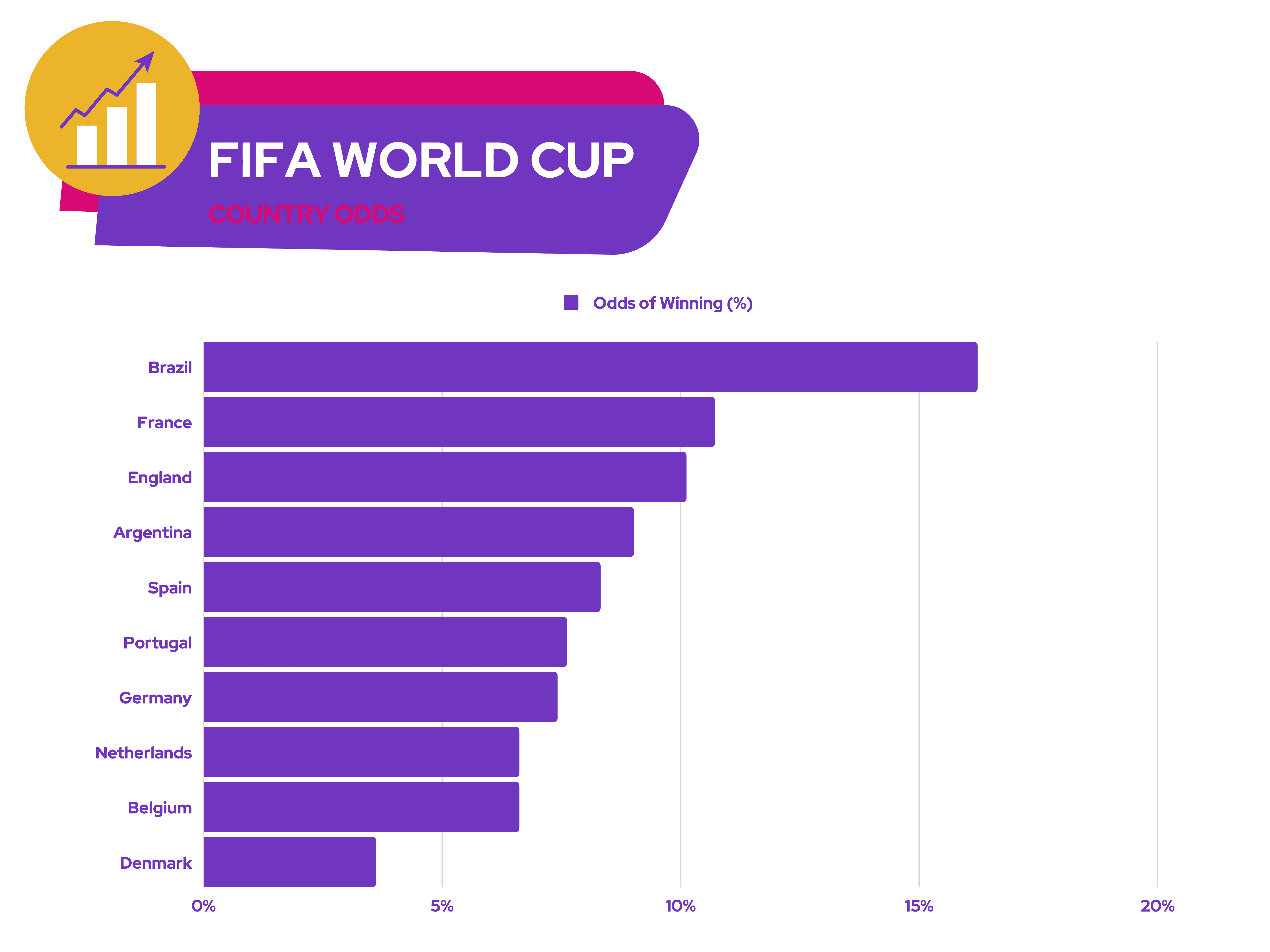

England have qualified for the knockout stages of the World Cup. There are several stocks that could stand to benefit if the team goes further in the tournament. With that in mind, here are three UK shares I’m considering buying this December.

1. Fuller Smith & Turner

Fuller Smith & Turner (LSE:FSTA) is a well-established UK pub and restaurant group, boasting over 200 establishments. The company also has a number of year-round sponsorships and ties with the football community. This makes it a great stock to invest in as the World Cup gains momentum.

The UK chain recently shared a positive set of half-year results. Additionally, it gave a generally positive outlook as it hopes to capitalise on the World Cup and Christmas season.

Nonetheless, its Q3 performance could hinge on England’s performance in Qatar. Getting to the latter stages of the tournament could result in more ‘casual’ fans taking a greater interest and boost its top line.

On the flip side, momentum could very quickly dissipate if England make an early exit. That being said, I’m bullish on England’s chances given how close they came last time. I think I could reap some benefits if I were to buy shares in one of the UK’s biggest pubs.

2. Diageo

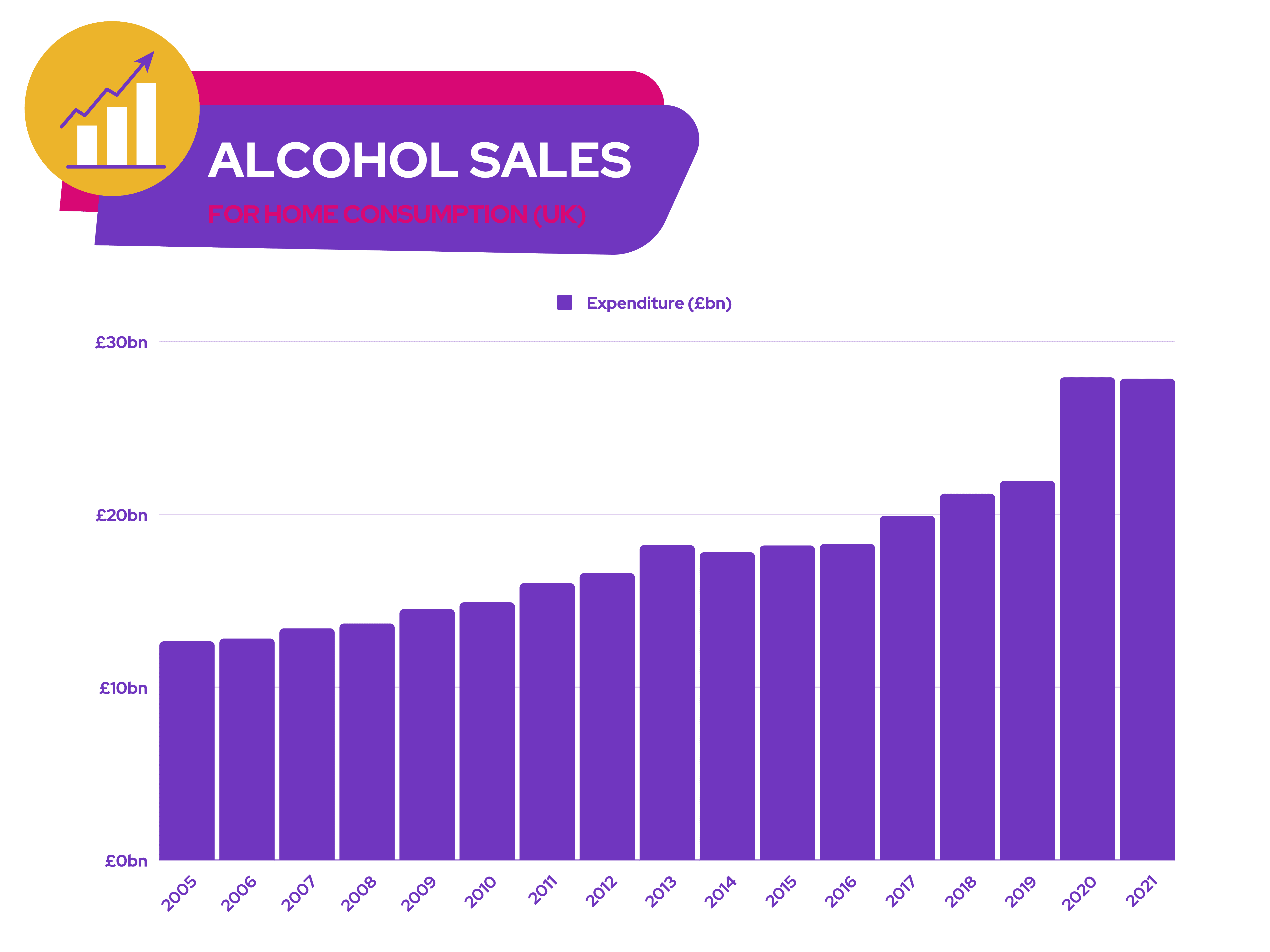

Sticking with the theme of alcohol, Diageo (LSE: DGE) is another stock I’m keeping an eye on. The FTSE 100 firm is one of the world’s largest spirits company. As such, it stands to benefit from any increase in alcohol consumption associated with the World Cup as well.

With the UK, US, and various European countries sharing the stage at the World Cup, Diageo has a broad base of markets to reap rewards from. Moreover, its product portfolio, which ranges from Guinness and Johnnie Walker to Smirnoff, should see an uptick in demand as the tournament progresses.

The producer also announced robust sales growth in its most recent set of results. In fact, CEO Ivan Menezes expects its spirits to continue flying off the shelf despite the ongoing cost-of-living crisis. He forecasts consistent sales growth of 5% to 7% through to FY25.

This is in line with overall alcohol consumption over the past decade. These numbers aren’t stellar by any means. However, Diageo shares could also serve to protect my portfolio from downside risks during a recession.

3. Marks and Spencer

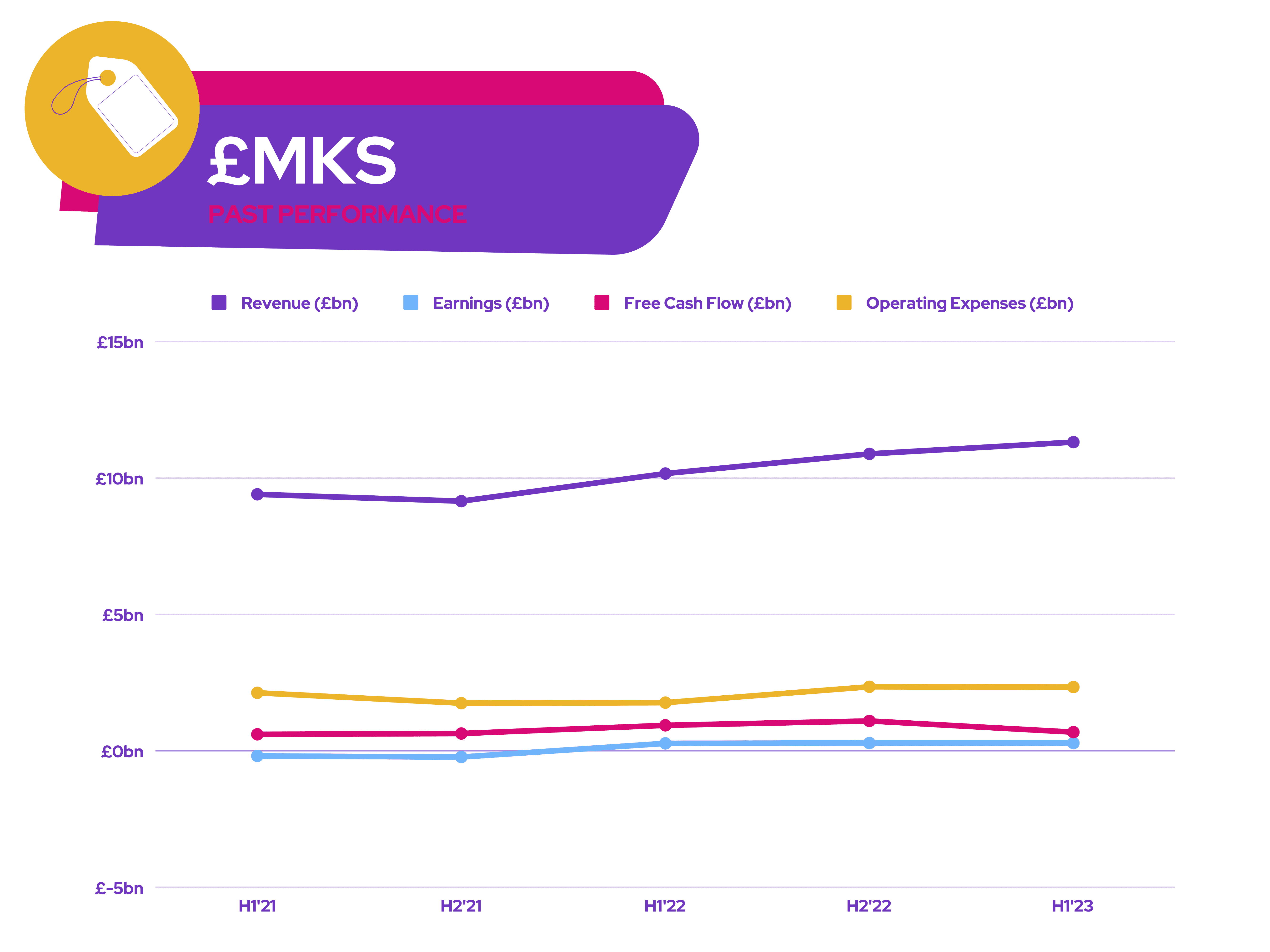

Unlike other grocers that have been reporting slower or declining sales growth, Marks and Spencer (LSE:MKS) has bucked the trend. This can partly be attributed to the Veblen effect — abnormal consumer behaviour caused by the belief that higher prices mean higher quality or value.

Furthermore, on its half-year earnings call, the UK supermarket said that it expects its customers to be spending more this year due to their more affluent backgrounds. Along with this, the FTSE 250 retailer has exclusive England-themed items for sale due to its partnership with the national team. All of these could mean better-than-expected sales for Marks and Spencer this quarter.

Nevertheless, I’m also aware of the potential headwinds surrounding the premium supermarket. These include elevated commodity costs eating into its bottom line and sky-high inflation impacting consumer basket sizes.