The PayPal (NASDAQ: PYPL) share price is now trading below $70 and has hit a five-year low. This is on the back of its Q3 earnings that resulted in PayPal stock now trading at a ‘reasonable’ price-to-earnings (P/E) ratio of 35. Therefore, I think its shares are worth me considering.

Good numbers don’t pay off

The fintech company actually posted a solid quarter of results, beating analysts’ expectations on its top and bottom lines. As such, I was expecting a positive reaction. Unfortunately, this wasn’t the case, but why not?

| Metrics | Analysts’ estimates | Q3 2022 | Q3 2021 | Change |

|---|---|---|---|---|

| Revenue | $6.81 | $6.85bn | $6.18bn | 11% |

| Diluted GAAP earnings per share (EPS) | $0.63 | $1.15 | $0.92 | 25% |

The devil in the detail was the account metrics. Despite account numbers seeing growth, they still missed analysts’ estimates, albeit by slim margins. It wasn’t helped by the miss in PayPal’s volume metrics either. As a result, investors punished PayPal stock by as much as 20% in after-hours trading.

| Metrics | Analysts’ estimates | Q3 2022 | Q3 2021 | Change |

|---|---|---|---|---|

| Total payment volume (TPV) | $344.5bn | $337.0bn | $309.9bn | 9% |

| Total payment transactions (TPT) | 5.8bn | 5.6bn | 4.9bn | 14% |

| Total active accounts (TAA) | 438m | 432m | 416m | 4% |

| Payment transactions per active account (PTPAA) | 49.4 | 50.1 | 44.2 | 13% |

| Net new accounts (NNA) | 3.9m | 2.9m | 13.3m | -78% |

Apple and Amazon become Pals

Did the miss on those metrics justify the monumental drop in Paypal stock though? Probably not. So why did its share price drop so violently then? Well, I suspect that this was due to the guidance provided by the board. While management upgraded its guidance on EPS, it was the outlook on revenue that left a sour taste in investors’ mouths.

| FY22 guidance | Now | Before |

|---|---|---|

| Revenue growth | 10% | 11% |

| Non-GAAP earnings per share (EPS) | $4.08 | $3.92 |

Nonetheless, there were still a couple of things I’m feeling celebratory about despite PayPal stock declining. The first would be the partnership with Apple to “enhance offerings for PayPal and Venmo merchants and consumers”. The collaboration allows PayPal’s American consumers to integrate its payment cards into Apple Pay, while also allowing US merchants to accept Apple Pay on their PayPal devices.

The second would be the official announcement that Venmo will now be available as a payment method on Amazon. This could be a boost for the payments firm with the festive season right around the corner. With CFO Gabrielle Rabinovitch citing a slowdown in e-commerce traffic in Q4 so far, she’s hoping that the Apple and Amazon partnerships will help payment volumes in Q4 and onwards.

Capitalising on an overreaction

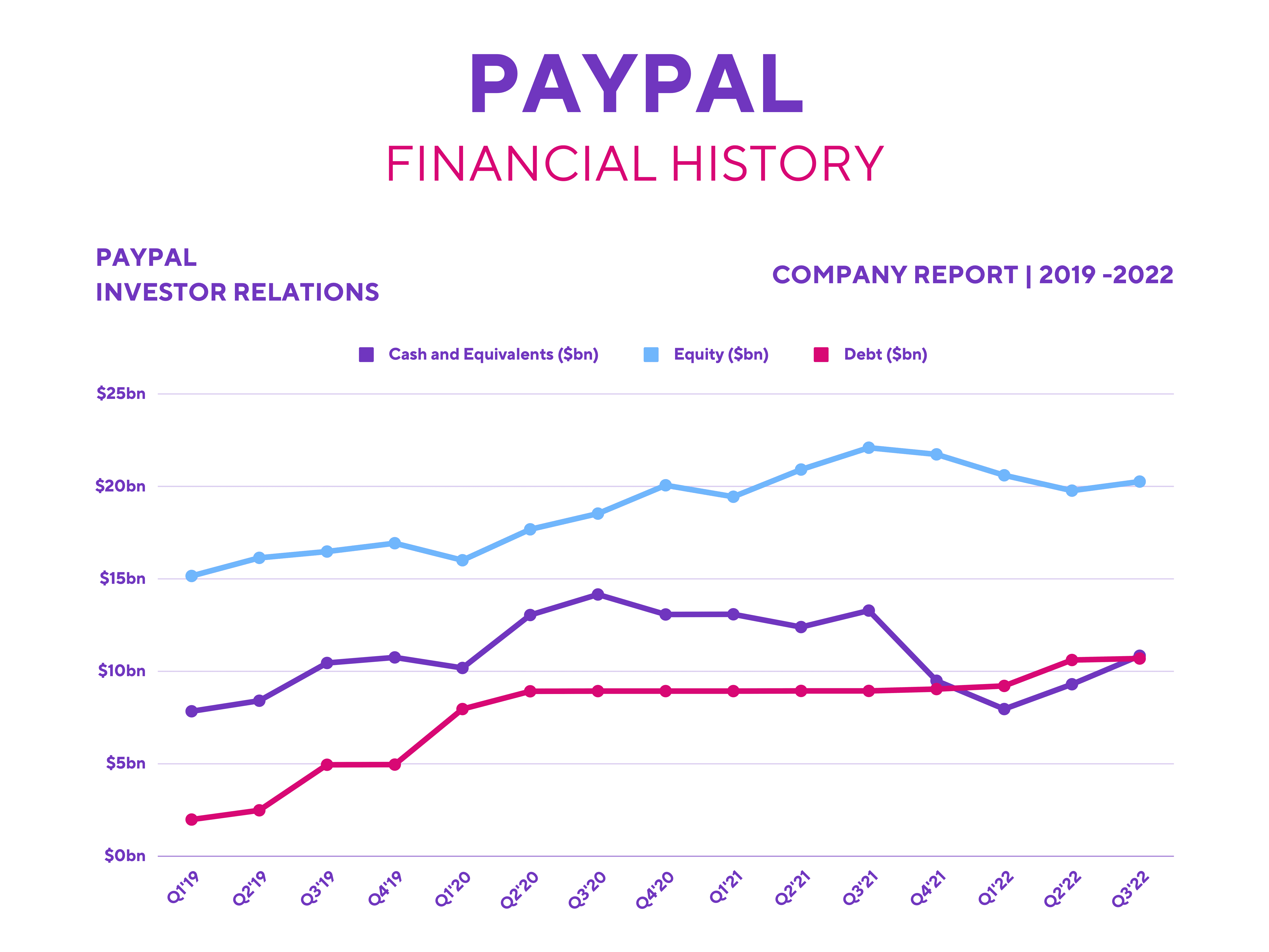

So, do I rate PayPal stock a buy for my portfolio then? To put it simply, yes. The company’s financials have improved since its last quarter. Its operating and transaction margins saw modest improvements, while operating and free cash flow reached its highest levels. Moreover, its balance sheet remains robust, as cash levels rose 45% since last quarter to $6.66bn. And long-term debt remains at a manageable level of $10.24bn.

CEO Dan Schulman also reiterated PayPal’s commitment to further cost savings of $1.3bn going into FY23. So the board expects EPS of at least $4.70 next year, which could translate to a 15% improvement! Pair that with the continued innovation from the firm after onboarding CPO John Kim, and I think the future is bright for PayPal.

Although the short-to-medium term remains cloudy due to the current macroeconomic environment, I believe PayPal will do just fine, given its more affluent user base and a strong US dollar. Therefore, with an improved outlook and a declining P/E ratio, I think the sell-off has been a massive overreaction. For that reason, I’ll be loading up my portfolio with more PayPal stock.