Rolls-Royce (LSE: RR.) shares have been a popular investment this year. It seems a lot of investors believe the stock – which has fallen significant since the start of the Covid-19 pandemic – is undervalued.

Currently, I don’t own any Rolls-Royce shares. Should I buy them for 2023? Let’s discuss.

Rising revenues and earnings

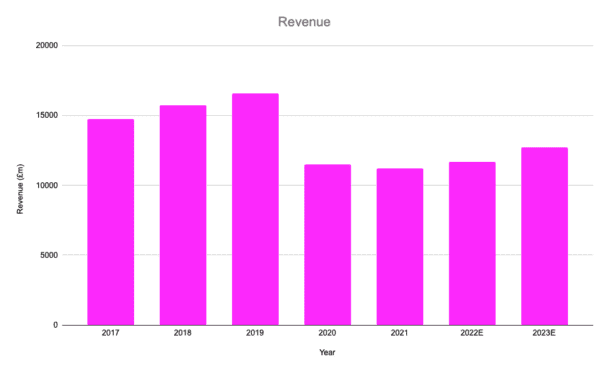

Rolls-Royce has certainly had a tough time in recent years. With the airline industry crippled due to the pandemic and the subsequent disruption, the aircraft engine maker’s revenues and profits have tanked.

City analysts do expect revenues and profits to rebound going forward though. Currently, they expect the group to generate revenue of £11,656m and £12,702m for 2022 and 2023 respectively, up from £11,218m in 2021. Earnings per share (EPS) are expected to come in at 110p this year and 362p next year.

One thing that could certainly help Rolls-Royce here is China’s reopening. This could result in far more planes in the air. An end to the Russia/Ukraine war could also provide a boost, although there’s no guarantee we will see this.

Factored into the share price?

The thing is though, a lot of this recovery appears to be baked into the share price and valuation already.

Currently, Rolls-Royce shares have a price-to-earnings (P/E) ratio of 84 using 2022’s EPS forecast and 25 using 2023’s EPS forecast. These multiples are well above the median FTSE 100 P/E ratio of 13.3. So they don’t strike me as very attractive.

Huge debt pile

Digging deeper, there are few other things that concern me about Rolls-Royce shares. One is debt on the balance sheet. In its most recent trading update, posted in early November, the company said it had £4bn of debt on its books. That’s quite high and adds risk to the investment case.

Brokers’ views

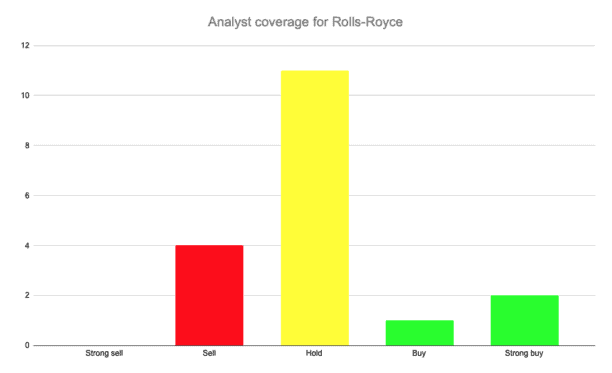

Another issue for me is that analysts aren’t very bullish here. Of the 18 brokers covering the stock, only three currently rate it as a ‘buy’ or ‘strong buy’. Worryingly, four rate it as a ‘sell’.

Meanwhile, broker share price targets are a little underwhelming too. Here’s a look at some recent targets:

- Barclays: 110p

- Berenberg: 100p

- Deutsche Bank: 90p

- JP Morgan: 60p

Sure, Barclays’ price target implies some decent upside from here. However, on the flip side, JP Morgan’s implies significant downside from current levels.

Poor long-term track record

Finally, Rolls-Royce’s track record in terms of profitability is also a little concerning. Looking at the financials, the company posted net losses in 2016, 2018, and 2019 (all before Covid-19). This isn’t very encouraging. I prefer to invest in companies that are consistently profitable.

My move now

Putting this all together, I won’t be buying Rolls-Royce shares for my portfolio for 2023. To my mind, the risk/reward proposition isn’t very compelling.

Right now, there are plenty of other stocks I see as more attractive.