Grocery price inflation declined for the first time in almost two years in November. As such, analysts are forecasting for consumers to spend at record levels this Christmas. With that in mind, I think supermarket stocks like Tesco (LSE: TSCO) are worth a look.

Prices are chilling out

The latest Kantar and inflation reports shows that inflation, especially for groceries, could be on the verge of cooling down. Consequently, Kantar now forecasts for supermarkets to face the busiest sales period ever recorded as the research firm has noticed that shopping frequencies are also increasing.

The combination of inflation and festive spending means that the coming month is on course to be the biggest ever for take-home grocery sales. December looks set to be a record-breaking month with sales going above the £12bn mark for the first time.

Kantar

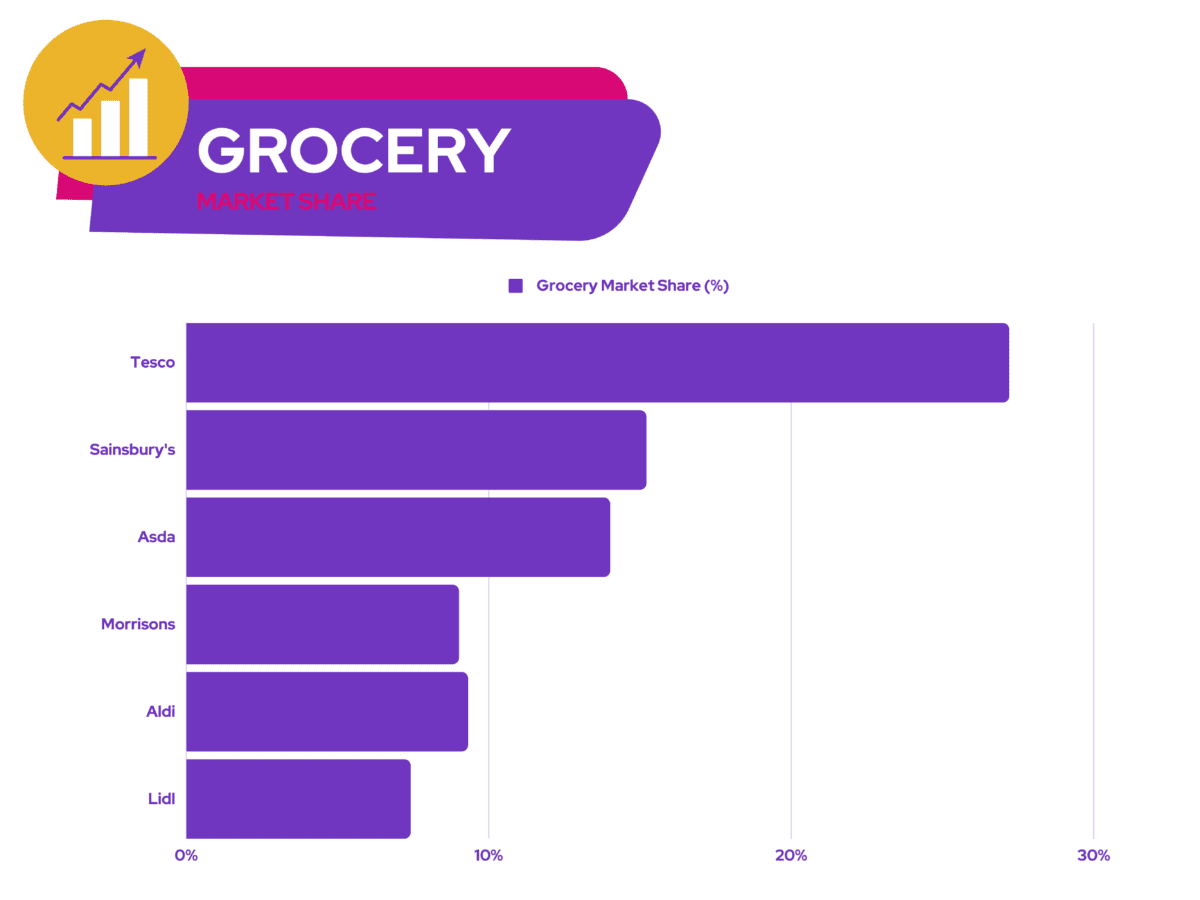

Tesco’s market share of 27.2% remains robust despite the cost-of-living crisis. Therefore, I believe it’s well positioned to take advantage of the increased spending this holiday season. After all, its sales are up 3.9% on an annualised basis.

Joining the club

To complement this positive momentum, Tesco has also joined its peers in revising its Clubcard loyalty programme. The FTSE 100 conglomerate will be launching a new version of its app to include more features and personalisation.

The new app will hopefully boost customer volumes through better and more personalised offers. Additionally, the nation’s biggest supermarket will be handing out more coupons to loyal shoppers more often. These will be handed out as often as every two weeks, rather than the previous eight times a year.

Shares on discount?

Should I buy Tesco shares then? And more importantly, are they currently trading on good value? Well, for starters, its share price has collapsed by more than 20% this year.

As a result, it’s currently trading at a price-to-earnings (P/E) ratio of 18. The wider index trades at an average P/E of 14, which means that the stock isn’t particularly cheap. However, It’s worth noting that the P/E ratio is a lagging indicator.

A more accurate way to value Tesco would be to look at its forward P/E. This takes its forecast future earnings into consideration. Trading at a forward P/E of 12, it can be said that I’m paying a fair value for future earnings growth within a year. Moreover, its price-to-earnings (PEG) ratio of 0.1 complements this. Furthermore, the retailer has reasonably priced price-to-sales (P/S) and price-to-book (P/B) ratios too. These stand at 0.3 and 1.3, respectively.

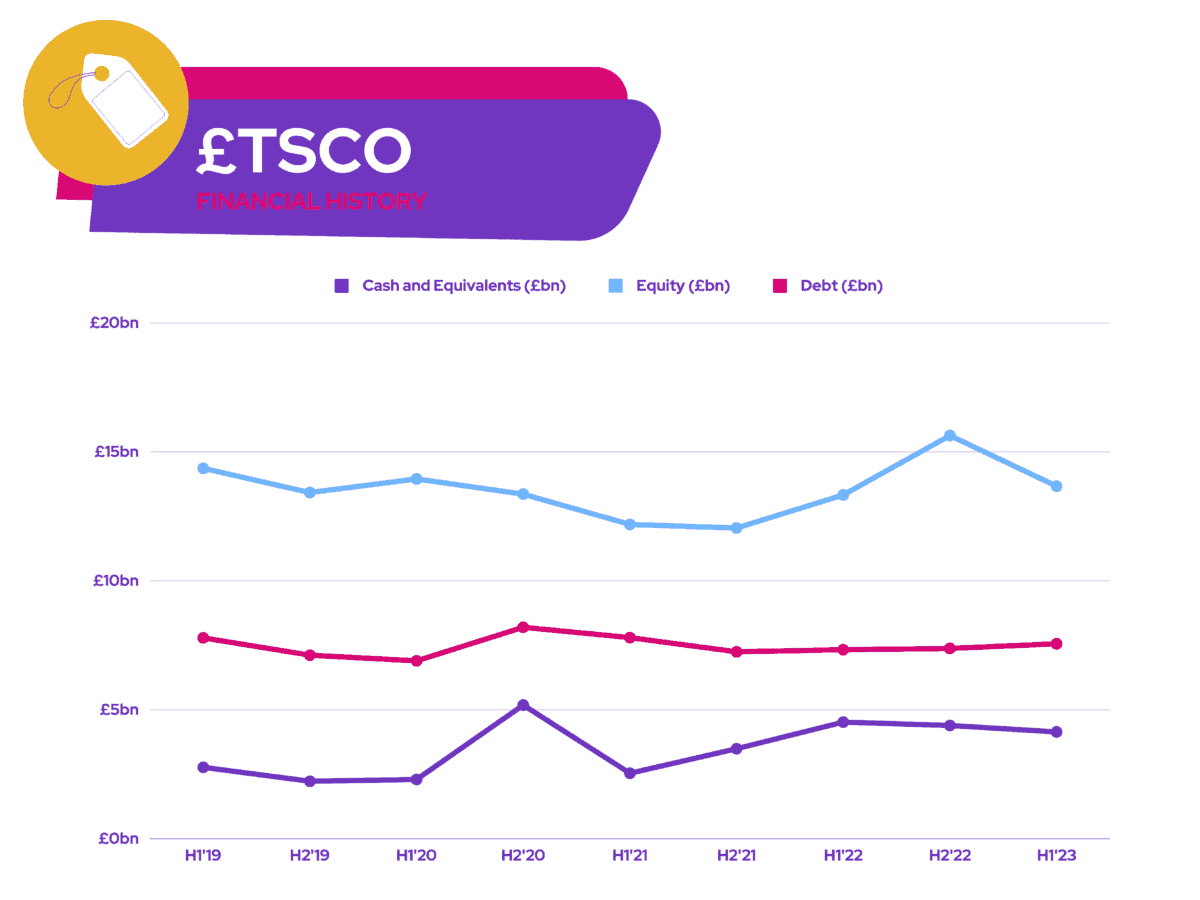

Hence, the above multiples indicate that shares in the grocer are decently priced. To make things sweeter, it’s also got a lucrative dividend yield of 5.1%, which it can cover comfortably at two times given the strength of its balance sheet. Nonetheless, it’s worth noting that a short-term decline to its bottom line could impact dividend payments for the next few quarters.

Even so, the industry’s headwinds are slowly reversing into tailwinds, with the retail giant set to benefit. In fact, JP Morgan reiterated its ‘overweight’ rating on the stock with an average price target of £2.70, citing it as a ‘winner’ in 2023. Thus, I’m deeply considering buying Tesco shares for its potential 20% upside and lucrative dividend yield when I’ve got more spare cash.