Glencore’s (LSE:GLEN) share price has risen strongly since the summer. Yet on paper, the commodities giant continues to offer tremendous all-round value.

City analysts think earnings here will slump 30% year on year in 2023. This leaves the FTSE 100 stock trading on a forward price-to-earnings (P/E) ratio of 5.9 times. Glencore shares also carry a mighty 8.9% dividend yield for next year. This is more than double the FTSE index average of 3.7%.

So should investors buy this rocketing value stock for their portfolios?

Danger zone

Glencore is one of the biggest raw materials producers on the planet. It gathers copper, nickel, cobalt and an array of other industrial metals from its vast global network of mines. The business also operates a vast recycling operation for base and precious metals.

It is also one of the planet’s biggest marketer of metals and energy products.

The trouble is that Glencore’s profits are highly sensitive to broader economic conditions. It doesn’t matter how much cost-cutting the company does to mitigate this. When commodities demand sinks and prices fall, profits at mining businesses like this tend to collapse.

Under pressure

And things here look grim for 2023. Analysts at ING Bank, for example, predict that “there is further downside for commodity markets” as consumption cools.

They paint a particularly worrying picture for metals specifically too. ING’s experts note that “comfortable supply and demand balances” and “poor sentiment” suggest that “most metal prices will remain under pressure in the early part of 2023”.

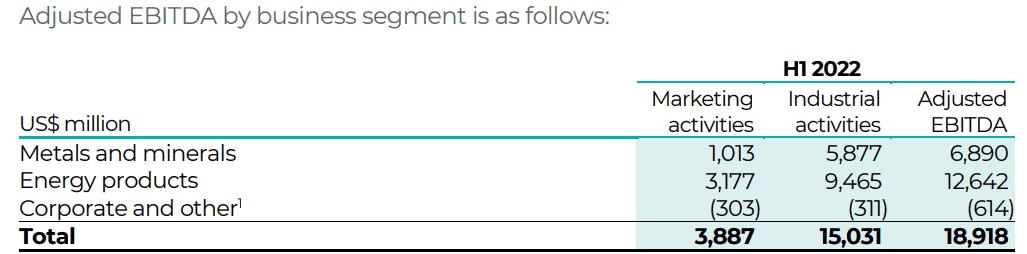

A meltdown in metals prices would be a problem for Glencore. The production and marketing of metals is a major earnings generator for the business, as the table below shows. There’s a danger too that prices could be lower than expected in the second half of next year too, if supply growth is surprisingly large.

Such uncertainty explains why Glencore’s shares still carry such a low valuation.

Demand set to boom?

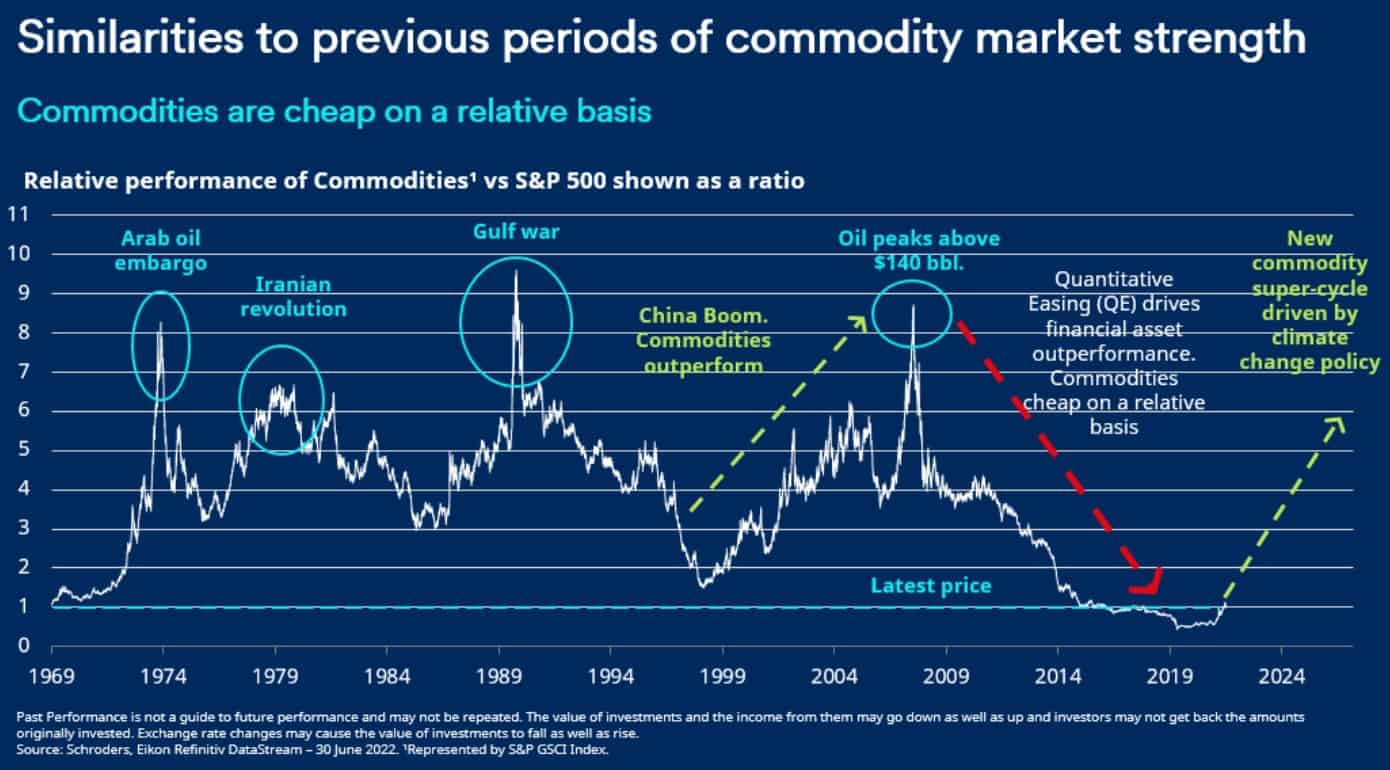

Having said that, from a long-term perspective, I think the business offers terrific investment potential. In fact, I expect Glencore’s share price to soar from current levels as the new commodities supercycle gets underway.

As the chart shows below, demand for a huge range of raw materials is tipped to rocket as demand for green technology heats up. Rising infrastructure spending across developed and emerging economies will also light a fire under commodities sales.

Analysts at Rystad Energy expect copper consumption, for instance, to rise 16% by the end of the decade to 25.5m tonnes. Soaring production of electric vehicles (EVs) and renewable energy hardware is set to drive demand for the red metal.

The verdict

So I’d buy Glencore shares today before they might soar. That low P/E ratio provides a wide margin of safety in case trading conditions considerably worsen in 2023. And that huge predicted dividend (which is covered a healthy three times by anticipated earnings) could give my passive income a big boost.

I think Glencore could be one of the best FTSE 100 bargains out there.