I’ve looked for the best FTSE 100 shares in what could be another wild year for the global economy. Here are four I think could deliver splendid investor returns in 2023 and beyond.

Severn Trent

Water companies such as Severn Trent are brilliantly boring. They’re not ideal investments for share pickers seeking exciting earnings growth. But the essential service they provide gives them exceptional profits visibility.

This in turn gives them the financial strength and the confidence to consistently pay decent dividends. Yields at Severn Trent sit at 4% and 4.4% for the financial years to March 2023 and 2024 respectively.

I think this utilities share is an attractive buy, even though it carries huge amounts of debt. The costs of servicing this could increase sharply as interest rates rise.

Bunzl

Support services business Bunzl has been one of my most profitable holdings. I also consider it to be one of the best ‘stress free’ stocks out there.

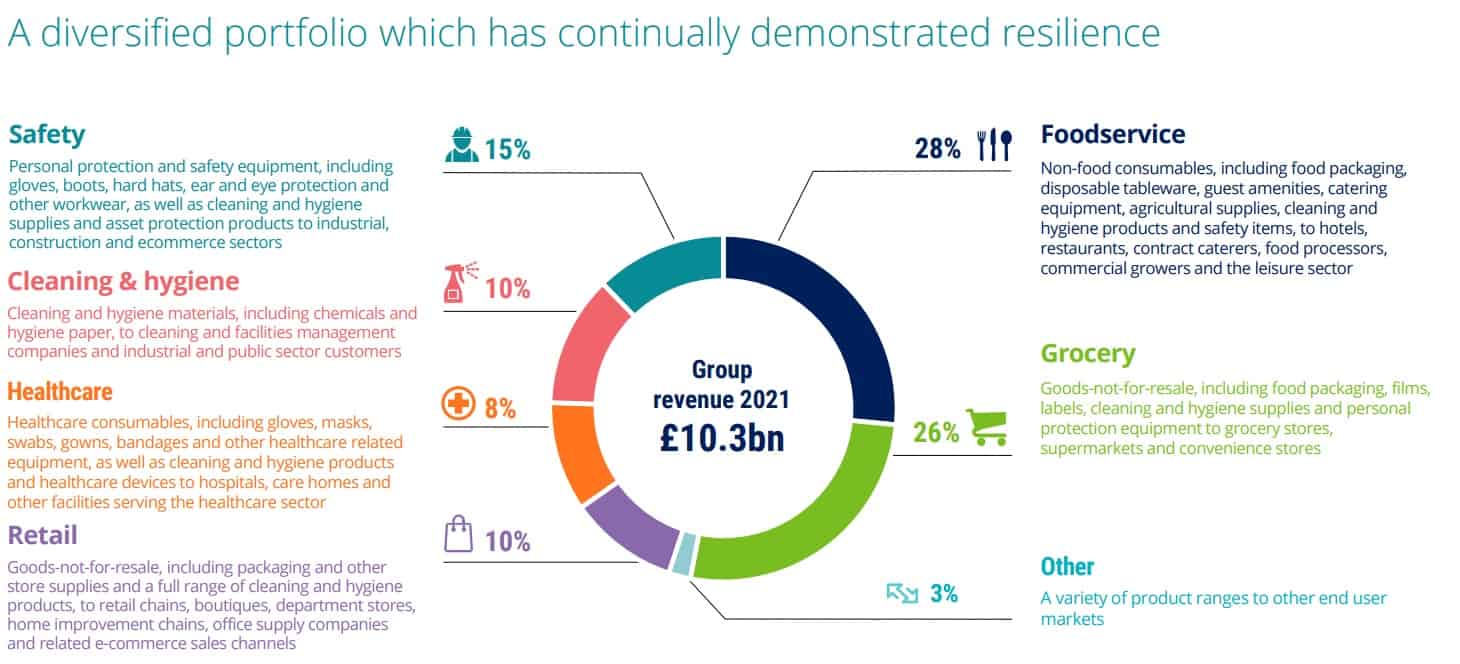

The company sells a wide range of essential goods in multiple sectors across the world. This gives it terrific earnings visibility at all points of the economic cycle.

The FTSE 100 company is also able to keep growing earnings, thanks to its ambitious acquisition-based growth strategy. Just last week it announced four more buys spanning Europe and Australasia in the healthcare and packaging sectors.

When they go wrong mergers and acquisitions can erode shareholder value. But Bunzl’s strong track record here provides me with peace of mind.

GSK

Healthcare shares such as GSK are some of the most robust during economic downturns. Spending on medicines that improve or extend our lives is something people don’t easily cut back on.

However, investing in pharma shares like this carries dangers. The route from lab bench to pharmacy shelf is complicated and expensive. Setbacks can cost drugs developers a fortune in extra costs and lost revenues.

But GSK has a stellar record on this front. In fact, the hard work of recent years has lit a fire under sales of late. Group turnover jumped 18% during the three months to September.

The company’s late-stage pipeline has also improved in 2022, boosting its revenues outlook beyond next year.

Diageo

History shows that demand for alcoholic beverages remains stable during good times and bad. As a result, buying Diageo shares for 2023 could be a wise move for investors as the global economy toils.

The company makes market-leading products like Smirnoff vodka, Guinness stout and Johnnie Walker whisky. These labels command excellent brand recognition which give the business another layer of protection in tough times. It can raise prices to grow earnings without suffering a sharp fall in volumes.

The main drawback is that Diageo operates in a highly competitive industry. So it has to spend vast amounts on marketing to stay ahead of its rivals. This can take a big bite out of profits.