As 2023 starts, I’ve been thinking about which of my holdings I’d like to add to. I’m a net buyer of stocks, so I’m generally purchasing shares rather than selling them. And these three investment trusts stand out to me as incredibly well positioned for long-term growth.

A fallen FTSE 100 star

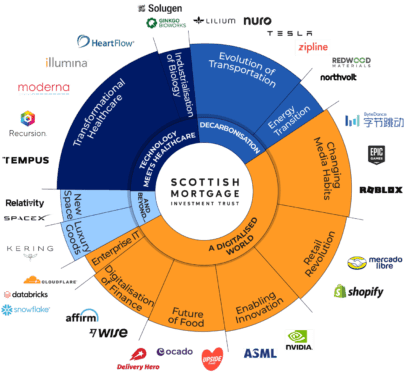

Down 45%, Scottish Mortgage Investment Trust (LSE: SMT) was one of the worst performers on the FTSE 100 last year. Yet there are a couple of reasons why I’m bullish on the shares over the next 10 years.

Firstly, a decade is a long time. It’s long enough for developing trends to go mainstream and for once-unprofitable companies to start generating substantial earnings. That’s where Scottish Mortgage’s strength lies. The long term. The managers ask investors to judge their performance over a five to 10-year period.

The trust has had great success over a long period. It found the likes of Nvidia, Tesla, and Amazon early on and generated large returns.

However, this style of investing is currently out of favour. That might not change for a while. But I think that risk is now priced into the stock, as it’s currently trading at a 10% discount to its estimated net asset value (NAV).

That means that the stock is potentially undervalued — for the first time in many years. As such, I’m ready to snap up some more shares for my pension portfolio.

Growth squared

Pacific Horizon Investment Trust (LSE: PHI) invests in the Asia-Pacific region (excluding Japan). This is the fastest growing part of the world, driven by an expanding middle-class and major exporting hubs.

The trust aims to invest in the top 20% of the fastest growing companies in the region. It summarises this approach as ‘Growth²’. That is, growth (of companies) multiplied by growth (of the region).

However, I like that this isn’t a pure tech fund. It also owns mining and energy stocks, which brings balance.

Top 10 Holdings

| 1. Samsung Electronics |

| 2. Daily Hunt |

| 3. JD.com |

| 4. Delhivery |

| 5. Li Ning |

| 6. Jadestone Energy |

| 7. Samsung SDI |

| 8. Reliance Industries |

| 9. Zijin Mining |

| 10. Ping An Insurance |

One risk is that of a further outbreak of Covid across Asia. China has experienced fresh waves of the virus recently and there’s every possibility it could spread further as travel opens back up.

Even so, I’m less worried about this over a 10-year horizon. Rather than Covid, I believe that the rapid development of the Asia-Pacific region will be the most important long-term factor.

Powerful tailwinds

The final stock I’d buy is BlackRock World Mining Trust. It targets both income and capital growth through investments in mining and metal shares. The stock has a dividend yield of 6%.

The portfolio is exposed to a range of compelling long-term themes, such as decarbonisation and digitalisation. Copper, iron ore, and lithium are all central to these trends, and all are well represented in the portfolio.

I think this trust is the safest way for me to gain exposure to these trends. Top holdings include BHP, Glencore, and Rio Tinto.

One risk is that mining stocks can be very volatile. However, over a decade-long period, I believe the trend will be upwards.