I’m looking for new passive income ideas, with a particular focus on FTSE 100 stocks. In the context of a booming commodities cycle, I’m drawn to mining companies that have performed remarkably well over the past year — and could continue to do so.

One firm on my radar is Chilean copper miner Antofagasta (LSE: ANTO). Here’s how I’d target a £1 per day second income by regularly investing in the stock.

A reliable dividend stock

Antofagasta shares currently yield 5.94%, which is above the average Footsie dividend yield of 3.52%. As I write, the stock’s changing hands for £17.29 — a 27% increase compared to a year ago.

As an illustration, let’s imagine the share price and dividend yield remained constant throughout the year. In reality, both figures would fluctuate over this time frame, as equities are volatile assets. Nonetheless, for simplicity, my calculations show how I could achieve a regular passive income by investing in the company.

If I wanted to buy seven Antofagasta shares a week, I’d need £121.03. Sticking to this investment plan over a year would carry a total cost of £6,293.56. That fits well within my £20k annual tax-free allowance in a Stocks and Shares ISA.

After 52 weeks, my shareholding would provide me with dividends of £373.84 a year, or £1.02 per day. It’s notable that Antofagasta paid dividends throughout the 2008 financial crisis and the 2020 stock market crash caused by the pandemic.

With that in mind, I believe it’s one of the most reliable dividend stocks in the FTSE 100 index, although there’s always a risk it could suspend or cut payouts if profitability became a concern.

Outlook for the share price

Copper is the lifeblood of Antofagasta’s business. The company believes the price of the orange metal could surge this year, buoyed by renewed Chinese demand as the country relaxes its Covid-19 restrictions and reopens its economy.

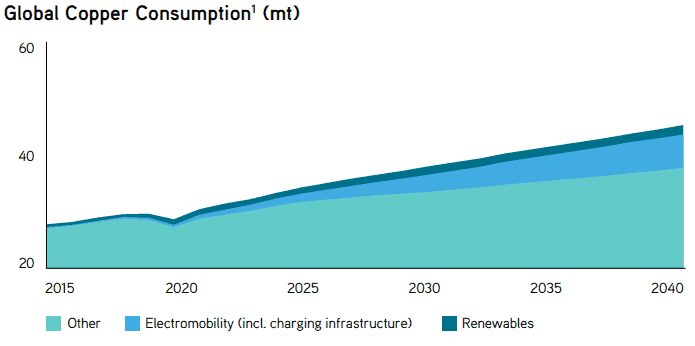

The commodity has a wide range of industrial uses thanks to its unique conductive properties. It’s used in a variety of electronic devices, from mobile phones to televisions. Copper’s also a key material for renewable energy systems and electric vehicles. These factors make Antofagasta bullish on the outlook for global demand.

The miner recently released positive guidance, anticipating its annual copper output will reach between 670,000 and 710,000 tonnes in 2023. That’s an increase on its 2022 production of 646,200 tonnes, but still down on 2021.

That being said, an ongoing drought in Chile hampered the company’s mining efforts last year, with particular difficulties at its Los Pelambres sulphide deposit. This is a reminder of the significant climate risks facing the business. Any further disruption at the company’s key operations sites could weigh on the Antofagasta share price.

To combat the adverse impact of water shortages, it has nearly finished a desalination plant at Los Pelambres. The project was 93% complete at the end of 2022.

My passive income plan

If I had spare cash, I’d invest in Antofagasta alongside other Footsie shares to ensure my stock market holdings are sufficiently diversified.

I think the mining company is a reliable dividend stock that would make a useful addition to my passive income portfolio.