Google’s parent company Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has been one of the best-performing stocks of the past decade. But 2022 has been a nightmare for the conglomerate. Nonetheless, with its stock price down 30% this year due to a bear market, its charts could indicate a once-in-a-lifetime bargain.

Charting the numbers

Alphabet is a combination of several businesses. Its main source of revenue comes from advertising, but within that includes its Search, Network and YouTube operations. Additionally, the group has exposure to Cloud and even biotech in its Others Bets segment.

| Business segment | Revenue (Q3 2022) | Operating margin (Q3 2022) |

|---|---|---|

| Google Services | $61.38bn | 32.2% |

| Google Cloud | $6.90bn | -10.2% |

| Other Bets | $209m | -52.7% |

| Overall | $69.09bn | 25% |

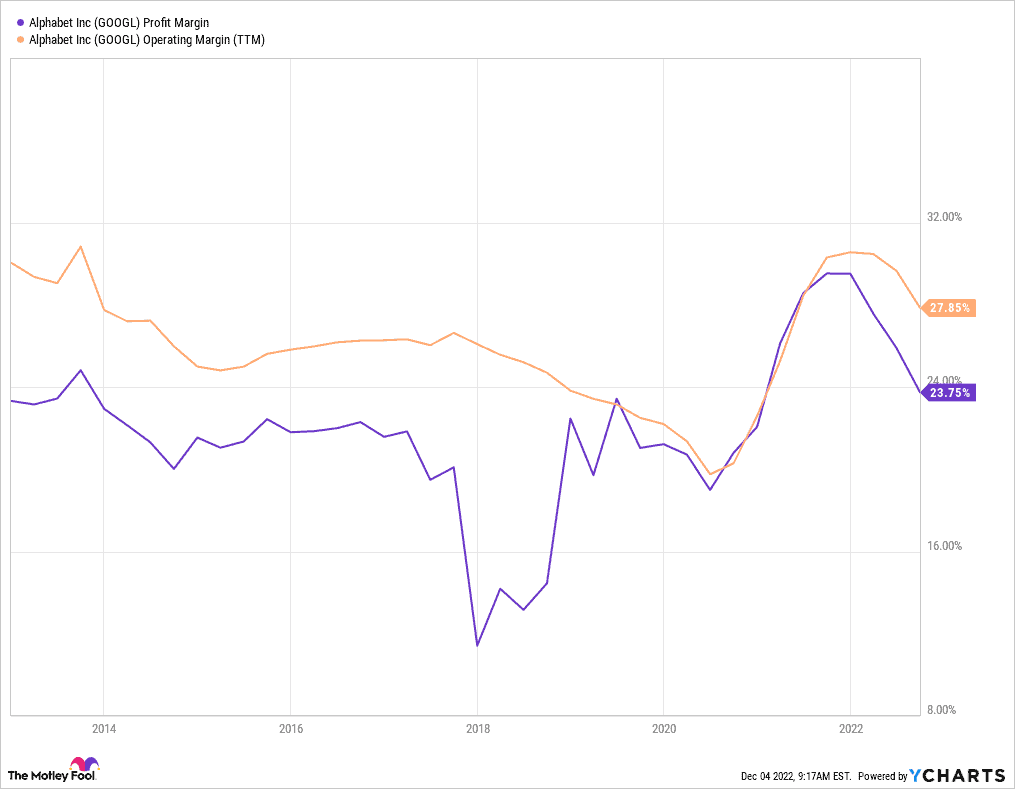

These segments all have drastically different margins. But all together, Alphabet’s operating and profit margins are considered to be healthy at above 20%. More importantly, these metrics have seen relative improvement over the last decade, which is a rarity at other companies.

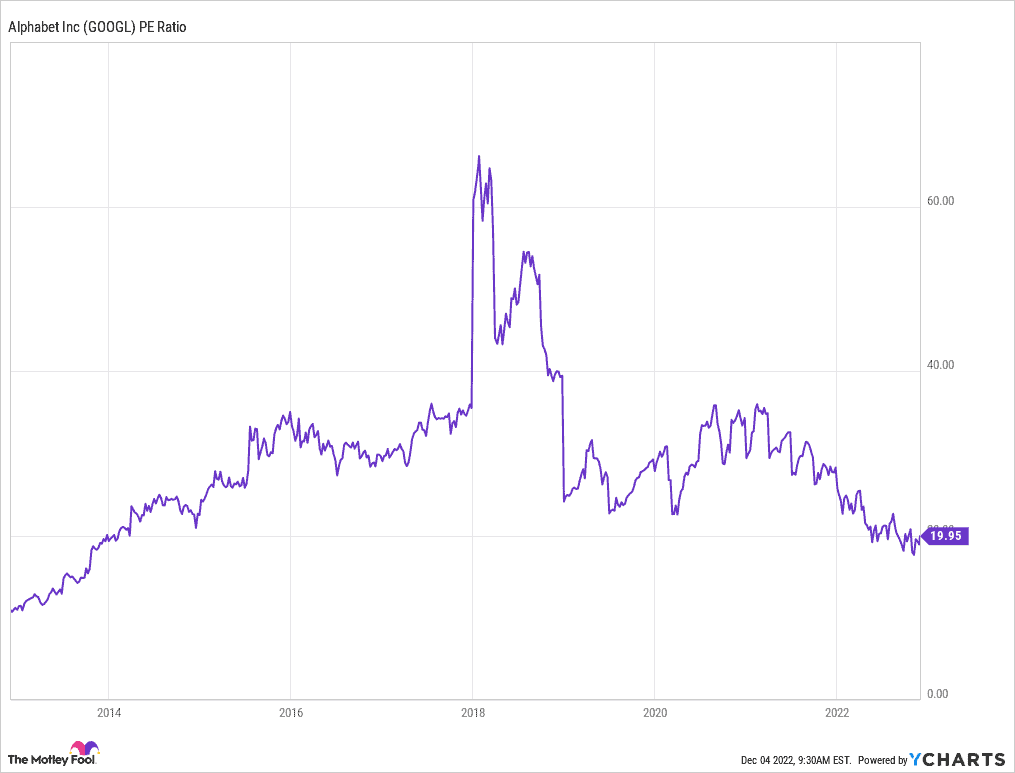

But what catches my eye is that the stock currently trades at a price-to-earnings (P/E) ratio of 20. This is slightly cheaper than the S&P 500‘s average P/E of 21. What makes this significant is that it’s the first time in years that Alphabet stock is trading at a cheaper valuation than the broader market.

In search of growth

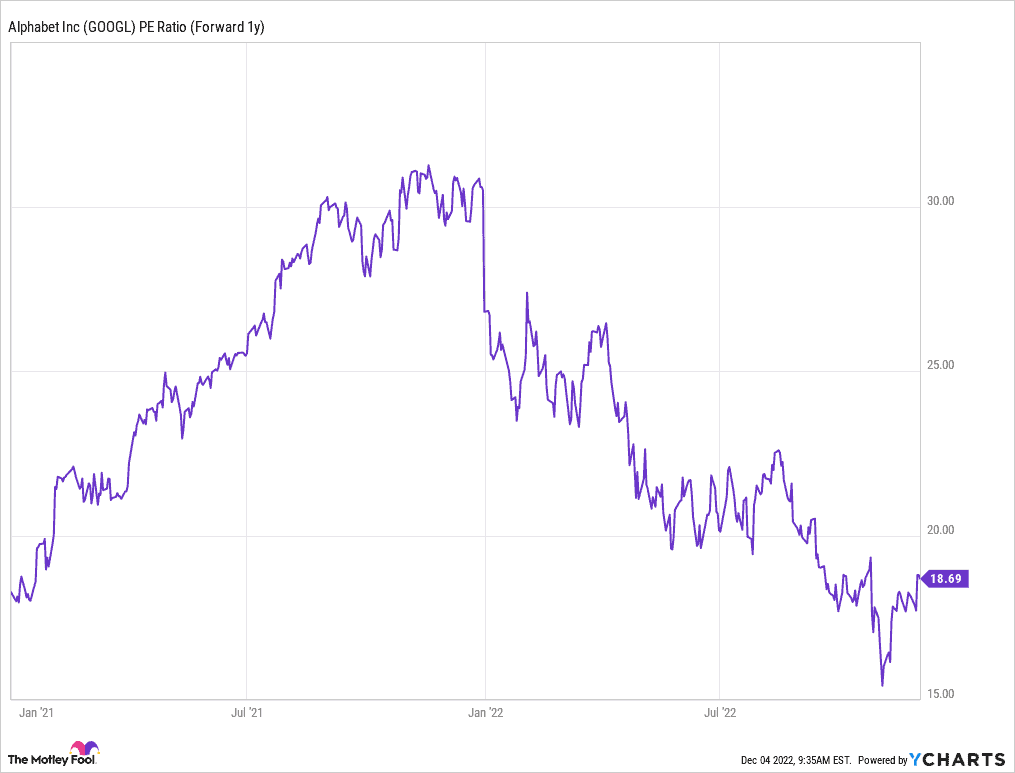

It’s worth noting, however, that P/E ratio is a lagging indicator. A more accurate way to value Alphabet would be to look at its forward P/E. This takes its forecast future earnings into consideration. With a forward P/E of 19, it can be said that I’m paying a fair value for future earnings growth within a year.

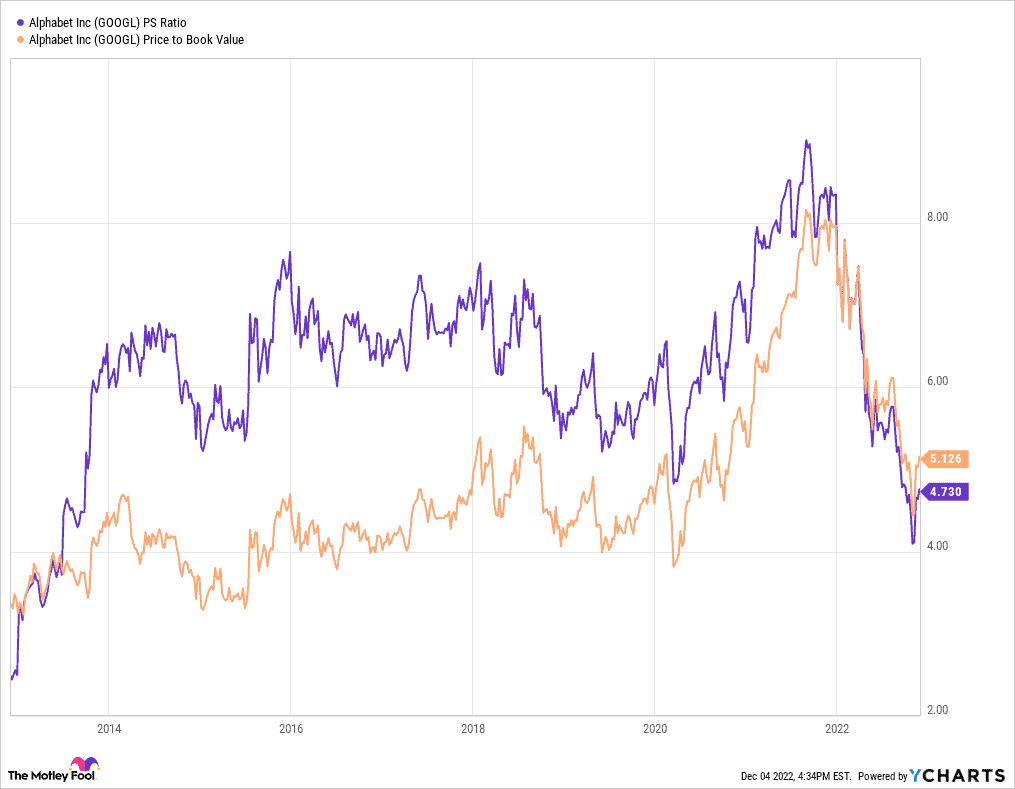

On the flip side though, other multiples such its price-to-sales (P/S) ratio and price-to-book (P/B) ratio are higher than the S&P 500’s average of 2.3 and 3.8 respectively.

Nevertheless, it’s important to note that the above multiples don’t account for the long-term growth of Alphabet’s brightest prospects, such as Google Cloud. That’s because these growth multiples only account for one-year horizons.

With cloud computing forecast to be a multi-trillion dollar market, Google Cloud’s current revenue doesn’t reflect its full earnings potential. Analysts are expecting this segment to be Alphabet’s next growth juggernaut.

Having said that, I see Alphabet returning to double-digit top and bottom-line growth once wider macroeconomic conditions improve. On that basis, Alphabet stock at its current share price presents a bargain, in my opinion.

Great capital utilisation

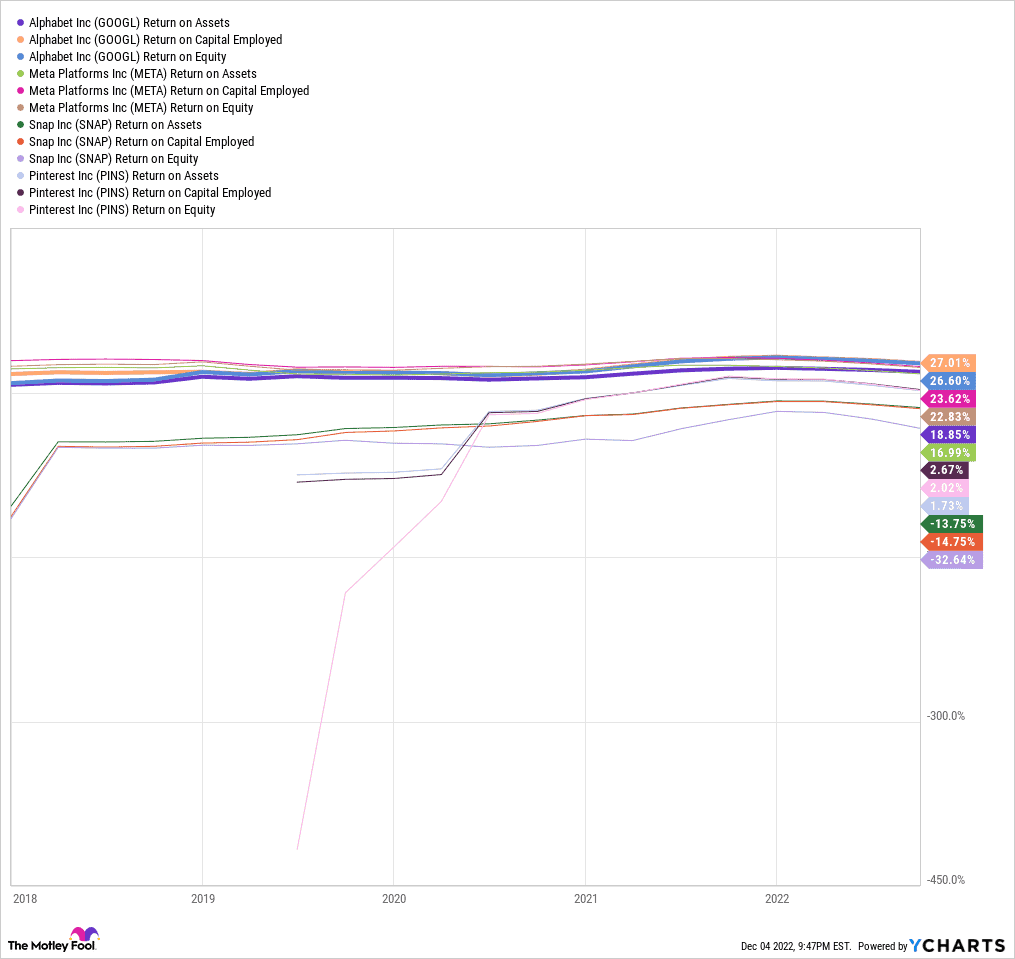

Moreover, CFO Ruth Porat has an excellent track record of overseeing large returns for shareholders. Looking at the company’s return on assets, equity, and capital employed, there’s clearly a distinction to be made, with Alphabet outperforming many of its social media peers.

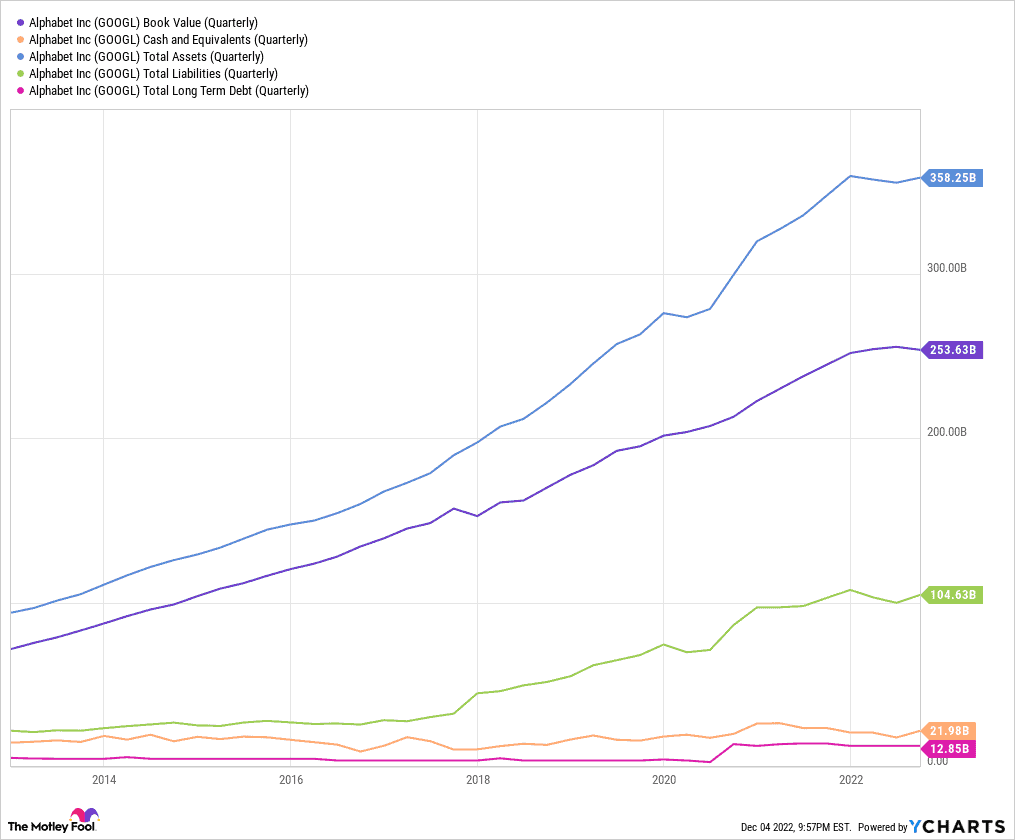

There’s certainly some noise surrounding the firm’s headcount at the moment. However, I’m sure Porat understands the importance of managing costs in a recession. After all, she and the rest of the board have managed to build one of the strongest balance sheets in Silicon Valley.

Therefore, I believe Alphabet stock’s current valuation of approximately $100 is cheap given my investing time horizon of three to five years. So, with an average ‘strong buy’ rating and price target of $129 from analysts, I’ll be buying more shares for my portfolio to capitalise on the stock’s long term upside.