | $1.94 | $1.88 | $2.10 | -10% |

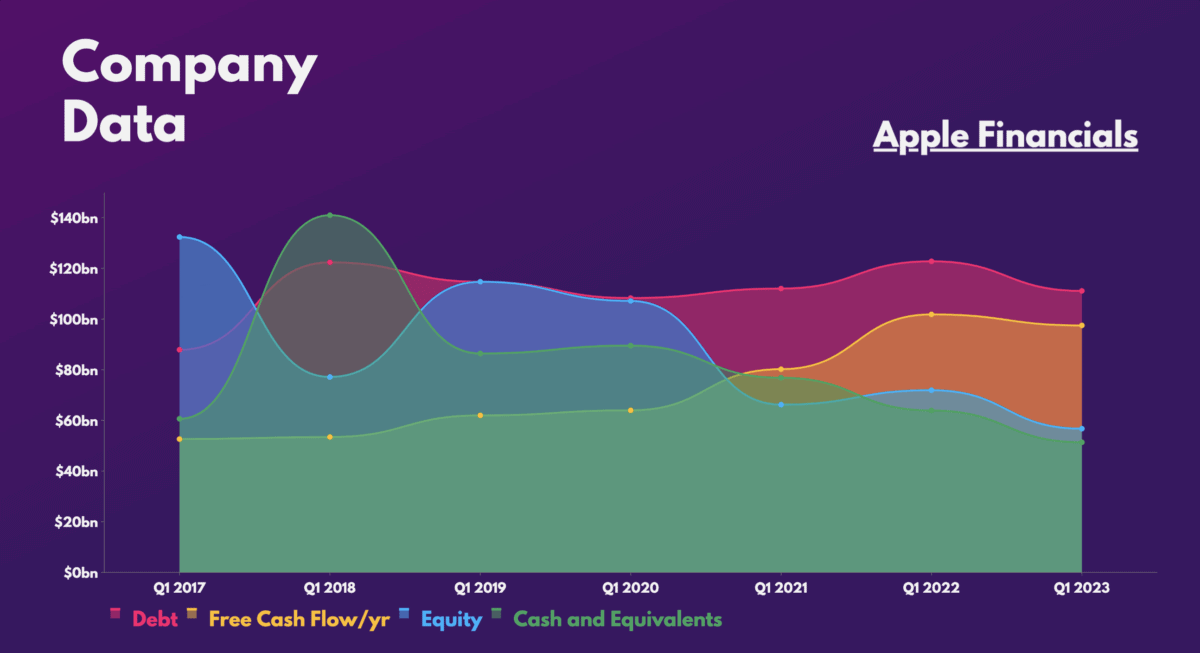

Moreover, debt levels remain elevated, although the conglomerate’s strong EBITDA can easily cover its repayments. Overall, it was a bad quarter, but given the stock’s popularity, there are numerous bull and bear arguments worth exploring.

The bull case

Bulls will be first to point towards the ‘short-term pain for long-term gain’ argument for several reasons. For one, Apple is looking to launch its groundbreaking virtual reality headset later this year. Many are expecting the product to have a higher adoption rate than Meta‘s Quest 2 due to a better API. And if successful, it could blow up just like the iPhone did in 2007. Then there’s the return of China. With a record level of household savings, Chinese sales could well go through the roof in 2023.

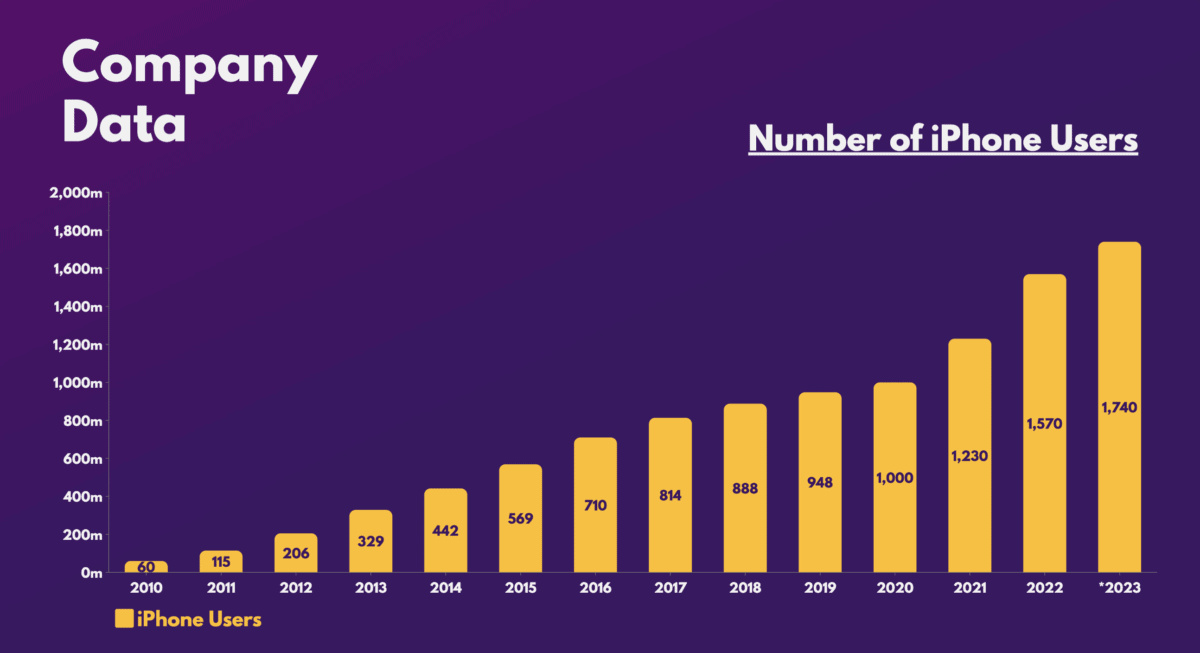

Citi analyst Jim Suva also cites additional reasons to be bullish on Apple stock. The broker is confident that the firm’s expansion into India will open a new stream of revenue. What’s more, long-term services revenue will continue to grow as the number of active iPhones increases. These all add up to expand the group’s margins, which will positively impact free cash flow and its bottom line.

The bear case

That said, there are risks associated with the stock. The biggest one for me would be its bet on launching its VR headset. Having seen the carnage at Meta from excessive spending with multi-billion losses, I’d be equally worried that the iPhone maker could go down the same route.

Aside from that, there’s also the possibility of further production disruptions. Although Apple is attempting to diversify its production sites to India, the short-term fragility of its supply chain remains a weak spot. Pair that with regulatory battles it faces surrounding its App Store, and it’s understandable why the bears have a case too.

My verdict

Even so, I believe the bullish thesis outweighs the bearish arguments, especially over the long term. After all, Apple stock has an average ‘buy’ rating and price target of $173 from an array of analysts. This presents a 14% upside from current levels, which isn’t bad at all.

Nonetheless, I’m more incline to side with Barclays on its ‘hold’ rating. That’s because its trailing and forward valuation multiples are currently sitting at 10-year highs. I’ve certainly got no doubts that Apple has upside potential. However, given the downside risks associated with its VR headset failing to impress, I’d rather hold on to my current gains. I’ll wait and see what happens before buying more Apple stock.

| Metrics | Valuation multiples | S&P 500 average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 25.2 | 22.0 |

| Forward price-to-earnings (FP/E) ratio | 24.6 | 21.0 |