Over the past year, investors like myself have been wary of potential dividend cuts as a result of the cost-of-living crisis. Tesco (LSE:TSCO) shares have been one such example. But with a sound set of Q3 numbers, the stock still has the potential to be a source of second income for me. Here’s why.

A fine Christmas update

The company’s latest Q3 update could be an indicator that its declining profits could finally be bottoming for a couple of reasons.

The first is that like-for-like sales saw an acceleration in growth, compared to last year. And while its Q3 growth rate is admittedly lower than Sainsbury’s and Marks and Spencer, it’s worth noting that Tesco’s revenues are much larger, which makes growth percentages look smaller.

| Like-for-like sales (ex. fuel) | Christmas | Q3 2023 | Q3 2022 |

|---|---|---|---|

| Tesco | 7.9% | 5.7% | 2.4% |

| Sainsbury’s | 7.1% | 5.9% | -4.5% |

| Marks and Spencer | N/A | 7.2% | 18.5% |

The second is the reiteration of their original guidance for FY23. The board still expects to achieve an adjusted operating profit of between £2.4bn and £2.5bn, free cash flow of at least £1.8bn, and an adjusted operating profit of approximately £120m to £160m for its bank business.

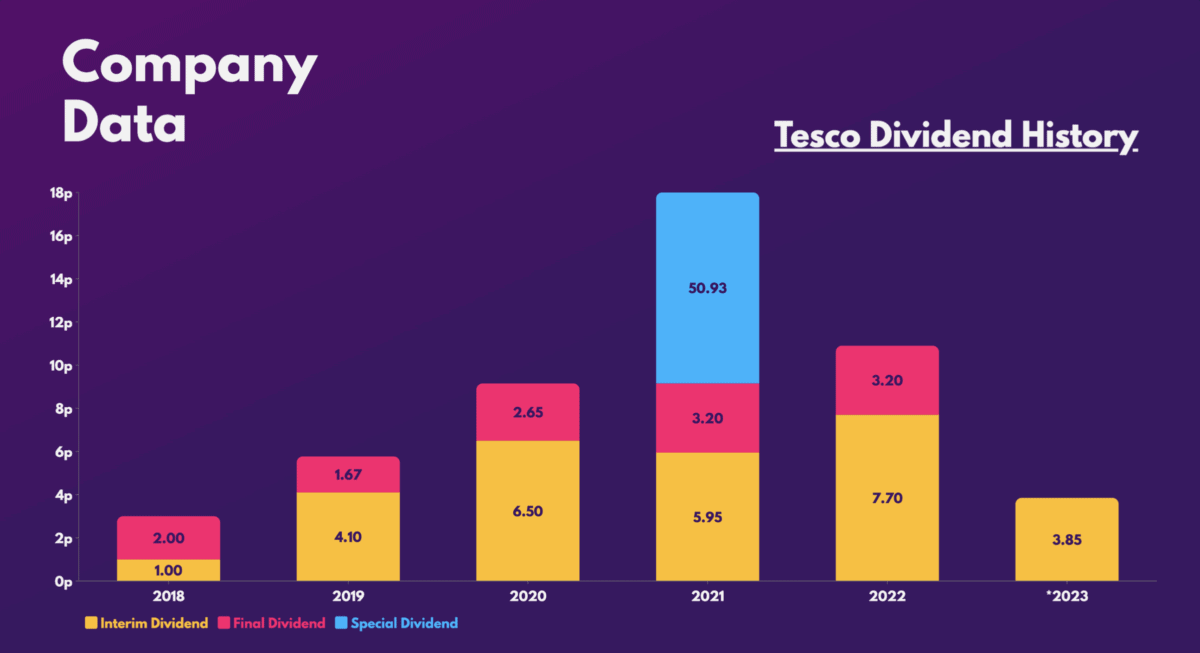

Although the majority of these figures are still forecasted to come in lower than FY22, there’s respite in knowing that margins aren’t going to go any lower. This clears a path to margin expansion in the medium term. This would allow the group to continue paying its dividends, and even potentially increase payouts in the future.

Eating away the competition

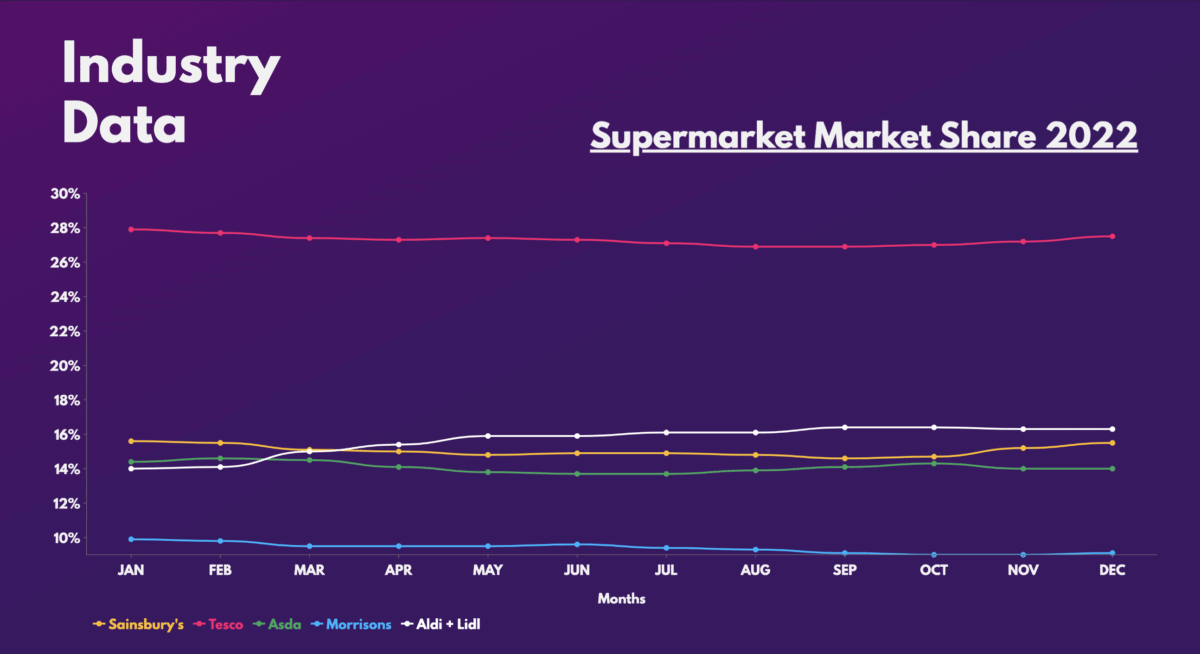

Another positive was Tesco’s market share gains. The UK’s largest supermarket continues to cement its position as the market leader as it reported being the only full-line grocer in the country to grow its market share since 2019. But what’s even more impressive was its ability to hold onto its share of the market last year, despite the rise of Aldi and Lidl.

What’s more, the FTSE 100 firm’s catering business, Booker, continues to grow its market too. The arm’s third-quarter sales saw an increase of 5.7%, with Christmas sales up 7.9%. Additionally, its banking division’s sales rose by 14.6%.

Although these divisions only contribute a minuscule amount to Tesco’s underlying figures, their larger margins could positively impact dividend payouts in the future.

Shopping for alternatives

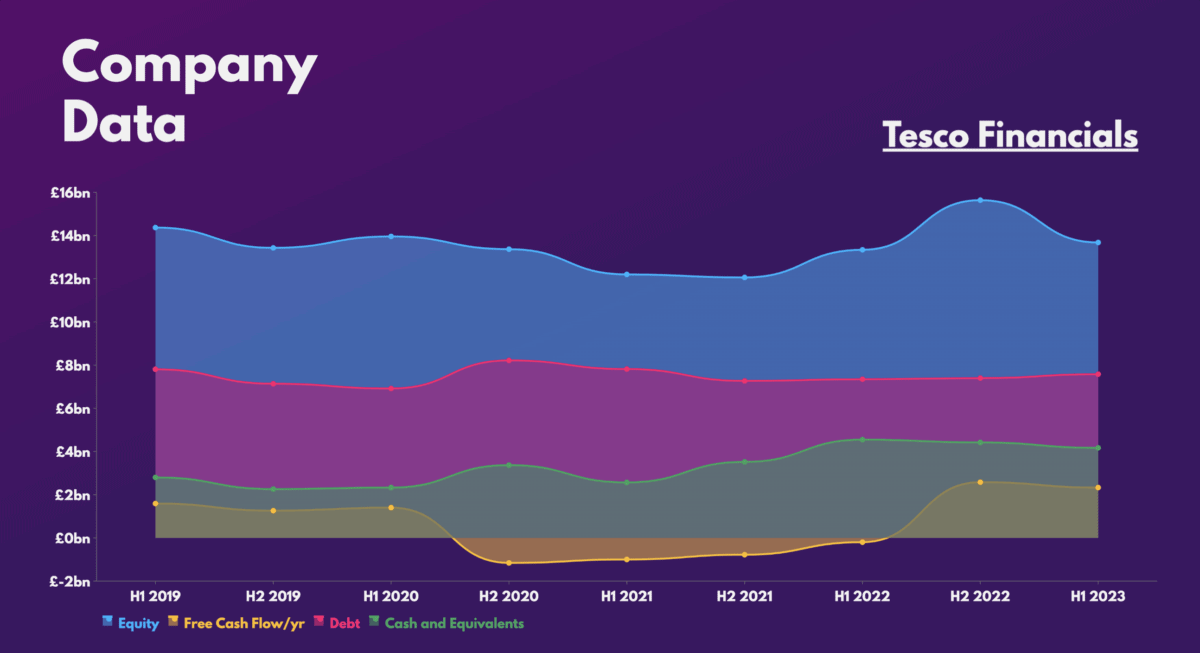

All that being said, would I deem Tesco shares a buy for my portfolio? Well, the progressive dividend is certainly lucrative and is covered two times. Moreover, the company’s balance sheet, while not the best-looking, isn’t atrocious either with a healthy debt-to-equity ratio and healthy free cash flow.

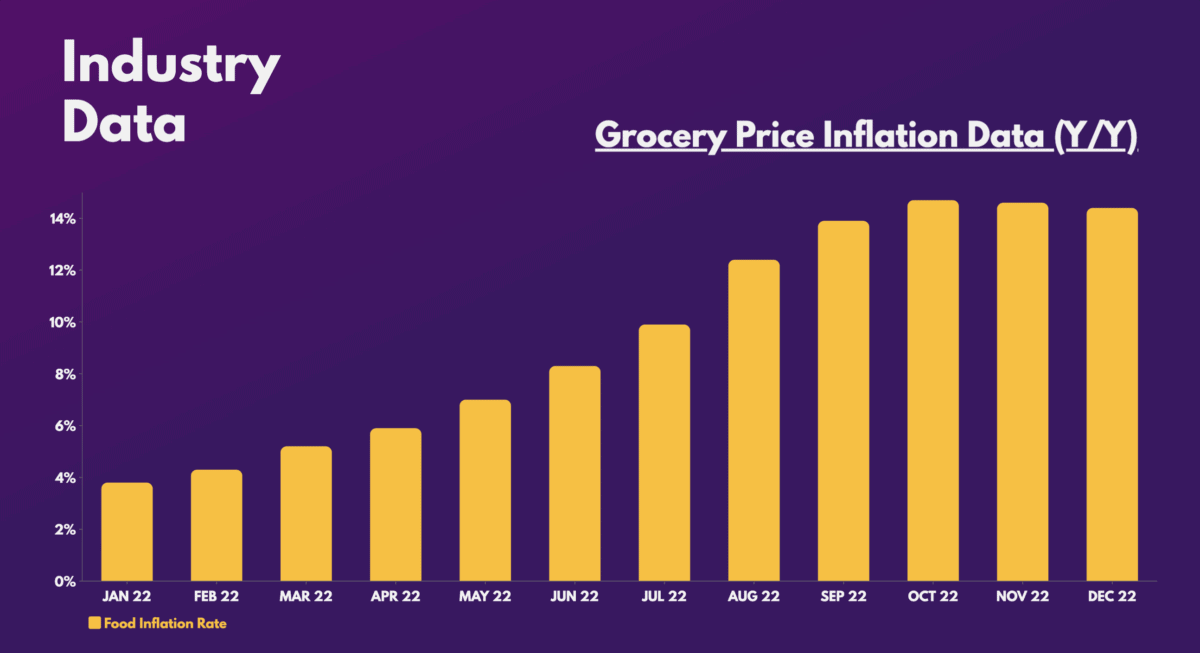

Furthermore, food inflation is also starting to taper off. And with the impact of lower commodity prices yet to be realised, this should allow for margin expansion in the second half of the year.

Nonetheless, I question whether the combined future gains of its share price and dividends outweigh the potential returns of other stocks. Some of the stock’s valuation multiples are trading at a discount which could indicate a bargain.

| Metrics | Valuation multiples |

|---|---|

| Price-to-earnings (P/E) ratio | 19.8 |

| Price-to-sales (P/S) ratio | 0.3 |

| Price-to-book (P/B) ratio | 1.4 |

| Price-to-earnings growth (PEG) ratio | 0.2 |

However, I hold the view that there are other shares with stronger growth potential, higher dividends, and wider margins. Thus, I’m more inclined to agree with Shore Capital’s ‘hold’ rating on Tesco shares, as I wouldn’t buy them given the array of better options to earn a second income.