Investing in penny stocks can be risky business. Newer and financially-weaker companies can be vulnerable during economic downturns. However, small-cap stocks like these also often deliver spectacular, market-beating capital appreciation over the long term.

I don’t have unlimited reserves of cash to spend. But here is a penny stock I’m considering buying for my portfolio today.

Screen idol

Huge uncertainty faces the global cinema industry in 2023. The impact of the cost-of-living crisis on ticket sales could well scupper the boost provided by a stronger film slate compared with next year.

But I’d still be prepared to buy Everyman Media Group (LSE:EMAN) shares right now. In fact, following recent trading news my enthusiasm for the cinema operator has grown stronger.

This week the AIM share said that revenues rocketed 62.5% year on year in 2022. This in turn meant that group EBITDA would rise almost 75% over the period and above what the market had been expecting.

Chief executive Alex Scrimgeour commented that “the UK’s appetite for film and the Everyman brand remains reassuringly strong”, adding that “our proposition is aligned with prevailing long-term consumer trends focused on affordable, high quality entertainment”.

City analysts are expecting a sustained bottom-line recovery at the leisure giant. They expect losses to have continued narrowing in 2022, with losses per share of 3p anticipated.

They think Everyman will break back into the black with earnings per share of 1.1p this year. An eye-grabbing rise of almost 240% is predicted for 2024, too, to 3.7p.

High cost

My only concern with buying the share is its sky-high valuation. Everyman’s share price has soared 18% over the past week. At 91.3p per share, the penny stock now trades on an elevated forward price-to-earnings (P/E) ratio of 83 times.

If trading news suddenly becomes more uncomfortable then this expensive company could slump.

As I say, this is a UK share I’d buy to hold for the long haul. This means that the impact of any volatility on my returns is likely to be ironed out. But if I had to sell my shares for some reason I could end up eating a big loss.

The rebound continues

Still, on balance, I believe the possible rewards of owning Everyman shares outweigh this risk.

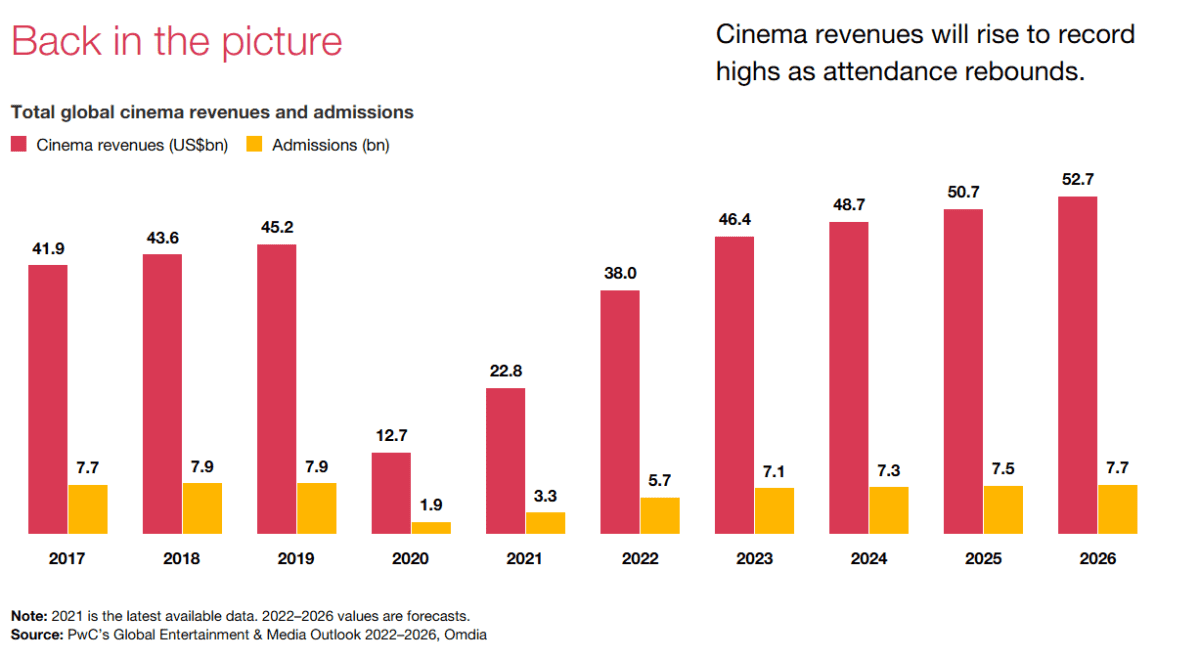

Cinema operators still face extreme competition from streaming services like Netflix and Amazon’s Prime service. But analysts still believe the movie theatre industry will continue its strong post-pandemic rebound.

As the chart below shows, boffins at PwC think cinema revenues will hit repeated record highs over the next four years.

Everyman could be particularly-well positioned to take on the streamers, too. The bars and restaurants inside its venues mean it offers customers a better social experience, giving movie lovers more reason to leave the sofa.

With the business also resuming its expansion strategy I expect earnings to grow strongly in the coming years.