The Taylor Wimpey (LSE: TW) share price has suffered this year amid fears of a recession. However, some data seems to suggest strength in the housing market, and could serve as catalysts to spark a further rally.

Builds are looking up

Compared to pre-pandemic levels, Taylor Wimpey posted an excellent set of numbers for the first half of 2022 with results coming in above analysts’ consensus. This then sparked a 10% recovery in the share price.

| Metrics | H1 2022 | H1 2019 | Change |

|---|---|---|---|

| Revenue | £2.08bn | £1.73bn | 20% |

| Adjusted Earnings per Share (EPS) | 9.0p | 7.4p | 22% |

| Completions (Excluding Joint Ventures) | 6,587 | 6,432 | 2% |

| Operating Margin | 20.4% | 18.0% | 2.4% |

| Order Book Value | £2.89bn | £2.37bn | 22% |

| Average Selling Price (Excluding Joint Ventures) | £300,000 | £261,000 | 15% |

| Net Cash | £642m | £392m | 64% |

With such solid numbers and positive guidance, it doesn’t seem like Taylor Wimpey is likely to lose momentum any time soon. Cancellations in absolute numbers are down, while customer interest remains high, and orders for the rest of the year are almost filled.

| Metrics | FY22 Outlook |

|---|---|

| Completions | 14,660 |

| Operating profit | ~£924m |

| Operating margin | 22% |

| Net cash | £600m |

| Average selling price | £313,950 |

In fact, management is so confident about the company’s future that they’ve decided to increase the interim dividend by 12%, to 4.62p per share. This confidence was further reflected in a couple of high-ranking directors purchasing £50,000 worth of shares in August, so far.

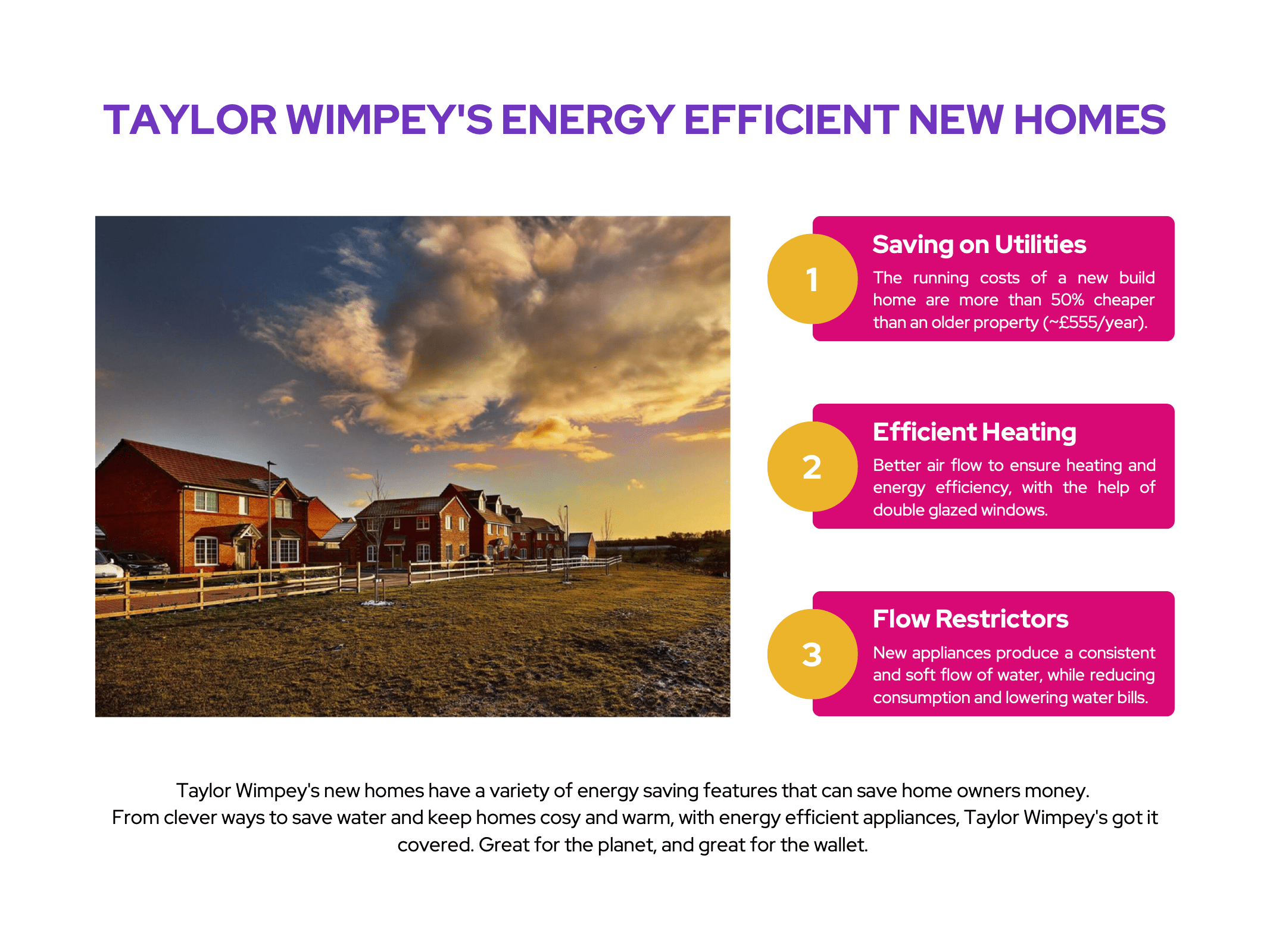

Moreover, the company recently launched its new range of energy efficient homes. With the national EPC rating currently at D, I’m expecting these new homes with average EPC ratings of A or B to capture more market share.

Rough landing

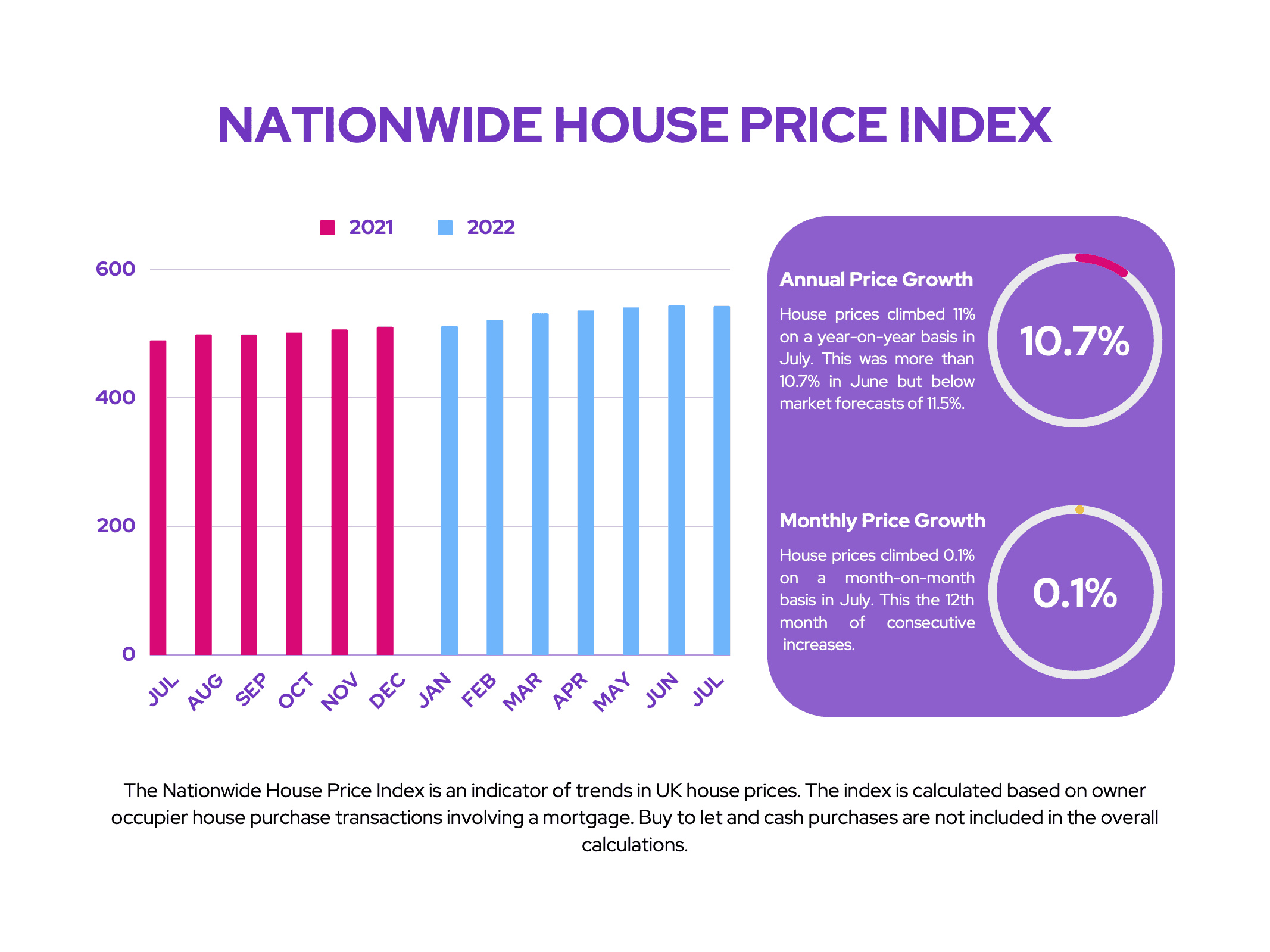

Despite the upbeat outlook though, the wider macroeconomic data hasn’t quashed fears of a house market crash. As a result, the Taylor Wimpey share price recovery has stalled. This is a reflection of stalling house prices seen in the most recent RICS House Price Balance and Nationwide House Price Index.

Furthermore, mortgage approvals have been steadily falling according to the UK’s biggest mortgage lender, Lloyds. Along with this, mortgage repossessions saw an uptick in the first three months of the year.

To make matters worse, mortgage rates are expected to go higher with interest rates. This would affect the 2m households currently on variable mortgages, and another 1.8m households on fixed rate mortgages that expire next year.

Additionally, Taylor Wimpey faces trouble building more homes due to a nutrient neutrality issue. This is a problem regarding new developments exacerbating nutrient burdens on the soil in the area. The issue is expected to affect up to 120,000 homes across England. Nonetheless, CEO Jennie Daly is confident that the FTSE 100 firm’s large and geographically diverse land bank puts it in a good position to overcome this challenge.

Curb my optimism

Having said all that, I’m still a fan of Taylor Wimpey shares. Its balance sheet is solid, and it boasts quality earnings with high margins. Its dividend continues to see healthy increases too, with CFO Chris Carney stating that it would still be able to pay £250m worth of dividends even in its worst projected economic scenario.

But as much as I am positive about Taylor Wimpey’s numbers, I don’t think its share price will be rebounding into the green soon. I just don’t think the company has a unique enough selling point to outperform the wider market. Not to mention, there’s also a potential recession on the cards. Therefore, I’ll be putting Taylor Wimpey on my watchlist for the time being, and may open a position if its share price continues to dip, as I believe that its upside would be rather attractive.