At 48p, the Lloyds (LSE: LLOY) share price is anchored below where the bank was trading before the pandemic struck. Three years ago, the stock was changing hands above 60p.

With interest rates likely to rise this year, there’s support for the bull case. However, risks posed by a potential recession and a cooling housing market temper this somewhat.

So can Lloyds shares recover to their pre-Covid levels in 2023? Here’s my take.

Tailwinds

Currently, the Bank of England base rate is 3.5%. Britain’s central bank has indicated it will keep the cost of borrowing high in 2023 to tame runaway inflation. Indeed, the market expects the base rate could soar to 4.6% by July.

The black horse bank could benefit from climbing interest rates due to the positive effect this has on its net interest margin (the difference between what it charges for its loans and the amount paid to depositors).

Net interest income makes up the lion’s share of Lloyds’ total income as it doesn’t have significant exposure to investment banking operations. This means it’s particularly sensitive to changes in monetary policy.

Higher interest rates are also beneficial for the bank’s dividend payments. Currently boasting a 4.5% dividend yield, Lloyds shares are the cream of the crop among FTSE 100 banks. They deliver a greater yield than Barclays (3.6%), HSBC (3.8%), and NatWest (4.3%).

If wider spreads between loan rates and savings rates are a persistent feature in 2023, Lloyds’ profitability should improve. Ultimately, this means the dividend becomes more sustainable. This would support analysts’ forecasts that its annual distributions will rise this year to 2.44p per share.

Headwinds

Rising interest rates carry risks for the Lloyds share price too. Adverse impacts on the mortgage market from higher borrowing costs could translate into a property market downturn.

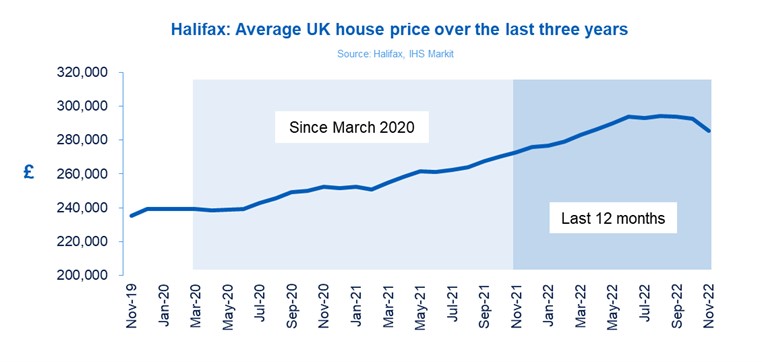

Indeed, Halifax (which is part of the Lloyds banking group) recently revealed house prices are starting to fall. It expects they could tumble by as much as 8% in 2023 due to buyers and sellers remaining cautious.

As the UK’s largest mortgage lender, a housing market downturn could weigh on Lloyds shares. In addition, the risk of a recession raises the spectre of an increasing number of bad loans on the bank’s books.

That doesn’t mean it’s unprepared. Credit rating agency Fitch Ratings classifies Lloyds’ mortgage loans as a “low-risk” asset class due to “conservative collateralisation“.

However, it warns that consumer loans and commercial lending face higher risks despite the group’s “conservative underwriting standards” mitigating this to some extent.

Will the Lloyds share price recover this year?

To recover to their pre-Covid levels this year, Lloyds shares would need to rise about 25% from today’s price. Given the broad economic challenges, that looks like a tough ask to me.

While I think investors will have to be a little more patient to wait for the stock to rise above 60p, I believe it’ll get there eventually if economic conditions improve. In the meantime, the market-leading dividend makes it a great passive income pick in my view.

I’ll be reinvesting dividends I receive from my shareholding into more Lloyds shares as the year progresses, allowing me to benefit from compounding returns over the long term.