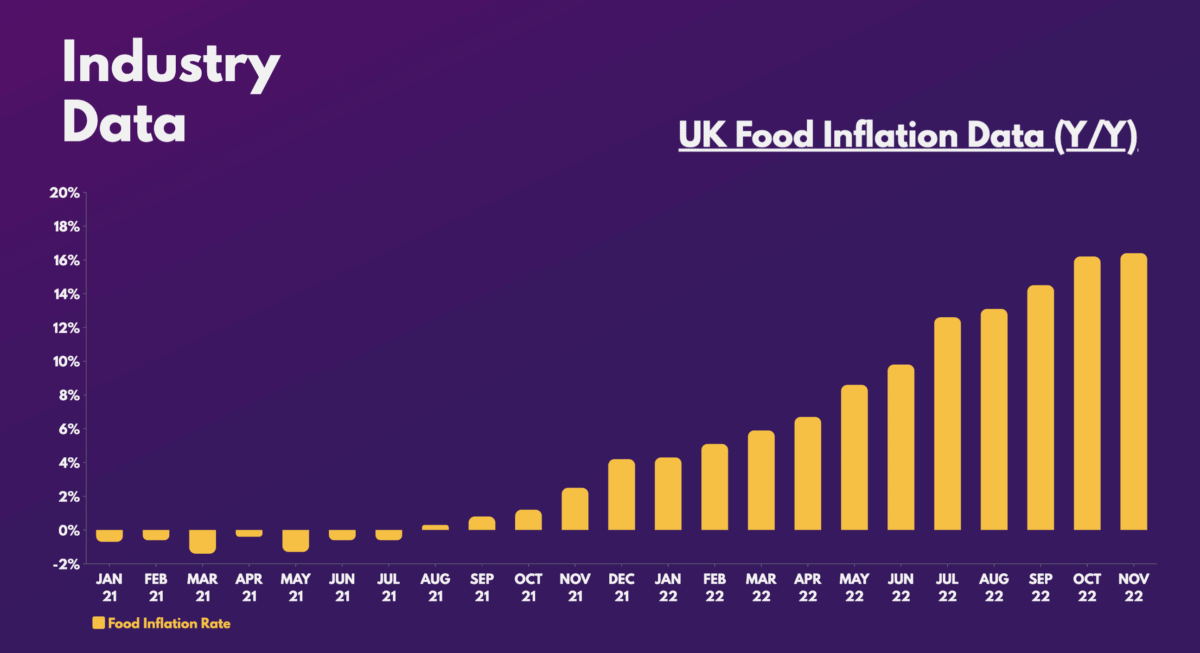

Sky-high inflation has forced many margin-pressured supermarkets, and their customers to tighten their belts. As a result, Tesco (LSE:TSCO) shares declined more than 20% last year as its bottom line took a substantial hit. Nonetheless, I think these three catalysts could allow the stock to do well in 2023.

1. Food inflation tapers off

Balancing shareholder returns while satisfying its customers has been a tightrope Tesco’s management has had to walk on. However, it’s the latter that has had priority. The FTSE 100 company has opted to absorb many cost increases, especially in food.

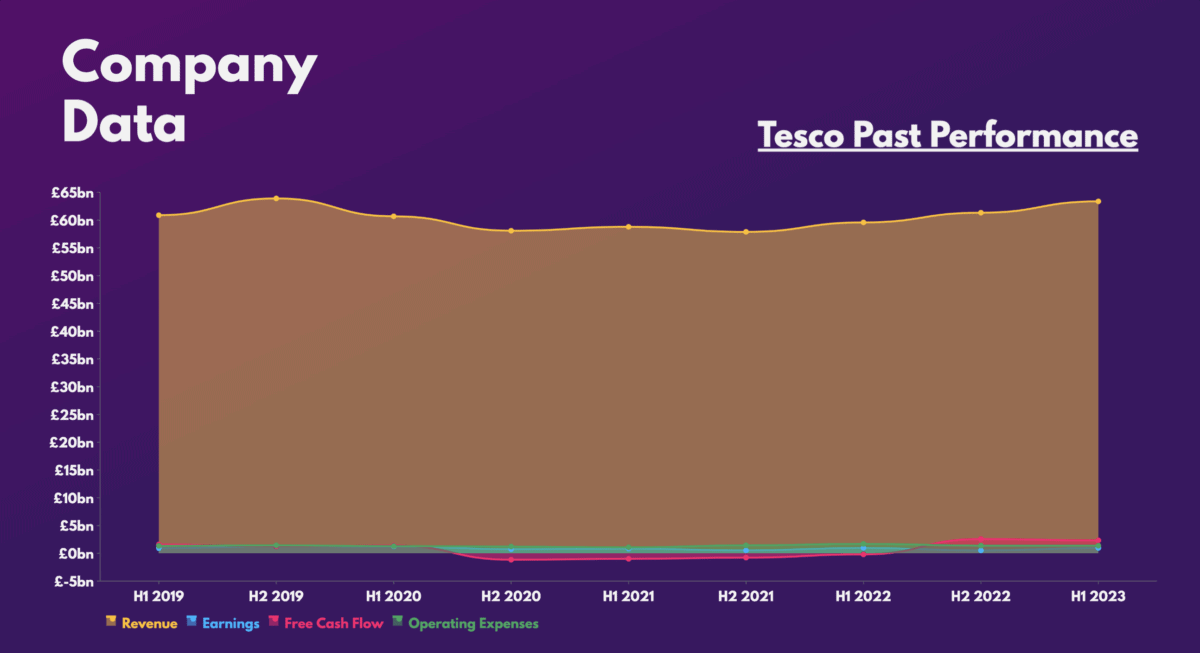

Consequently, its profit margins have taken a substantial hit over the past year. This was most evident when Tesco shared its latest half-year results, which saw net profit decline 67% despite revenue rising by 6.7%.

Having said that, thinning margins could be getting closer to an end. This is because food inflation is starting to slow. The combined impact of lower energy and commodity prices is beginning to positively affect food prices. Provided food inflation continues to cool, or even reverse in 2023, I can see Tesco begin expanding its margins again, which would be positive for its shares.

2. Successful Clubcard evolution

The conglomerate will also be launching a new version of its Clubcard app. This is expected to include more features and personalisation in a bid to fend off competition from improving loyalty schemes at other supermarkets.

Tesco CEO Ken Murphy shared his hopes that the revised scheme will boost customer volumes through better and more personalised offers. After all, Britain’s largest supermarket will be handing out more coupons to loyal shoppers more often. These will be given out as often as every two weeks, rather than the previous eight times a year.

If the new initiative is successful, I can imagine the retailer benefiting tremendously as it continues to assert its already dominant position in the supermarket sector.

3. Diversifying into advertising

That being said, the most exciting avenue for Tesco shares this year would be its venture into advertising. It may seem odd for a supermarket to enter such a competitive space. But I’d argue that Tesco’s dominance puts it in an excellent position.

Its data science business, Dunnhumby could very well capitalise on the amount of data it collects from customers and use it to their advantage in an extremely lucrative revenue stream. The company is already capitalising on this with its new Clubcard scheme.

Additionally, management is deciding to venture into selling ad space on its website and in-store. The group has already installed hundreds of ‘smart screens’ at the entrances of stores through a partnership with JCDecaux.

These moves could serve to prop up Tesco shares as the headwinds of 2022 potentially turn into tailwinds this year. Its advertising endeavour could also help expand its minuscule margins, if successful.

Nevertheless, I’m not a big fan of investing in companies with low profit margins due to the lack of pricing power — and the past year has shown why. Therefore, while I think Tesco’s short-term future is brighter than it was 12 months ago, I’m not inclined to invest until I see meaningful margin expansion.