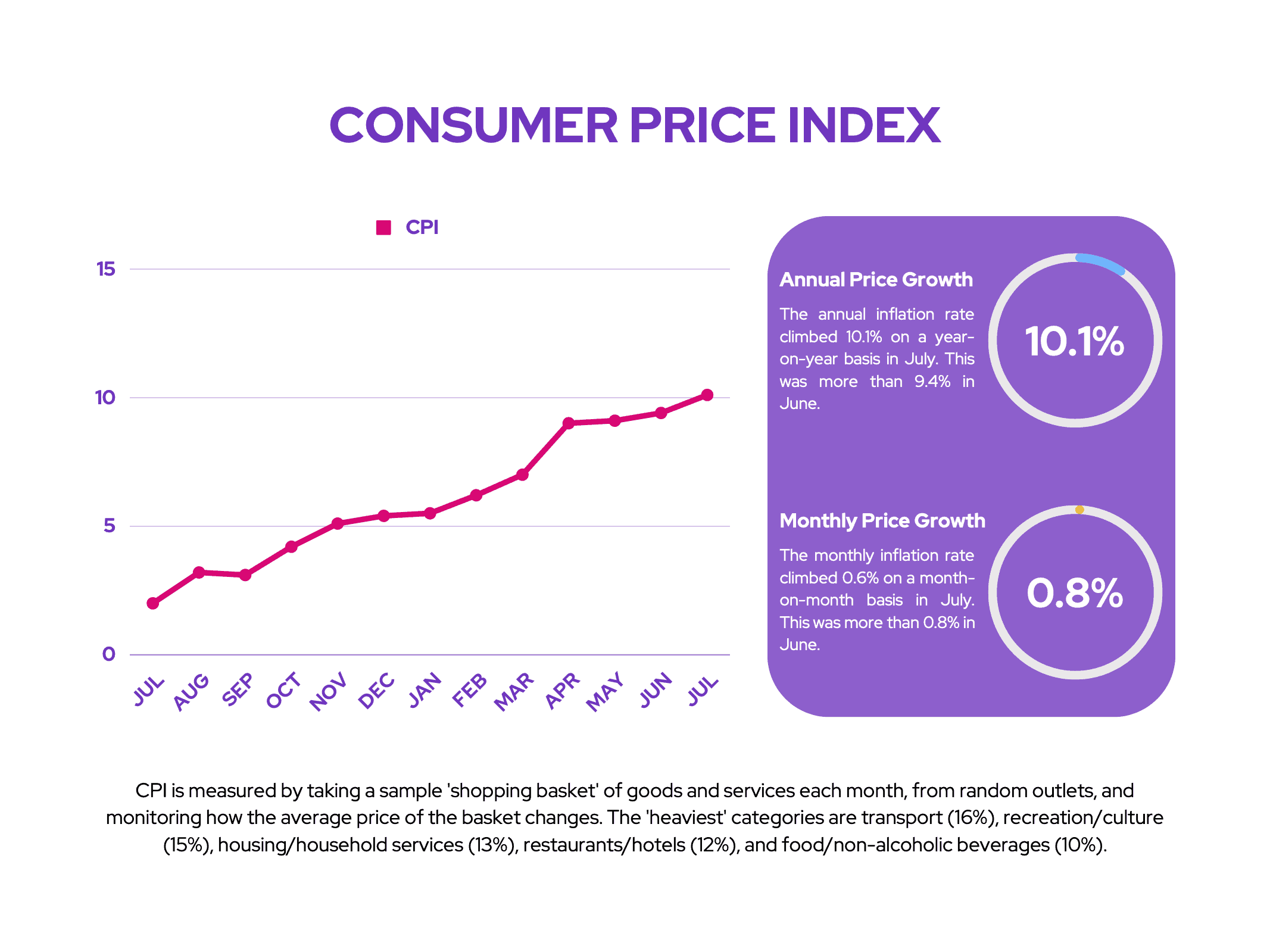

July’s UK consumer price index (CPI) came in hotter than expected at 10.1%. This is a 40-year high and has the potential to drive share prices further down as consumers struggle with a cost of living crisis. So, here are five shares I’m considering buying.

Lloyds

As the UK’s biggest lender, I believe Lloyds (LSE: LLOY) shares are a sound choice for my portfolio. It earns its money from the difference in providing and earning interest from loans. This is otherwise known as net interest income.

Interest rates are expected to go as high as 3% by 2024 as the Bank of England tries to combat inflation. As a result, the high street bank should get a top-line boost from higher lending costs, while benefiting from lower interest paid to customers. With enough cash to set aside for bad loan provisions, Lloyds doesn’t need to increase its savings rate to bring in more cash, thus allowing it to increase its profits. This was evident in the company’s latest half-year results, which saw it recording excellent numbers.

It’s worth noting, however, that the majority of its income stems from mortgages. With house prices and mortgage approvals starting to decline, it remains a possibility that Lloyds’ revenue could be impacted. Nonetheless, analysts think that the increase in rates should offset any declines for the time being. In fact, Lloyds stock is rated a buy as its dividend is also expected to increase. It has an average price target of 64.33p, or a 40% upside.

SSE

Energy prices have been the main culprit behind sky-high inflation. That’s because energy prices are at their highest levels since 2009. As such, I think SSE (LSE: SSE) is a share to buy for my portfolio given the circumstances.

When wholesale energy prices go up, energy suppliers increases their rates to cover the extra costs. This has allowed companies like SSE to benefit, with its top and bottom lines seeing modest increases. As a matter of fact, its profit and loss account saw its best numbers in FY22, which is why its shares are up 9% this year.

The latest inflation report shows that energy prices rose 3% on a month-on-month basis. And with a higher price cap expected in October, SSE should benefit from this. After all, its latest trading update indicates that it expects adjusted earnings per share (EPS) of at least £1.20 for FY23. This would bring its EPS to its highest level in five years.

Additionally, its dividend yield of 4.7% is rather modest and is expected to rise given its most recent increase in payout, from 25.5p to 60.2p. SSE shares are rated a moderate buy with an average price target of £20.78.

Unilever

Next on my list is Unilever (LSE: ULVR). Its share price has been rather volatile this year. Nevertheless, it has recovered by 5% since its reported its H1 numbers. Its shares are now only down by 1% on a year-to-date basis.

The fast-moving consumer goods conglomerate produces beauty products and personal care, foods and cleaning agents. Its brands include Lynx, Ben & Jerry’s, Dove, and many more. These are household names and have tremendous pricing power, given the inelastic demand surrounding most of its products. This is strongly reflected in the revised outlook given by CEO Alan Jope, when he improved the firm’s guidance.

Our guidance for underlying sales growth in 2022 was previously at the top end of a range of 4.5% to 6.5%. We now expect underlying sales growth to be above that range, driven by price with some further pressure on volume.

Unilever CEO Alan Jope

Nevertheless, it should be noted that Unilever shares are more of a defensive play to protect from potential downside at the moment. Analysts are forecasting an average price target of £40.81, which only means a potential 3% gain if I were to buy shares now.

Burberry

Burberry (LSE: BRBY) shares are a good inflation hedge, in my opinion. The brand’s status as a luxury retailer allows it to pass on many of its costs to consumers given the nature of its target market. This was confirmed by CFO Julie Brown in its Q1 trading update, with a positive outlook for the company.

The FTSE 100 retailer has benefited from the return of global travel, with a substantial amount of its sales coming from tourists. It saw its like-for-like sales numbers grow by 1% on an annual basis, despite lockdowns in key revenue driver, China. Excluding China, sales figures were actually rather impressive. They were 16% higher in Q1 overall, with EMEIA boasting impressive 47% growth. Moreover, the company’s most profitable products (leather goods and outerwear) also saw double-digit growth.

That being said, I should point out that China remains the firm’s achilles heel for the moment. With its government sticking to its zero-Covid policy, I don’t expect sales figures from that region to see an uptick any time soon. This is why its average price target currently sits at £19.34. Therefore, this is more of a long-term investment with a higher upside once China’s retail sales fully recovers.

Tesco

Last on my shopping list are Tesco shares (LSE: TSCO). Given that its core products are consumer staples, I’m expecting Tesco shares to be robust in a recessionary environment. It’s also been steadily increasing its dividend payouts, which should serve as an added benefit.

As the market leader in the UK supermarket sector with more than a quarter of the market share, I think Tesco will be able to outperform its peers. Its Aldi price match across hundreds of items has been a success so far. According to the last several Kantar grocery reports, the supermarket leader has seen its market share remain relatively robust. It has also managed to outperform most if its competitors with higher sales figures. And its Q1 trading update showed its strength in the industry.

Having said that, sales figures are expected to come in slightly lower for the year. The grocer no longer enjoys the tailwinds of the pandemic and faces slower sales as a result of high inflation. Even so, I still think Tesco can utilise its strong supply chain and relationship with customers to match last year’s stellar performance. Analysts seem to share the same sentiment, rating Tesco shares a strong buy with an average price rating of £3.19.