Earnings results are a great way for investors to judge a company. They’re used to determine whether companies are on track with their initial guidance. These results can often radically move share prices in either direction, depending on the numbers reported. So, here’s an earnings preview for three FTSE firms reporting results this week.

Analysts in the UK don’t always publish earnings previews for quarterly or half-year periods. Therefore, the upcoming figures can only serve as an indication as to whether the companies’ full-year forecasts can be met.

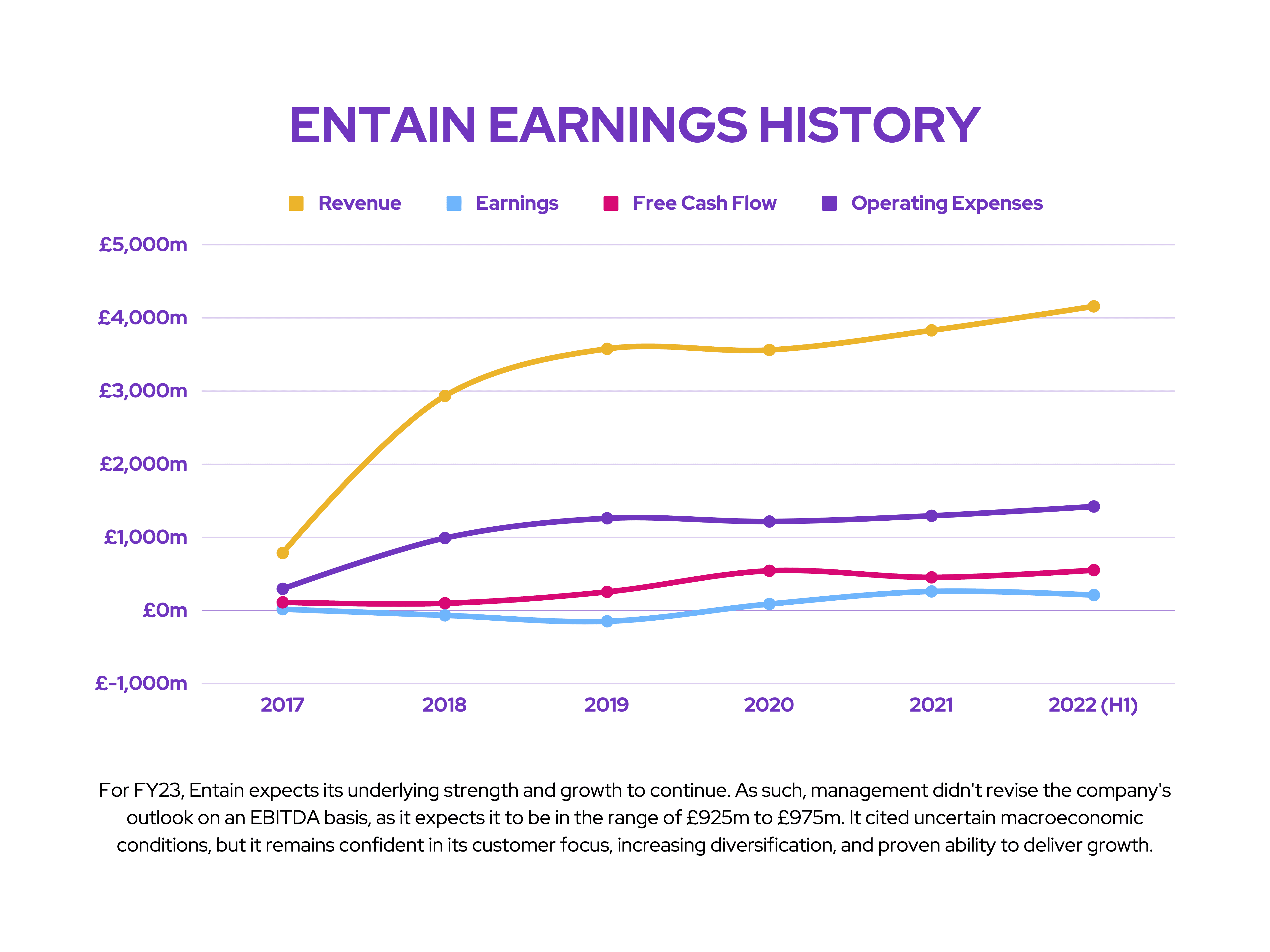

Entain (Q3 trading update)

Entain (LSE: ENT) is an international sports betting and gambling company. It owns brands such as Bwin, Coral, Ladbrokes, PartyPoker, and Sportingbet. Entain will provide a trading update for its most recent Q3 performance ending September 2022 on 13 October.

The FTSE 100 betting firm expects to report growth in revenue after a busy summer. However, City analysts are cautious about the outlook the company will provide after it cut its growth outlook in its last earnings report. With inflation continuing to run rampant, the cost-of-living crisis is expected to dampen the number of bets being placed.

While investors won’t be too excited about Entain’s flat online revenue growth this year, there will be plenty of attention on its US joint venture (JV) with MGM, and whether that is making good progress towards profitability.

Entain doesn’t disclose revenue or earnings figures for its quarterly updates, so a direct comparison can’t be drawn this October. Rather, the company discloses metrics such as net gaming revenue and updates on its JV, which are useful indicators too. These can serve as an earnings preview for investors to determine whether the firm is on track to hit analysts’ estimates by the end of the year.

| Metrics | Amount (FY21) | Financial Times earnings estimates (FY22) |

|---|---|---|

| Total revenue | £3.89bn | £4.31bn |

| Diluted earnings per share (EPS) | 53.8p | 58.8p |

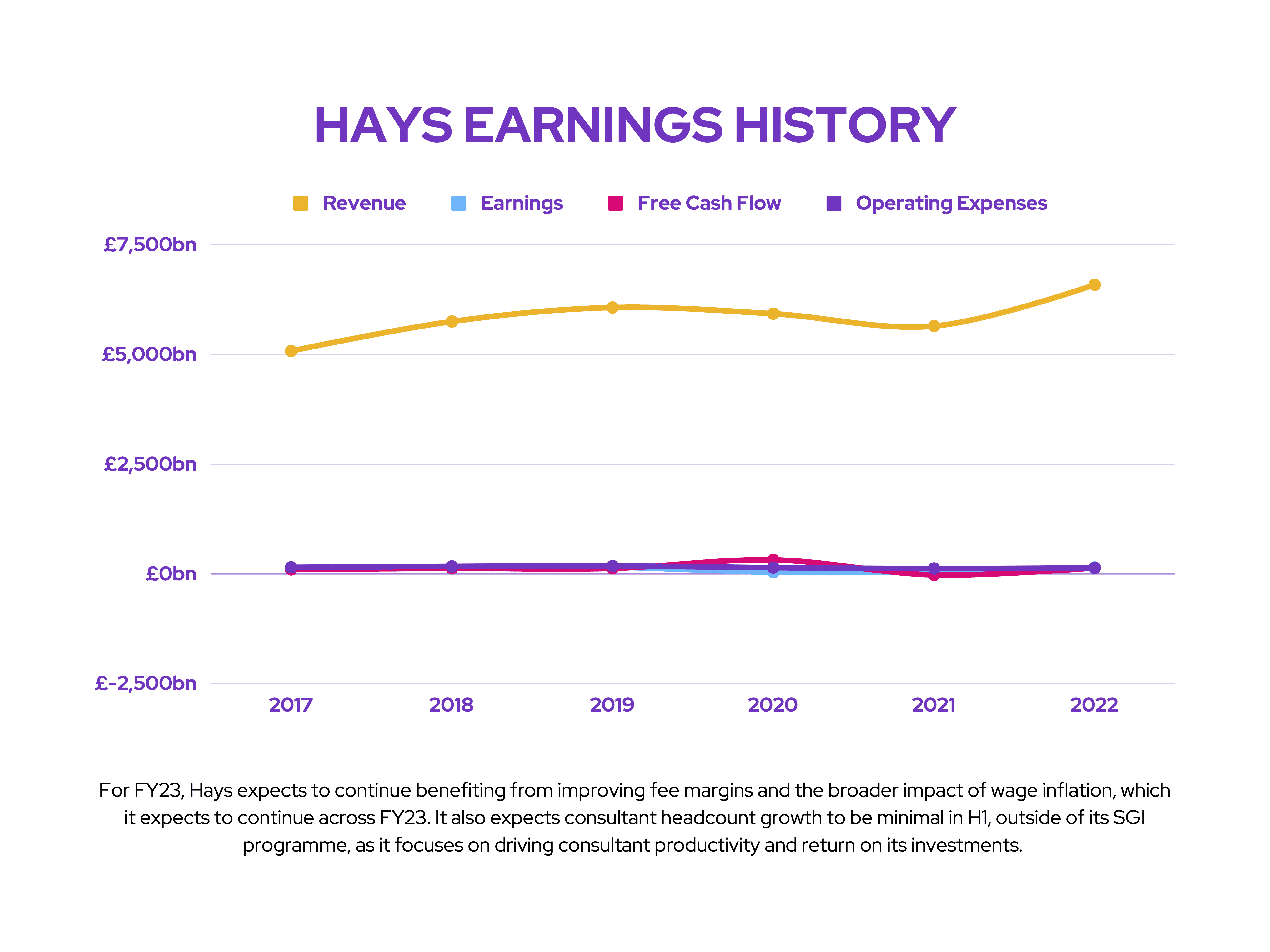

Hays (Q1 trading update)

Hays (LSE: HAS) is a multinational company that provides recruitment and human resources services to companies across 33 countries globally. The FTSE 250 firm is expected to release a brief trading update for its most recent Q1 performance ending September 2022 on 13 October.

Updates are also expected from Hays’s peers Robert Walters and PageGroup, which will provide a clearer picture of whether the industry’s robust performance have continued into the later part of this year. Investors will be keeping a close eye on headcount as well as skills shortages, and how the current macroeconomic environment has and may impact earnings moving forward.

Only slightly over a month ago, Hays disclosed impressive bottom line growth of 128%, while declaring a £121m special dividend. In doing so, it also affirmed to investors that it was well equipped to face the macroeconomic headwinds. Whether this will carry into Q1 and the rest of its financial year remains to be seen.

Like Entain, Hays doesn’t disclose specific revenue or earnings figures for its quarterly updates. Therefore, investors will have to make direct comparisons using growth rates disclosed in the update. These can serve as an earnings preview for investors to determine whether the recruiter is able to continue its strong showing.

| Metrics | Amount (FY22) | Financial Times earnings estimates (FY23) |

|---|---|---|

| Total revenue | £6.59bn | £6.93bn |

| Diluted earnings per share (EPS) | 9.11p | 9.17p |

YouGov (FY22 Earnings)

YouGov (LSE: YOU) is a British internet-based market research and data analytics firm. It also operates in Europe, North America, the Middle East, and Asia-Pacific. The company will be reporting its FY22 results ending July 2022 on 11 October.

After a pretty strong year in FY21, investors will be keen to see what the analytical company reports on Tuesday. Given its growth attributes, analysts have high expectations for both YouGov’s top and bottom lines, as well as the outlook for its new financial year. With the stock down 45% this year, investors will be hoping for a good report.

| Metrics | Amount (FY21) | Financial Times earnings estimates (FY22) |

|---|---|---|

| Total revenue | £169m | £215m |

| Adjusted diluted earnings per share (EPS) | 20.2p | 26.54p |