Like most investors, I keep a buy list. That’s a literal list of stocks that I plan to buy when I have the capital ready to put to work. Here are two FTSE 100 shares that are at the top of it right now.

Innovation on sale

For much of the past decade, Scottish Mortgage Investment Trust (LSE: SMT) stock only seemed to go up. In January 2011, the stock was at 140p. In November 2021, the share price reached 1,500p. Today, it’s down 51% from that lofty price.

As a long-time investor in Scottish Mortgage shares, I’ve certainly been feeling the pain as they’ve lost half their value. So why am I planning to add to my holding now?

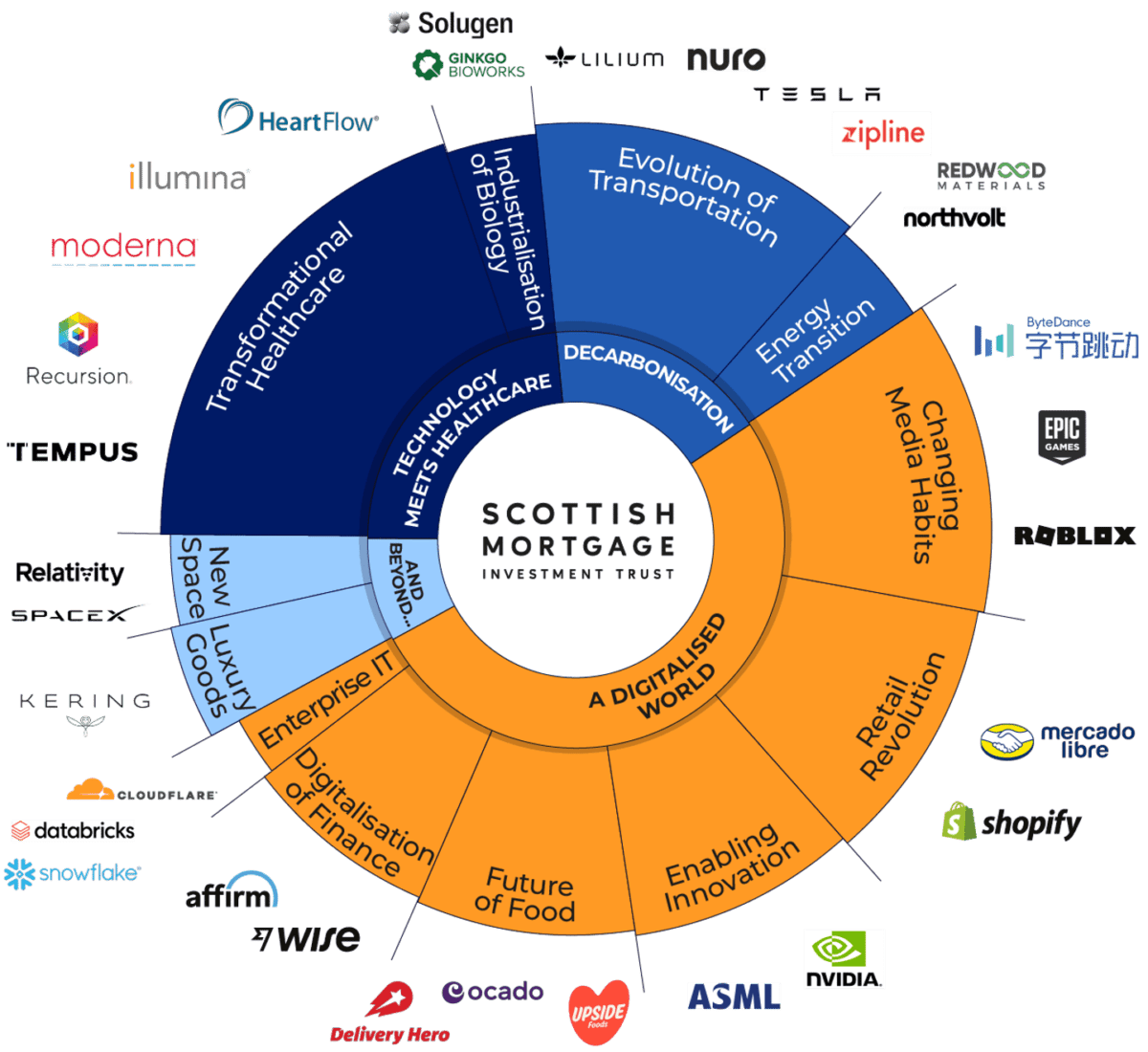

Well, as a reminder, the mission of the trust is to “identify companies and entrepreneurs building the future of our economy. Companies set to change the world“.

Scottish Mortgage Investment Trust portfolio

But most investors today suddenly aren’t interested in companies that might change the world in five to 10 years. This is entirely understandable given the uncertainty surrounding inflation, the global economy, and the war in Ukraine. These risks to the share price are ongoing.

But I believe that over the long term, the portfolio remains well positioned to outperform. One exciting holding is rocket pioneer SpaceX. This is a private company that I cannot buy shares of directly. But through Scottish Mortgage, I gain some exposure to SpaceX and the mega-trend of space exploration.

Boringly brilliant

With this next pick, I’m going from exciting companies set to change the world to boring and dependable. And that is Bunzl (LSE: BNZL). The company sources, consolidates, and delivers a range of everyday products to businesses. It’s been doing this since 1940.

Its products are extremely diversified across multiple sectors and geographies.

This stock has been a quiet winner for a very long time. And it has held up well recently too.

Bunzl stock performance

| Time horizon | Stock performance (excluding dividends) |

| 1 year | 7% |

| 5 years | 36% |

| 10 years | 160% |

| 15 years | 358% |

| 20 years | 634% |

Why has it performed so well for so long? Well, this is a company that has a compounding growth strategy. That has seen it grow its earnings at 10% every year for 25 years.

That level of consistency and profitability is exceptional. Moving forward, I think Bunzl is in a position to pass inflationary costs onto its customers, preserving profit margins in the process.

And it recently announced four new acquisitions, which is part of its long-term strategy of conducting bolt-on acquisitions to keep growing. I fully expect the company to use its strong balance sheet and cash flows to fund further acquisitions.

Plus, the stock has a dividend yield of 2.1%, which has increased for almost three decades! The dividend cover is normally a healthy 2.5 times or so.

Although I expect Bunzl to grow its dividend, another Covid outbreak could derail its payout. It cut its final dividend in fiscal 2019 due to the pandemic, though it made this up with an additional interim dividend the following year.

Overall, I’m attracted to the stock’s defensive qualities and the potential for long-term dividend growth.