Britain’s flagship index is renowned for being home to some of the world’s biggest and most consistent dividend payers. As such, these two FTSE 100 companies, both scheduled to go ex-dividend later this month, have caught my eye with their high yields.

1. Imperial Brands

First up is one of the FTSE 100’s biggest winners last year, Imperial Brands (LSE:IMB). Unfortunately, the blue-chip stock has failed to replicate last year’s performance so far in 2022, with investors shifting towards riskier assets as inflation cools.

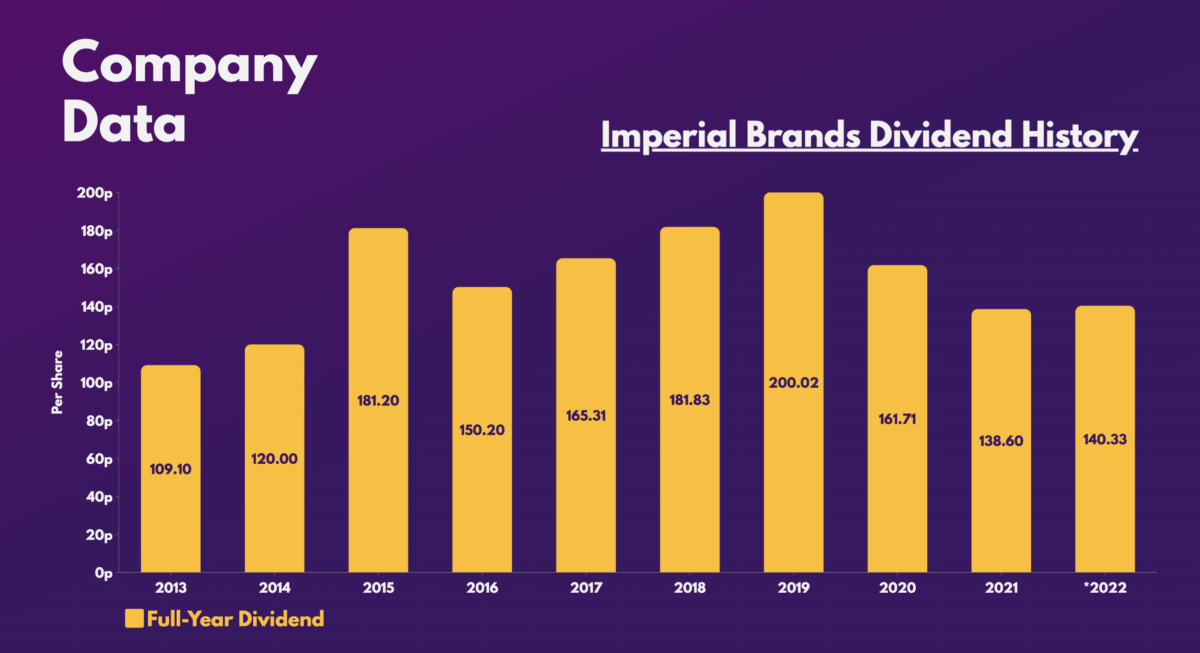

Nonetheless, where Imperial falls short on growth, it makes up for with its high dividend yield. The conglomerate is going ex-dividend later this month. This means that potential investors will have until 16 February to purchase Imperial shares if they want to receive its final dividend of 49.32p per share.

With a yield of 7.2%, the tobacco group pays one of the biggest dividends in the UK. This makes it one of the index’s most lucrative dividend stocks to invest in. Additionally, it’s got a rich history of being a dividend aristocrat, backed by its dividend cover of 1.9 times. As a result, the likes of Deutsche and RBC rate the stock a ‘buy’ with an average price target of £22.63. This roughly presents a 10% upside from current levels.

Having said that, I’m aware of the industry that Imperial operates in. Its future prospects aren’t great as tobacco falls out of favour globally. Nevertheless, the firm has a new line of vaping products which could spark growth. However, I see other shares with higher yields and brighter prospects to generate me a stronger avenue of passive income. So, despite the lucrative payout, I won’t be buying Imperial Brands shares.

2. Endeavour Mining

Next up is gold giant, Endeavour Mining (LSE:EDV). The extractor is set to go ex-dividend on 23 February with an interim payout of 33.25p per share. On annualised basis, this would bring its yield to a respectable 4.5%.

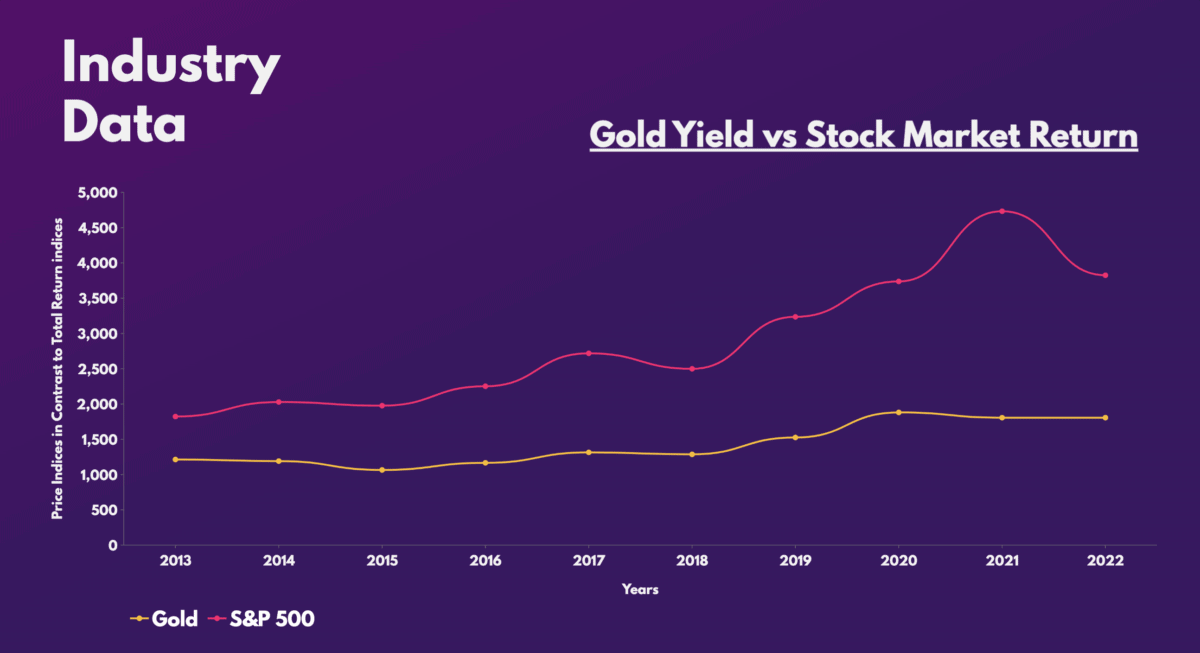

Endeavour spent the better part of 2022 rocking up and down like a ship in rough seas. This was due to volatile gold prices as investors swapped back and fourth between gold and the US dollar as a safe haven. Hence, the stock finished 2022 with a gain just shy of 5%.

Unlike Imperial, however, Endeavour has a much more promising future. Gold has an inverse relationship with the US dollar. Consequently, a potential pause in the Federal Reserve’s rate-hiking cycle has sparked a rally in gold prices since November as investors flock back to the yellow metal. Thus, it’s no surprise to see the likes of Barclays and Berenberg rate the shares a ‘buy’ with an average price target of £31. This presents a healthy upside of 66% from current levels.

That being said, it’s important to note that while gold has a good history of appreciating in value, it’s often underperformed the stock market. This is especially the case during bull markets. Therefore, even though Endeavour’s high yield and near-term potential is lucrative, I believe its upside potential may be limited by what seems to be a looming bull market. For that reason, I’ll keep a close eye on gold prices for now, and may start a position if a deeper bear market develops.