While I’ve identified a decent amount of stock market winners in recent years, one I haven’t got right is boohoo (LSE: BOO). I’ve always been quite bullish on the AIM-listed online fashion retailer. However, over the last 12 months, the boohoo share price has fallen about 85%.

As an owner of the stock, I’m also feeling the pain. At the start of last year, my boohoo shares were worth around £3,500. Today however, they’re worth just £420. Ouch! So what did I get wrong here? And, more importantly, what’s the best move for me now?

Where I got it wrong with boohoo shares

It’s fair to say that there have been a lot of issues with boohoo that I didn’t see coming. For starters, I wasn’t expecting growth to slow so rapidly after the pandemic.

My view was that the e-commerce industry would continue to expand at a healthy rate after lockdowns ended and that Boohoo would continue to benefit. However, e-commerce growth has slowed and Boohoo has been impacted. For the three months to the end of May, the company’s UK sales fell 1%.

I also didn’t anticipate the supply chain and cost issues that have arisen as a result of the pandemic. These issues have hit all retailers, not just Boohoo, reducing profits significantly.

Additionally, I wasn’t anticipating the continued sustainability issues here. I thought boohoo had a better handle on this. However, the issues refuse to go away.

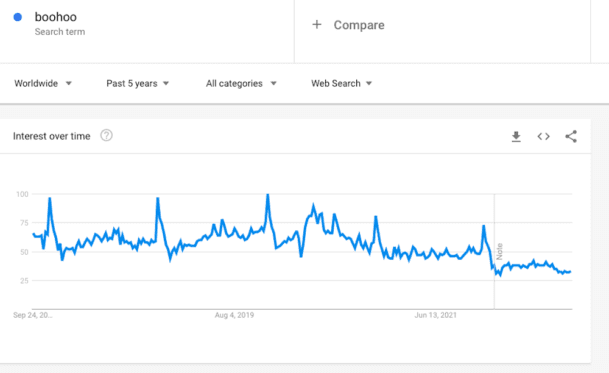

Finally, I thought brand power was stronger. Recently, interest in the company’s brands, including boohoo and PrettyLittleThing, has declined. This is illustrated in the Google Trends chart below (note that 100 represents peak interest).

It seems competition from rivals, including Chinese e-commerce powerhouse Shein, has taken its toll on the brand. All in all, I misread the outlook quite badly here (in the short term at least).

What do I do now?

It’s hard to be bullish on boohoo shares right now. Its brand power has faded and consumers are tightening their belts due to the energy-related cost-of-living crisis (another issue I wasn’t expecting a year ago). So the company’s performance could be underwhelming in the near term.

Meanwhile, short sellers are aggressively targeting the stock. According to shorttracker.co.uk, boohoo is currently the most shorted stock in the UK. This means hedge funds expect the stock to continue falling.

Having said that, I’m not convinced I should be selling out of boohoo now.

With my shares worth just £420, they’re now a very small part of my overall portfolio. So instead of selling, I’d rather hold on to see if the company can turn things around. I’ll stick the shares in the bottom drawer and come back to them in a year or two.

This approach could result in further losses for me. If performance continues to deteriorate, or the company is fined for sustainability-related issues, the stock could continue its downward trend.

However, I’m comfortable with this risk, given the potential upside if sales and profits do pick up. It’s worth noting that the stock currently trades at just 12 times next financial year’s earnings forecast. So if performance does start to improve, the stock could get a sharp valuation re-rating.