Warren Buffett’s Berkshire Hathaway bought a load of TSMC (NYSE: TSM) stock in November. The Oracle of Omaha is renowned for picking great securities to invest in. For that reason, I’m strongly considering investing in the world’s most valuable semiconductor company.

Chipping away

The TSMC share price hasn’t done well at all this year. The microprocessor manufacturer was once a pandemic darling due to sky-high prices for the commodity. This was a result of rocketing demand and dampened supply. However, momentum has quickly died down this year as fears of a recession have dented demand for semiconductors substantially. Additionally, there are geopolitical risks surrounding China’s intentions towards Taiwan, which hasn’t helped investor sentiment.

But Warren Buffett once said: “Be greedy when others are fearful”. The world’s greatest investor practiced what he preaches and started a multi-billion dollar position in TSMC last month. His fund purchased approximately 60m shares of its stock, totalling roughly $4.1bn. Hence, the chip maker is now in Berkshire’s top 10 holdings. News of this lifted TSMC shares that are now up 35% from its bottom this year.

Conducting growth

So, this leads me to wonder just why Buffett opted to go big on the business. To put it simply, the potential market for the semiconductor space remains a multi-trillion dollar one. As human beings become increasingly reliant on technology, demand for microprocessors is only going to increase.

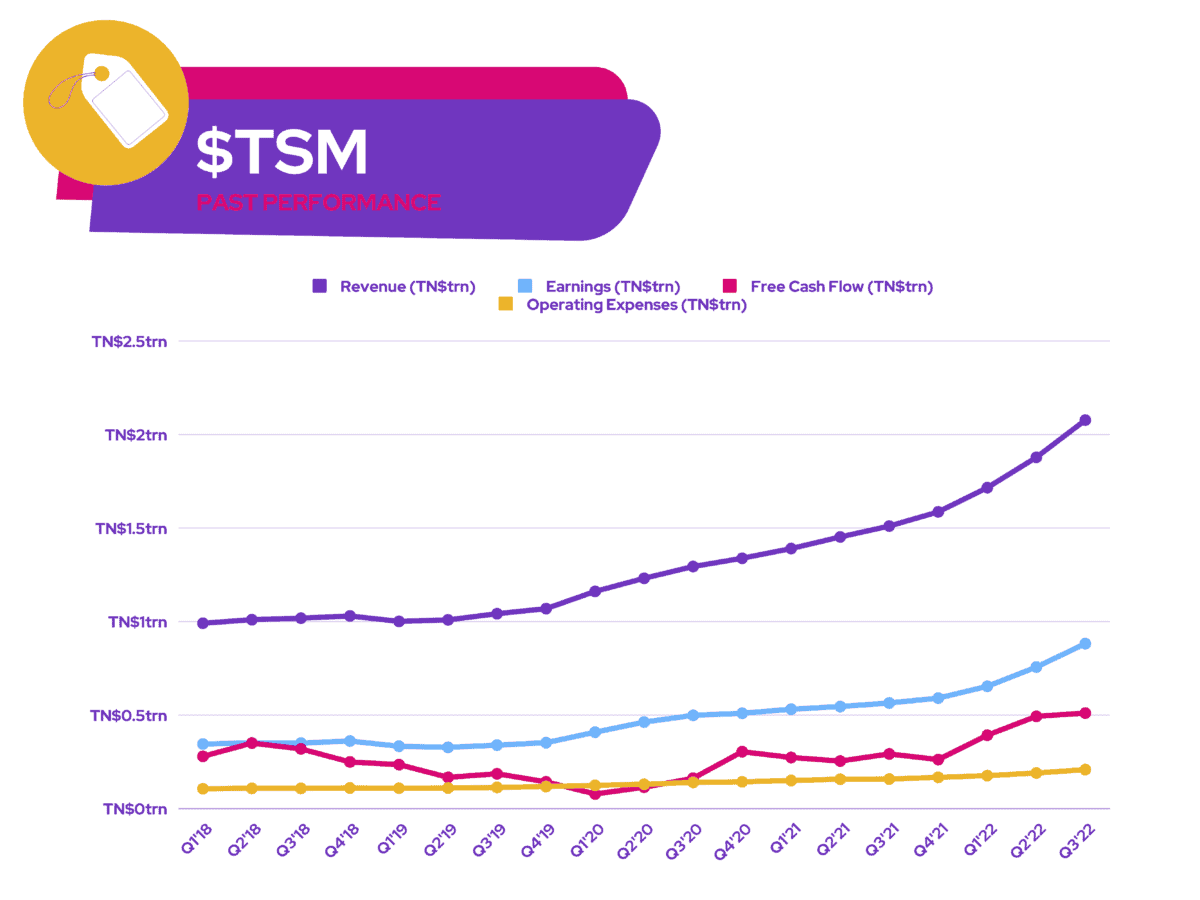

TSMC is well equipped to capitalise on this, and is optimistic about growing its reach and offerings moving forward. The company expects global sales to roughly double to more than $1trn annually within the next decade. With improvements in manufacturing capacity and subsidies for factory building by governments in the US and Europe, this remains a strong possibility.

Moreover, the manufacturer produces chips for several of the world’s biggest companies. These include the likes of Apple, AMD, Nvidia, and many more. With cloud computing and consumer electronics expected to continue growing over the coming years, I’m expecting businesses’ growth to continue on a steep upward curve.

That said, there’s always going to be the risk that China could become more assertive towards Taiwan at any time. This is why TSMC has opted to build a number of new factories outside the Chinese straits. This is good news as it allows the conglomerate to spread its eggs across multiple baskets.

Key points

Furthermore, it’s also been developing better chips, thus increasing its competitive advantage as well. In fact, the firm has been leading chip advancements since the early 2000s, all while maintaining more than half of the market share. And what’s even more impressive is that TSMC has seen its margins expanding at twice the rate of its peers.

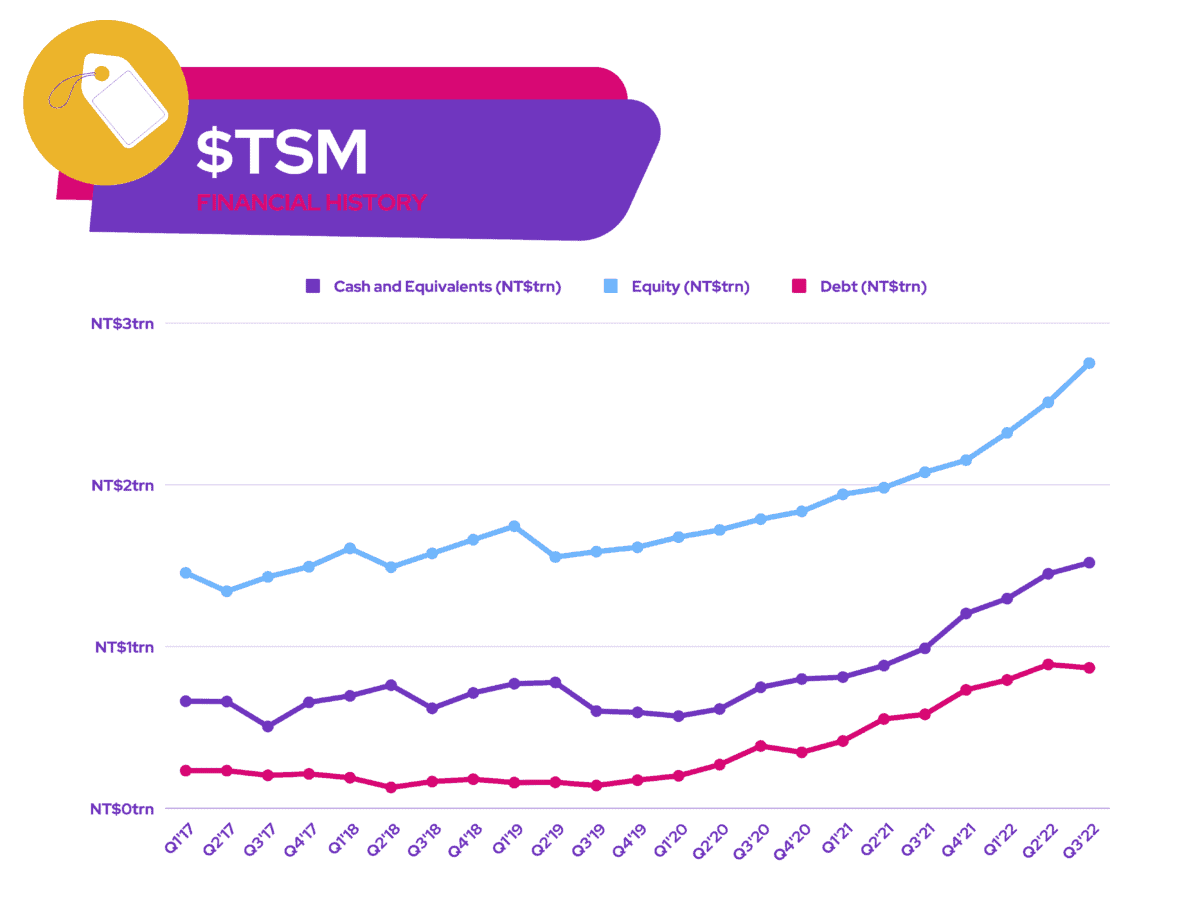

Having said all that, do I think its stock is worth investing in? Well, there’s certainly geopolitical risks to account for. Nonetheless, I’m a big fan of the firm’s financials, growth prospects, and strong moat. There’s certainly a lot more to TSMC than just that, but this ticks all the boxes that Warren Buffett focuses on for an excellent investment. As such, with an average ‘strong buy’ rating and price target of $99.50, I’ll be looking to invest in TSMC stock in the coming days.