One of Warren Buffett’s biggest holdings, Occidental Petroleum (NYSE: OXY) saw a 105% increase last year, due to raging oil prices. While I don’t think such a feat can be replicated this year, there’s still room for growth. Hence, I’ll be exploring whether it’s worth a position in my portfolio.

Golden barrels of cash

On the back of strong oil prices, Occidental’s revenues increased by as much as 79% in 2022. This sent net income soaring by 3,500% to $3.76bn when oil prices were at their peak.

This allowed Warren Buffett’s fund, Berkshire Hathaway, to hedge against its losses from other sectors like tech — which is why it managed to outperform the S&P 500 last year. Nonetheless, past performance is not an indicator of future performance. Thus, I’ll be exploring whether the strong momentum will remain in 2023.

China to outweigh Occidental pressures?

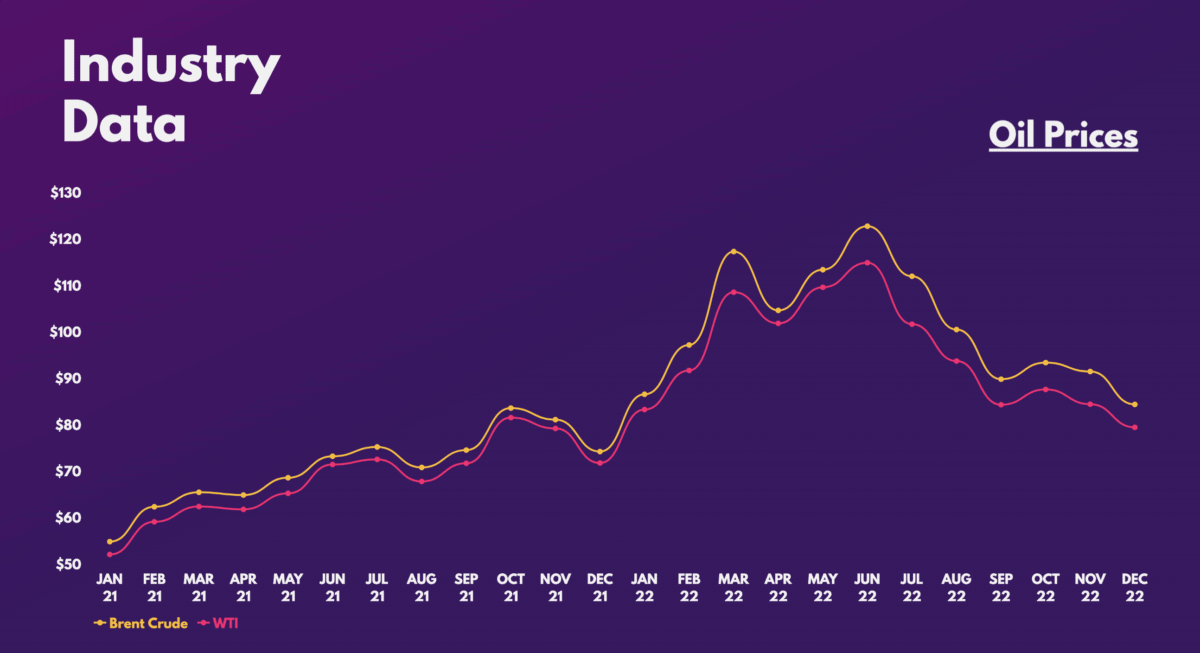

Sky-high inflation paired with rapid interest rate hikes have all led to alarm bells ringing surrounding a recession, particularly in Western countries. As such, oil prices have since come down drastically to 2021 levels over the past few months.

This has stoked fears in oil investors, given the downside risks. Nevertheless, Wall Street isn’t getting carried away by the noise, and neither is Warren Buffett, for several reasons.

For one, the gradual reopening of the Chinese economy should bring some support to oil prices in the medium term. Additionally, forecasts for a recession across Europe and the US indicate that it’ll be a shallow one. This means that demand for commodities and oil should remain at a reasonable level. Consequently, analysts are predicting oil prices to remain strong this year, with some even citing a rally.

Having said that, it’s worth noting that while Occidental’s stock relies heavily on oil prices, it also has other revenue streams such as liquified natural gas (LNG). With natural gas prices remaining elevated in both Europe and the US, I’m anticipating Warren Buffett’s investment to do relatively well despite the potential downturn in oil prices.

Exploring new streams of revenue

So, are Occidental shares worth buying for me? Well, they are currently trading at a relatively cheap price-to-earnings (P/E) ratio of 5. This is cheaper than many of its peers and the wider market. And given the bullish sentiment surrounding future earnings for the conglomerate, it’s trading at a relatively cheap forward P/E of 6 too.

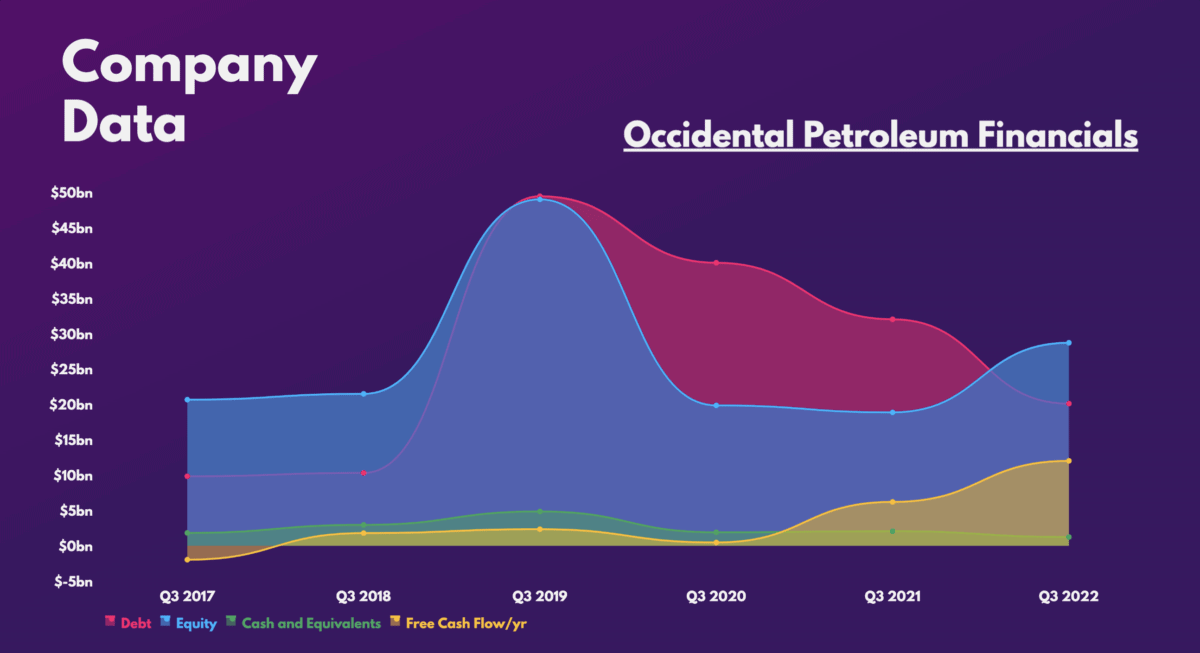

Having said that, while its debt-to-equity ratio is decent, its cash and equivalents barely cover it. This is something I’m taking note of. Even so, the company is reducing its debt pile while returning value to shareholders, which is a key trait Warren Buffett looks for when investing.

The stock has an average ‘hold’ rating with an average price target of $75. This indicates that the one-year outlook for the stock isn’t overly bright. However, the Oracle of Omaha wouldn’t have opted to purchase as much as 50% of Occidental’s outstanding shares if he didn’t believe in the long-term potential of the explorer.

After all, Oxy’s recent investments into carbon capture technology should allow it to benefit from the transition towards greener forms of energy generation as well. For those reasons, I may be inclined to start a small position when I’ve got more spare cash.