Airline stocks have been making an exceptional recovery since crashing during the pandemic. Some airlines have even seen their share prices double. However, easyJet (LSE:EZJ) shares have been an exception, as they still sit below their 2020-low. So, here’s why I’ll be buying the stock.

Ascending numbers

While easyJet continues to lag behind its peers, it’s worth noting that the airline’s passenger numbers continue to recover at pace. This has seen its revenue increase, although its bottom line still lags behind by quite some margin.

| Metrics | FY22 | FY21 | FY19 | Change vs FY19 |

|---|---|---|---|---|

| Passengers | 69.7m | 20.4m | 96.1m | -27% |

| Load factor | 85.5% | 72.5% | 91.5% | -6% |

| Capacity | 81.5m | 28.2m | 105.0m | -22% |

| Revenue | £5.77bn | £1.46bn | £6.39bn | -10% |

| Diluted earnings per share (EPS) | -22.4p | -159.0p | 87.8p | -126% |

Nonetheless, CEO Johan Lundgren is upbeat about the FTSE 250 company’s prospects. He’s expecting revenue per seat (RPS) to rise by 20%, and load factor to hit 87% this year. This should inch the firm ever closer towards its pre-pandemic levels and profitability.

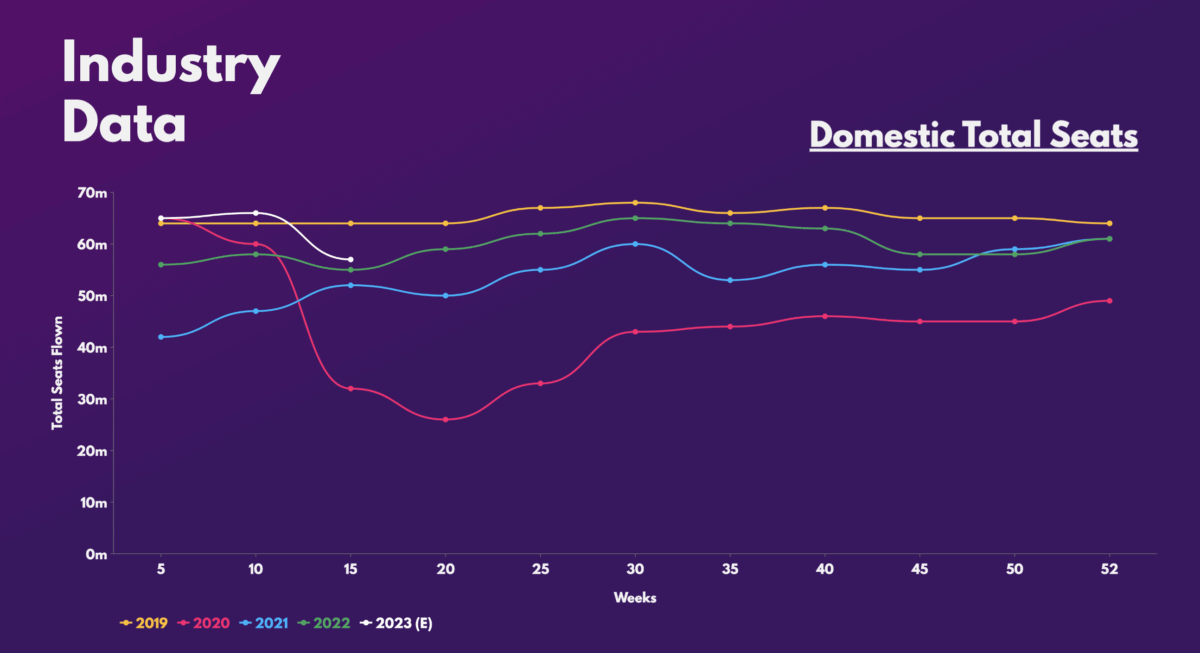

Concerns about an impending recession have caused investors to fear that demand for air travel will tick down. This has led to a lower number of domestic flights booked so far this year.

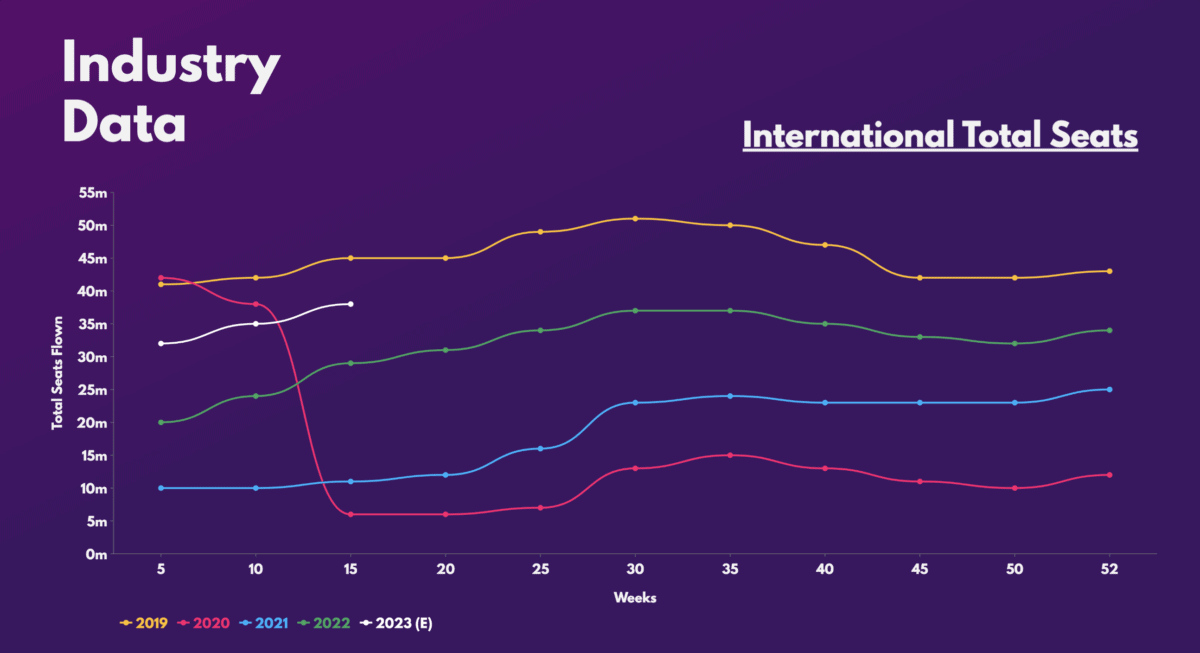

That being said, it’s important to note that the bulk of the company’s revenue stems from international flights, albeit short haul. Unlike domestic travel, international travel is forecasted to continue recovering in 2023, which the stock is expected to benefit from. In fact, the easyJet share price is already up 20% this year.

As the likes of Wizz Air and Ryanair report no signs of slowing demand for short-haul International air travel either, I’m anticipating the orange airline to report a rosy set of figures in its Q1 update later this month.

Making easy money?

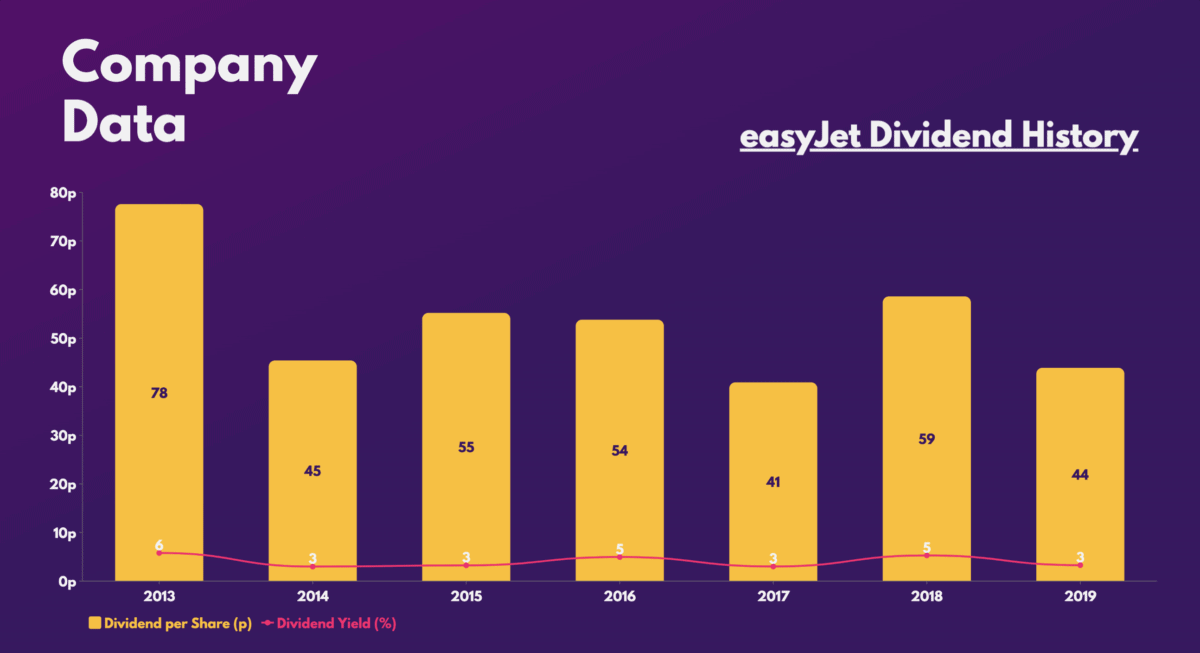

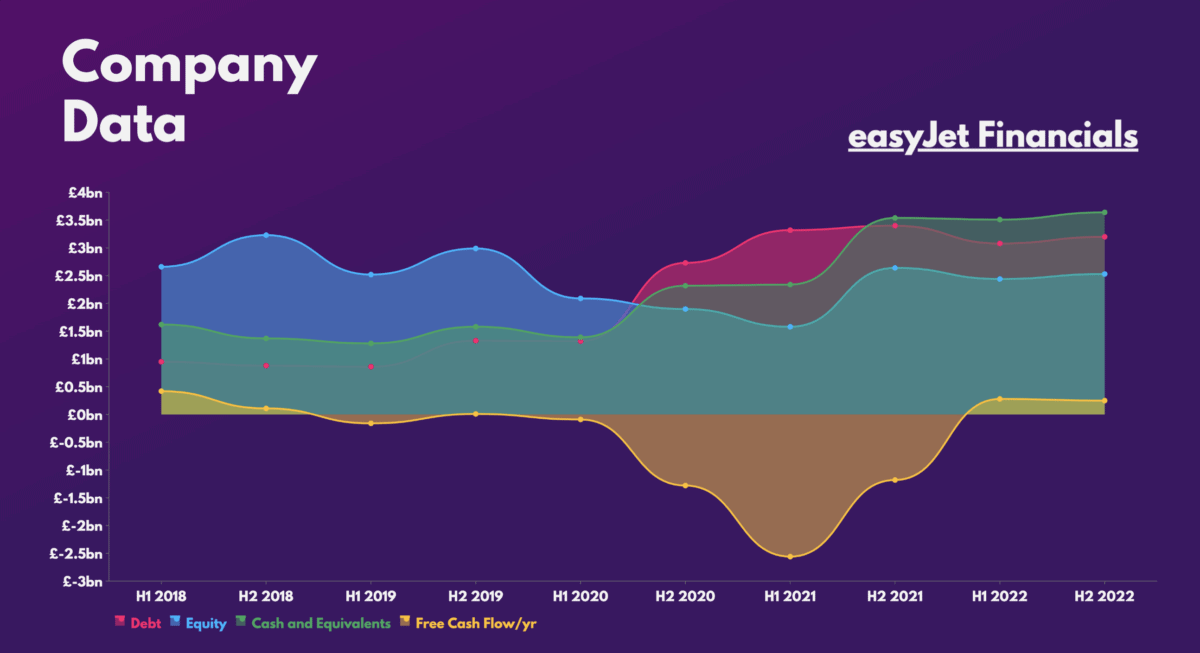

Prior to the pandemic, the group was paying a solid set of dividends annually. Unfortunately, shareholder returns have halted since, as earnings tanked and debt levels were driven higher.

Nevertheless, it’s worth stating that easyJet has one of the industry’s best balance sheets. Provided the conglomerate’s top and bottom lines continue to edge upwards, analysts alike are forecasting a reinstatement of dividends as soon as later this year. This would especially be the case if the budget airline achieves profitability by then. As such, I can imagine investors seeking passive income to start buying into the stock, and sending its share price higher.

Potential to fly higher

Apart from dividends though, the Luton-based airline also has a number of excellent long-term growth prospects. From attempting to develop a hydrogen-fuelled engine with Rolls-Royce, to industry tailwinds in which IATA forecasts passenger numbers for air travel to grow to 8bn passengers by 2040.

Additionally, the likes of Bernstein and UBS rate the stock a ‘buy,’ with an average price target of £6. This would present easyJet shares with a 50% upside from current levels. Moreover, a price-to-sales (P/S) ratio of 0.5, and a price-to-book (P/B) ratio of 1.3, indicate the stock is trading at a reasonable valuation at these levels.

easyJet isn’t renowned for its quality earnings as it averages a profit margin of less than 5%. Nevertheless, the strong upward momentum of its recovery leads me to believe that the growth stock can achieve meaningful margin expansion once it achieves profitability. After all, with fuel prices coming down, this could be possible. Therefore, I’ll be looking to buy easyJet stock once my preferred broker launches UK shares on its platform.