Ocado (LSE:OCDO) recently posted a disappointing trading update for its retail business over the Christmas period. This caused its stock to tank by almost 10%. Nonetheless, as an investor in Marks and Spencer (LSE:MKS) shares, I could benefit from Ocado’s disappointing performance.

Joining forces

Back in 2019, online grocer Ocado combined forces with physical retail giant M&S to form a joint venture (JV). The latter acquired a half-share of the former’s retail business with the intention of selling its products using its web and delivery services.

This was seen as a win for both sides. Ocado would need a new line of products after its longstanding partnership with Waitrose ended, while M&S was attempting to modernise itself and get into the grocery delivery market.

The FTSE 250 company ended up paying £562m in cash, with a bonus of £187.5m if certain performance requirements were met. So far, Ocado has managed to tick the boxes surrounding delivery and order capacity. This has resulted in a £33.8m payment.

However, £156m plus interest still remains. This is because the delivery service has struggled to hit the EBITDA threshold agreed. If it fails to hit the target by November 2023, it would have to forfeit the payment. While the specific target isn’t disclosed, its latest trading update doesn’t scream of optimism.

Unremarkable numbers

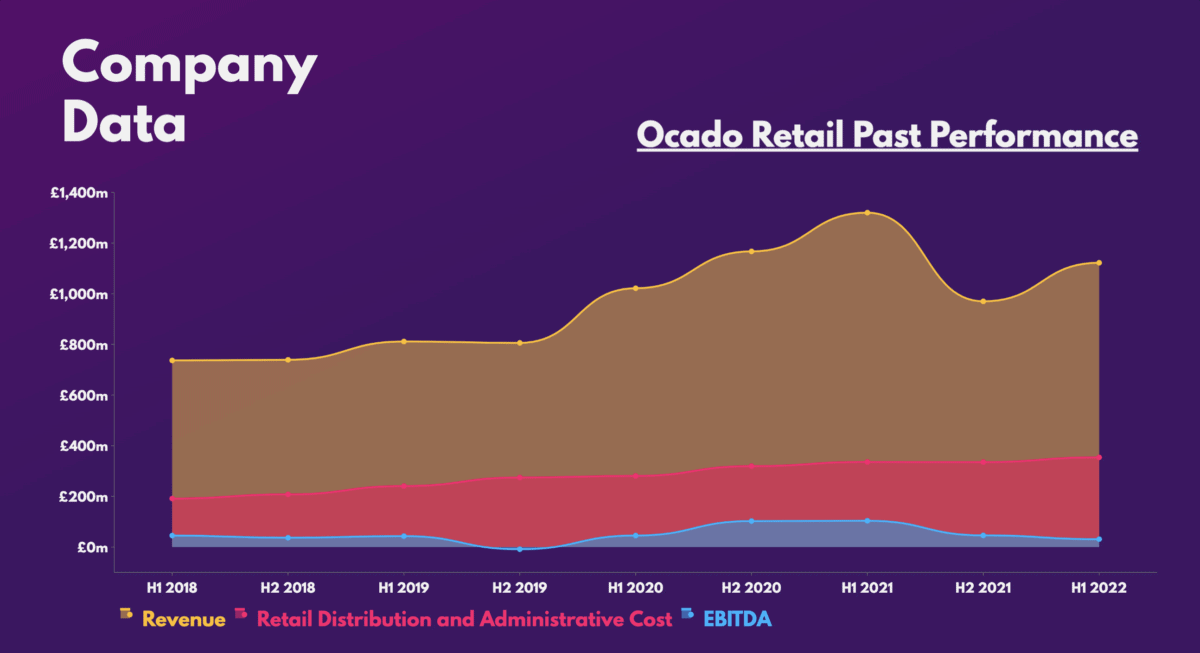

The preliminary figures were lacklustre to say the least. A drop in revenue and a further decline to its EBITDA didn’t impress shareholders.

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Retail revenue | £2.2bn | £2.3bn | -3.8% |

| Average orders per week | 382k | 357k | 1.9% |

Additionally, the outlook for the year ahead isn’t particularly bright either. The board is guiding for negative EBITDA in the first half, before a sharp rebound in H2 from stronger margins. Whether this actually happens remains questionable given management’s poor track record of over-promising and under-delivering.

Nevertheless, there were a couple of silver linings in the report. The first being its customer base as the group saw active customers grow by a respectable 12.9% to 940k. The second would be average orders per week, which saw a decent increase as well. These factors show that Ocado has the potential to acquire users that have the intention to spend.

So, provided cost inflation tapers off and customer intention remains strong, the tech unicorn could very well pull the rabbit out of the hat and achieve the EBITDA threshold by November.

Bagging a discount?

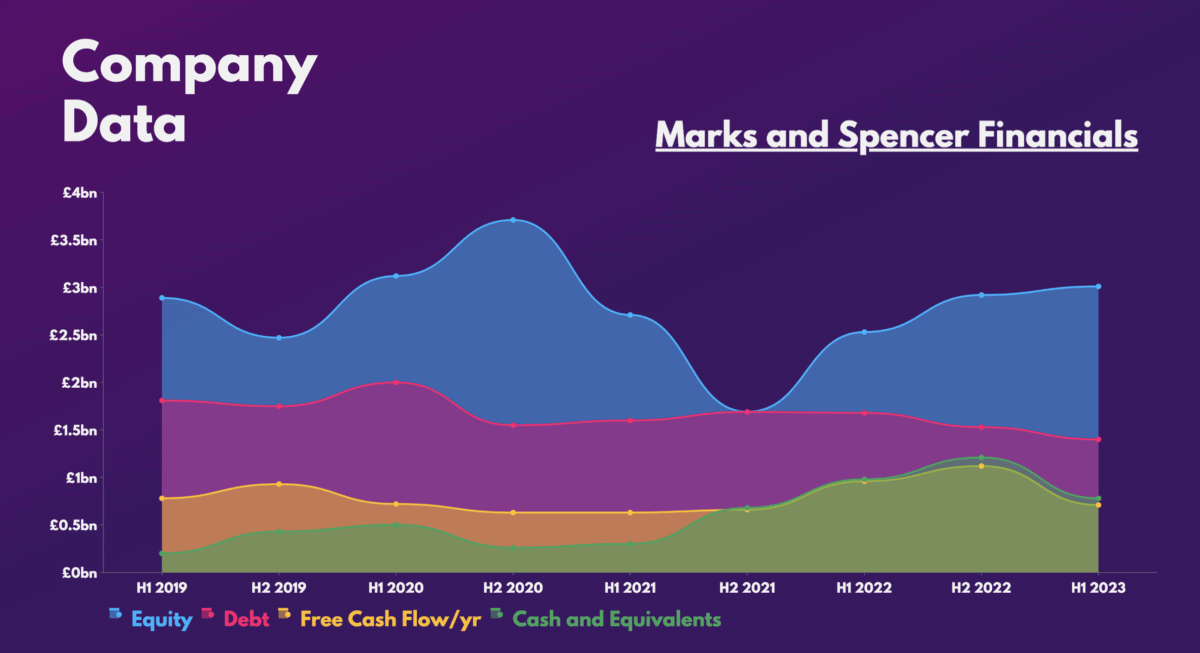

That being said, I don’t see enough tailwinds blowing Ocado’s way to achieve such a feat. As such, this could be good news for Marks and Spencer shareholders like myself. That’s because the conglomerate would bag a great discount on its JV purchase, all while restoring liquidity to its balance sheet.

Although M&S CFO Eoin Tonge has said that it would have to pump additional capital into the venture in the medium term, I don’t expect this to be a significant amount if Ocado achieves its EBITDA goal within the next couple of years.

And given that the JV’s net loss contribution to M&S’s bottom line, is negligible at -£0.7m, I think a slight delay in achieving the EBITDA target serves to be more beneficial than not when considering the amount of savings involved. Either way, I’ll continue to monitor the situation closely, and may buy more Marks and Spencer shares in the near future.