Britain’s biggest telecoms company has been in the spotlight recently. As a result, plenty of brokers have updated their stance on the stock. With that in mind, here are some clear reasons why I’d buy BT (LSE: BT.A) shares, and others that would encourage me to look elsewhere.

Striking a pay deal

There’s one optimistic reason to buy BT shares, and that’s the conglomerate’s latest move. The board has finally managed to strike a deal with its workers. The painful industrial action that has costs the company millions will come to an end, for now. In return, the FTSE 100 firm will offer a £1,500 pay rise to all staff on less than £50,000 a year. This is expected to take effect in January.

Although this will undoubtedly hurt its bottom line, there’s a case to be made that it’ll do more good than harm over the long term. This is because fewer strikes will allow the company to continue expanding its fibre optic broadband rollout, and fend off the increasingly hostile competition.

Lining up cost cuts

Management will be aiming to mitigate the increase in labour costs by cutting expenses elsewhere. It has proposed merging its Global and Enterprise divisions. This could see its savings target increase by an additional £10m-£20m from the revised £3bn quoted, and is another attractive reason to invest in BT stock.

Virgin competition

Having said that, there are also reasons that would encourage me to look elsewhere. The first would be BT’s competition. Its biggest rivals in the industry, Sky and Vodafone, are both in the middle of an ultrafast broadband war. The telecoms giant faces an uphill battle if it can’t keep up with their rush to build an ever larger fibre optic infrastructure.

And despite agreeing a pay deal, several analysts remain pessimistic. The next pay review comes in nine months’ time, and could see yet another round of strikes. If this follows through, BT’s Openreach division could see further a slowdown in its fibre optic installations, which could allow rivals to catch up.

My call

Its price-to-earnings (P/E) ratio of 7, and 6.4% dividend yield may make BT shares seem lucrative. However, I’m not so convinced. That’s because the price-to-earnings growth (PEG) ratio is above average at 0.8, with earnings expected to decline in the near term.

Additionally, the anticipated price increase of 3.9% plus inflation isn’t going to sit well with its customers. This is especially the case when a recession is on the cards while other competitors offer better deals.

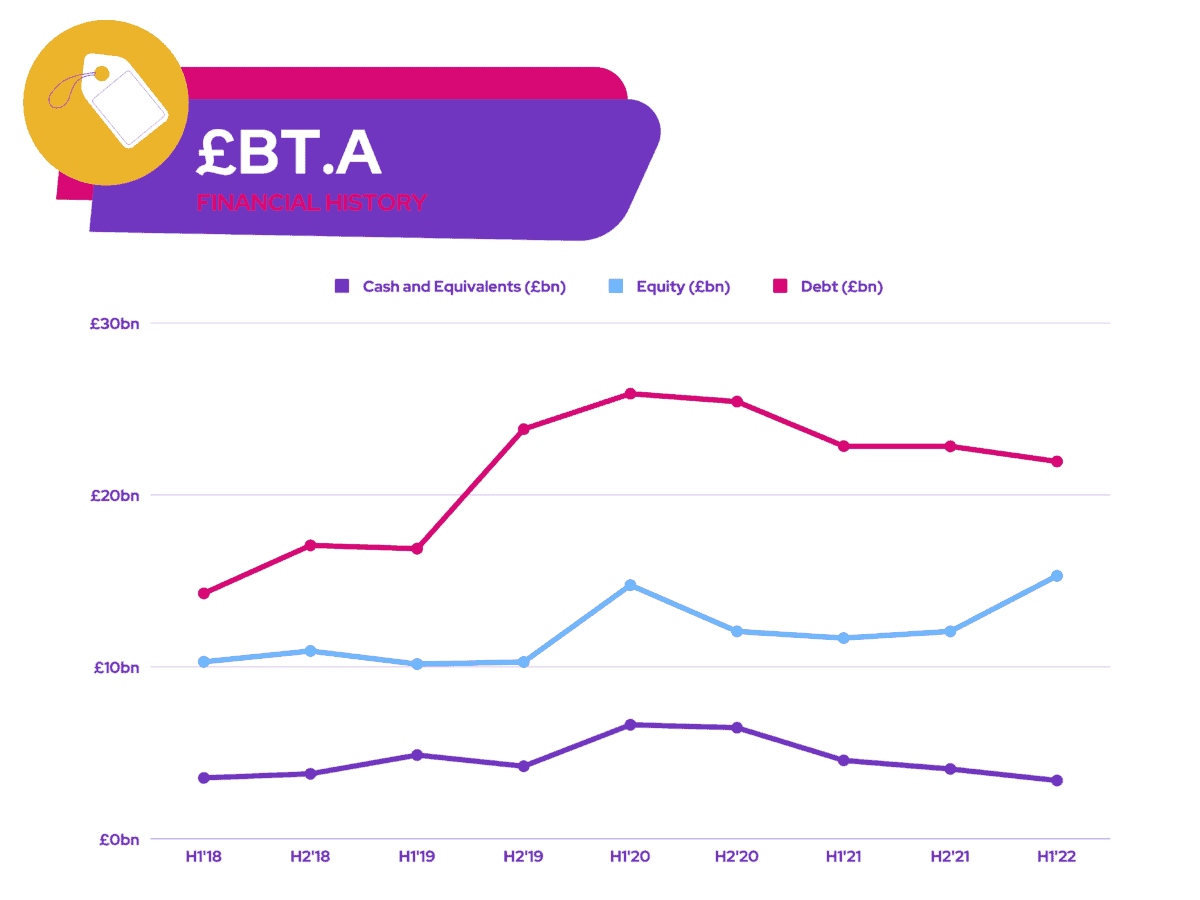

As such, I’m not entirely convinced of the firm’s earnings potential in the near-to-medium term. Barclays and JP Morgan may have an ‘overweight’ rating on the stock with an average price target of £2.05. But I’m sceptical of such high upside potential given the state of BT’s debt. In conclusion, I won’t be investing in the shares. Instead, I’ll be looking to invest in other companies with better balance sheets.