I’m searching for the best former penny stocks to buy for my portfolio for next year. Let me talk you through one I think could surge in value in 2023 and beyond.

The no-meat revolution

Demand for meat-free foods is rocketing. The number of vegetarians and vegans has been steadily growing because of ethical concerns. And, more recently, worries over the environmental impact of livestock farming have ramped up consumption of non-meat products.

It’s possible these same factors might also create a huge market for lab-grown meat. Okay, the industry has a long road ahead to convince consumers to taste its products. So companies in this fledling market may not turn a profit for some years to come (if at all).

But developments last week could prove a watershed moment for the cultured meat sector. The US Food and Drug Administration has just given a product grown from chicken cells the green light for human consumption.

Riding the wave

Why am I talking to you about this? Well UK small-cap investors can grab a slice of the industry by buying shares in Agronomics (LSE: ANIC).

This business currently trades at 14.4p per share and has a market-cap of £137m. This is just outside the accepted penny stock threshold of below £100m.

Agronomics is a venture capital company focused on businesses that make animal-based products from cell cultures. And it has flung its net far and wide, reducing the risk that one of these fledgling companies doesn’t make it, or that demand for a particular lab-grown product doesn’t take off.

Some of the companies the firm is invested in include beef producer Mosa Meats, seafood specialist BlueNalu and pork manufacturer New Age Eats. It also holds stakes in cultivated leather and pet food producers.

A booming market?

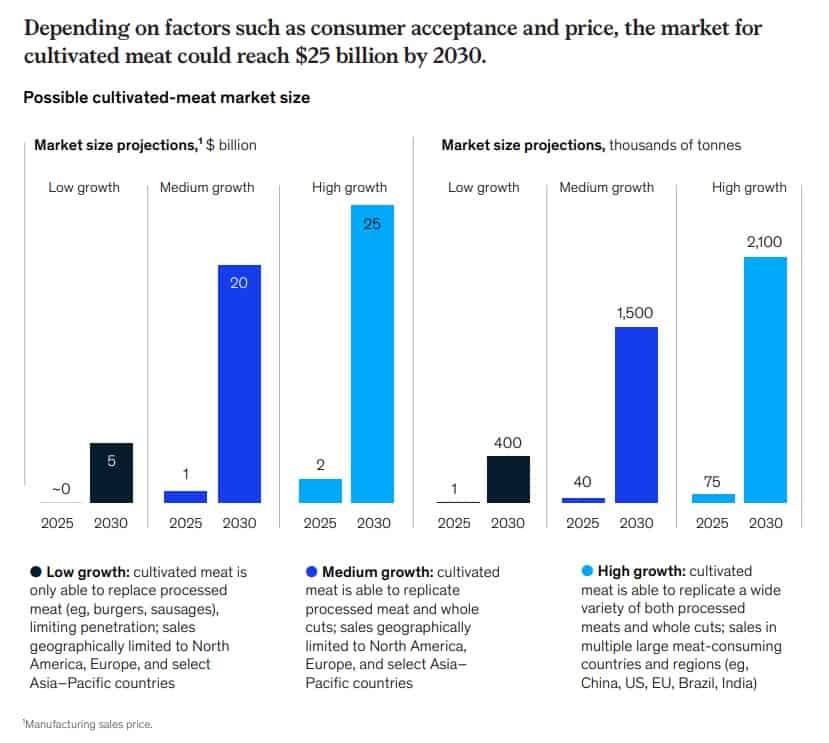

Market experts believe the lab-grown food market is set for explosive growth over the next decade. Take the experts at McKinsey & Company, for example, who predict the cultured meat market could be worth as much as $25bn by the end of the decade.

No wonder then that some of the food industry’s biggest players are trying to get a slice of the action. Even US meat giant Tyson Foods has been investing heavily in the field of lab-grown products in recent times.

Agronomics co-founder Jim Mellon described the FDA’s decision last week as “a landmark event for the field of cellular agriculture,” adding that “not only is [the US] a massive market, but the FDA is considered one of the most stringent regulatory bodies globally for food safety.”

He added that the regulator’s decision “should give investors comfort that the path to commercialisation is now clear.” It’s convinced me and Agronomics is now on my shopping list of growth stocks to buy in 2023. With spare cash to invest, I’ll snap it up for my portfolio.