2022 hasn’t been kind to the Aston Martin Lagonda (LSE: AML) share price. The luxury sportscar maker has fallen 94% in value since the turn of the year. At 86.9p per share, it’s also worth a fraction of its IPO price of £19 back in autumn 2018.

Aston Martin’s time on the London Stock Exchange has been a disaster since Day One. But could now be a good time to buy in?

Here are four important things potential investors need to think about today.

1. Exceptional brand power

Aston Martin has one of the best names in the business. It’s the embodiment of both speed and luxury. It also helps to be superspy James Bond’s favourite carmaker (barring a short period during the 1990s when BMW took over).

The automaker has spent more than 109 years building its formidable reputation. And, more recently, its sought to reinforce its sporting pedigree through entry into the Formula 1 racing series.

Aston Martin’s half-year report revealed “strong demand across product lines” and that its GT and Sports cars were sold out until 2023. Its badge remains as popular as ever.

2. Near-term sales stress

The problem for Aston Martin is that near-term revenues look extremely shaky, regardless of its brand appeal.

Supply chain and logistics problems mean it’s struggling to meet orders. This is a problem that’s set to persist too amid, for example, troubled production of semiconductors in Asia.

Aston Martin’s sales might also suffer as the global economy teeters towards recession. Sales of big-ticket items like luxury automobiles are particularly vulnerable during tough times.

3. Fast-growing markets

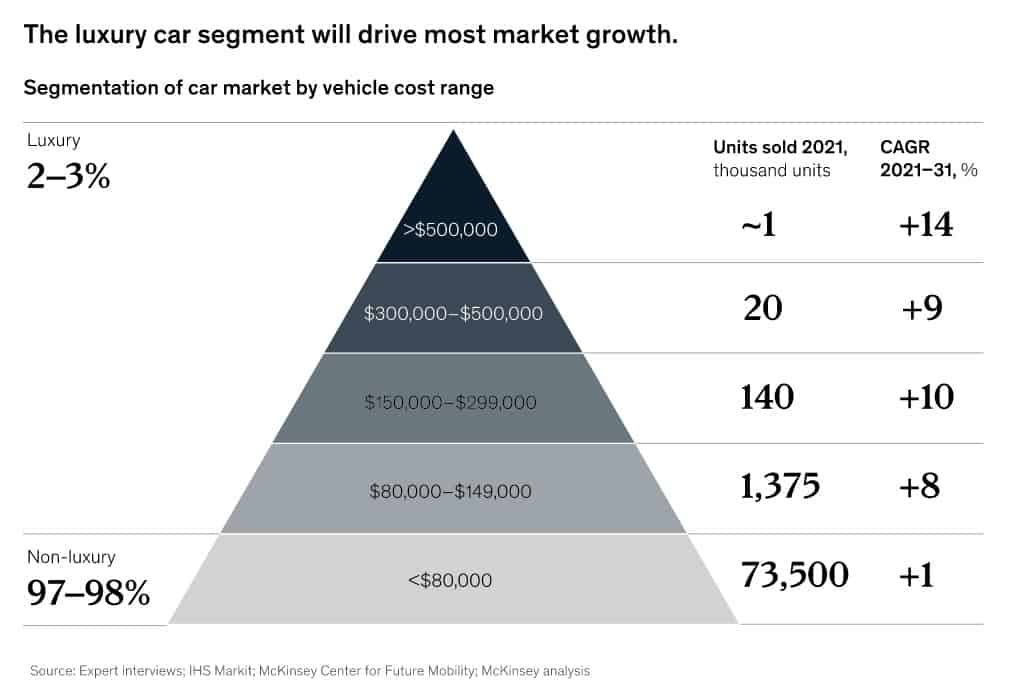

Having said that, the long-term outlook for the business remains exciting. Analysts at McKinsey & Company believe that the luxury car market will grow strongly between now and 2031. They think demand for vehicles largely in Aston Martin’s price point will expand at a compound annual growth rate of 9-10%.

I’m especially encouraged by Aston’s attempts to grab the Chinese market. Sales in the company’s fastest-growing territory rocketed 206% in 2021.

The launch of the firm’s DBX Straight-Six model last November — which is only sold in China — illustrates the determination it has to build its brand there.

4. Debt questions

Aston Martin’s balance sheet is the main thing influencing whether I should buy the automaker’s shares. And sadly the company’s liquidity gives me the shivers.

The company recently raised £654m in capital after Saudi Arabia’s sovereign wealth fund and Chinese carmaker Geely jumped on board. However, Aston continues to carry a mountain of debt (net debt stood at £1.3bn as of June).

Unfortunately, the cost of getting its new models from designer drawing board to the road will cost a small fortune. There is also the question of how Aston Martin will deal with its debt problem if sales do indeed slump in the near term. The possibility of it tapping its shareholders for cash is one possibility.

I love Aston Martin’s products. But, as an investor, I’m happy to steer clear of the under-pressure carmaker.