I think it’s fair to say it’s been a wild ride for boohoo (LSE: BOO) shares over the past half-decade. Following acquisitions of fast fashion brands NastyGal and PrettyLittleThing in 2017, the FTSE AIM 100 stock maintained a steady upward trajectory until the onset of the pandemic — a period characterised by high volatility and choppy trading action.

The Manchester-based business has since plummeted, hovering around 41p at present. If I’d invested five years ago, how much would I have now?

Poor returns

Although it boasts a history of profitability, the online retailer has never distributed dividends. This means my total return would be calculated on the basis of fluctuations in the value of the company’s shares alone.

Crunching the numbers makes for grim reading. The boohoo share price collapsed nearly 84% over the past five years. Accordingly, my initial £1,000 investment would have shrunk to a measly sum of around £164 today.

Financial concerns

I can find plenty of reasons to be bearish even after those enormous losses. For starters, I’m not sure the brand ever truly recovered from damaging accusations concerning poor labour practices in its UK supply chain. This is despite the company terminating its relationships with a number of manufacturers.

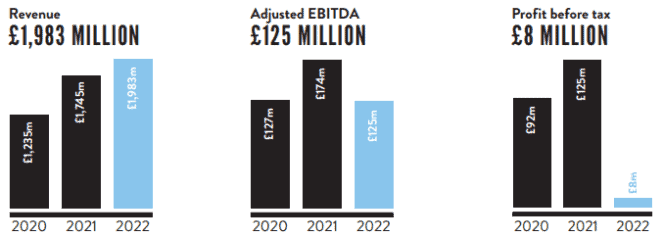

In addition, the FY22 results contained a series of revelations across a range of metrics that concern me. At £8m, adjusted pre-tax profit was still in the black — but only just. For context, the preceding year saw the company delivering £125m in pre-tax profit. The group’s net cash holdings also declined by £275m to a paltry £1.3m today.

For me, this isn’t a good position for boohoo to be in as it battles to retain customers amid spiralling inflation and a possible recession.

A brighter future?

Nonetheless, despite my worries that boohoo shares could represent a value trap, I see some merit in the bull case.

There were glimmers of hope in the company’s results. A 14% uptick in revenue to £1.98bn was encouraging to see. So too was the announcement that the retailer now has 20m active customers — a 43% increase since 2020.

The business also recently partnered with Kourtney Kardashian, who will act as a sustainability ambassador. This is an exciting development that may improve the company’s image, which is a crucial asset in the fashion world.

Having said that, the initial reception was mixed. Kardashian and boohoo both received criticism for alleged ‘greenwashing’. This will likely be a hot issue for shareholders going forward as the company navigates an ongoing Competition and Markets Authority (CMA) investigation alongside competitor ASOS regarding potentially misleading sustainability claims.

Should I buy boohoo shares today?

I’m glad I’ve resisted the temptation to invest in boohoo so far. To say returns have been disappointing would be an understatement.

Until the recent financial results, I’d have predicted the business was probably resilient enough to cope with macroeconomic storms currently engulfing the stock market. However, now I’m not so sure.

There are some considerable risks facing boohoo shares. Plus, I don’t like the absence of dividends. I believe there are better UK stocks to buy at present and I wouldn’t invest in boohoo today.