The International Consolidated Airlines Group (LSE:IAG) share price tumbled by mid-teen percentages during 2022. But it recovered strongly in the second half and City analysts are now gently positive on the FTSE 100 stock.

Of the 13 analysts with ratings on IAG shares, eight rate the company as a ‘buy’, four are neutral on the British Airways owner, while one has placed a ‘sell’ on it. That’s according to stock screener Digital Look.

So should value investors like me buy the travel giant’s shares for their portfolios?

2 reasons to buy

Like legendary investor Warren Buffett, I love a bargain. So I find the rock-bottom valuation on IAG shares extremely attractive.

City analysts expect the flyer’s earnings to explode 276% in 2023. Another 85% bottom-line increase is forecast for next year too. Consequently, its low price-to-earnings (P/E) ratio of 9.6 times for this year drops to a tiny 5.2 times for 2024.

The travel industry is recovering at a rapid pace following the coronavirus crisis. And IAG could also be considered one of the best ways to exploit this, thanks to its wide wingspan.

By this, I mean that the business has exposure to the fast-growing budget sector as well as the highly lucrative transatlantic market. It serves the former with its Vueling and Aer Lingus brands, and the latter most famously through British Airways.

Rumour has it that the FTSE firm has plans to continue building its scale too. It built a 20% stake in low-cost Air Europa over the summer and a full takeover could be launched soon.

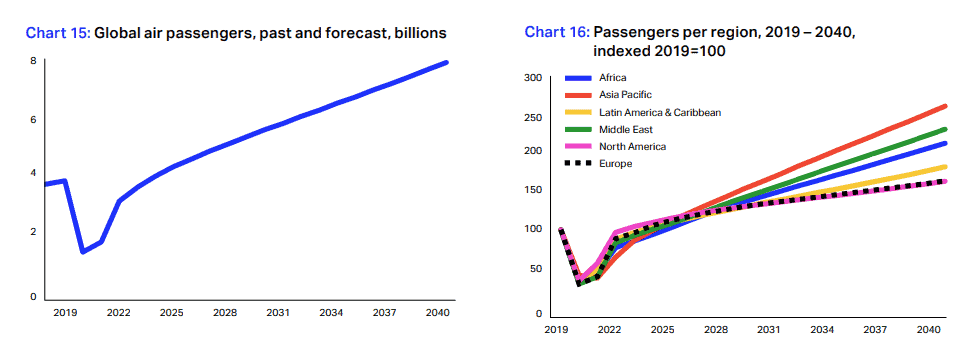

An enlarged group would provide even more opportunity to profit from long-term growth in the civil aerospace market. The International Air Transport Association (IATA) expects passenger demand to soar across all regions in the coming decades.

3 reasons not to buy

IAG shares have plenty of long-term potential then. But investors also need to consider the company’s high levels of debt. This is falling, but net debt still clocked in above €11bn as of September.

The cost of servicing this debt looks set to keep climbing too, as central banks raise interest rates to combat inflation. Such levels of indebtedness could also hamper the company’s growth plans.

I’m particularly worried about IAG’s debts, given the uncertain market outlook in the short to medium term. The recovery in air travel could hit the buffers as the global cost-of-living crisis intensifies.

Profit forecasts at IAG are also in danger from rising labour and fuel costs. These could be big obstacles in 2023 as workers struggle to make ends meet and the war in Ukraine drags on. Airline margins are notoriously thin, after all.

The verdict on IAG shares

So while I find IAG’s low share price highly attractive, I’m still not tempted to buy the FTSE firm just yet. I’d rather invest in other cheap UK shares for 2023.