Thinking like Warren Buffett and investing ‘on the dip’ led to the emergence of a new class of investor in the 2010s. These people are known as Stocks and Shares ISA millionaires.

When stocks markets crashed around the 2008 financial crisis, they didn’t follow the herd and run for cover. They took a long-term view and stuffed their stocks ISAs with beaten-down bargains.

This meant that when the eventual stock market recovery came they watched the value of their assets soar and reaped the rewards. It’s a strategy that has allowed Warren Buffett to create a personal fortune north of $100bn.

The rise of the millionaires

Strong dip buying meant that the number Stocks and Shares ISA millionaires soared again in 2021, too.

Hargreaves Lansdown says that the number of ISA millionaires on its books increased 69% year over year in 2021, to 973. The rebounding stock market helped them to generate excellent returns as the stocks they bought during the Covid-19 downturn jumped in value.

Long-term investing

But these stock market millionaires are doing more than just looking for value stocks when markets fall. They are also following other key Warren Buffett investing principles, Hargreaves Lansdown says.

For example, ISA millionaires buy shares regularly and take a long-term view to building wealth. Hargreaves Lansdown says that these successful investors have invested in stocks “every year for decades”. Indeed, the average age of these individuals is 72 years, the financial firm says.

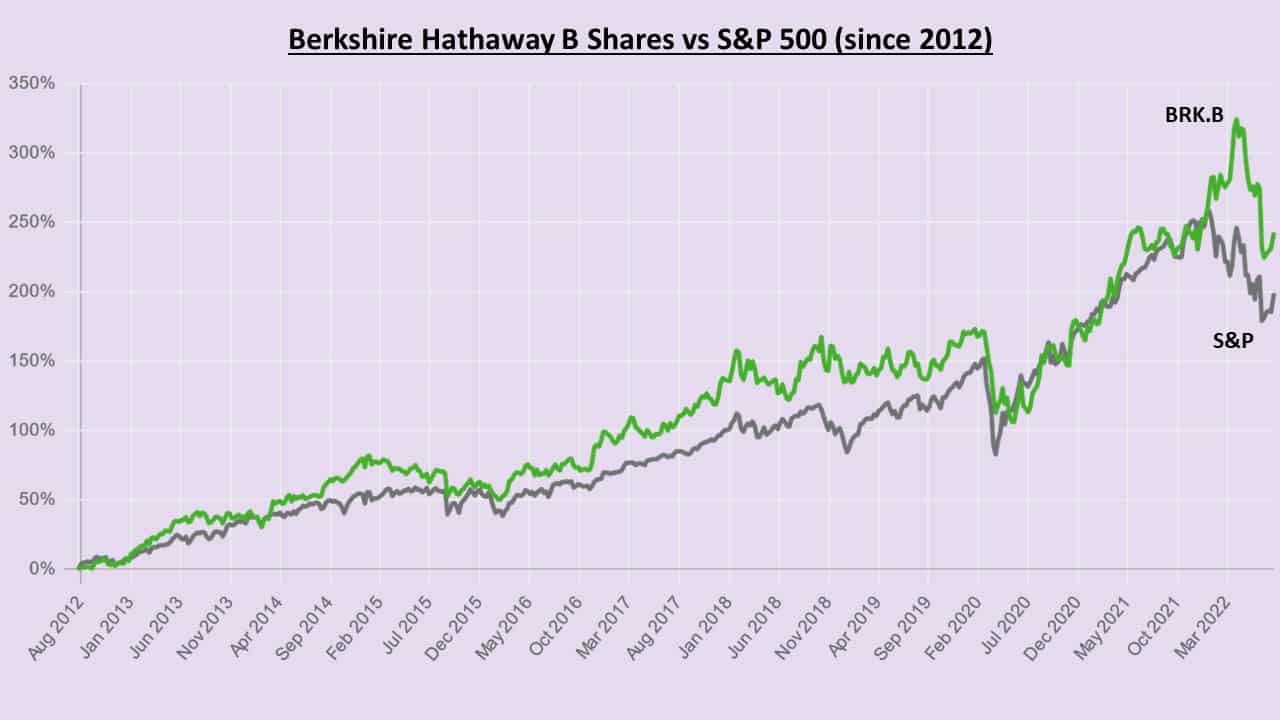

Using a similar buy-and-hold in investing strategy has allowed 91-year-old Buffett to make billions with his Berkshire Hathaway investment firm since the 1960s.

Buying blue chips

Buying reliable large-cap companies is another way that ISA millionaires have emulated Warren Buffett and made enormous wealth. According to Hargreaves Lansdown, “the top 10 shares held by this group are dominated by blue-chip companies, including those that traditionally pay strong dividends”.

Buffett’s portfolio has also long consisted of some of the world’s biggest blue-chip companies. Right now some of the US shares owned by Berkshire Hathaway include Coca-Cola, Apple, Chevron, and American Express.

I’m investing like Buffett!

There’s no guarantee that an individual will make mountains of money by investing in stocks. But the success of those ISA millionaires shows that it can be done. And following the successful blueprint of legendary investors like Warren Buffett can help investors reach their goals.

Let’s say that I have a £10,000 lump sum to invest right now, and I buy an extra £400 worth of stocks each month. Based on a 10% rate of return I would have, after 30 years, made a cool £1,006,211. I’d have joined the millionaire’s club.

And that 10% rate of return is no pipe dream, either. It’s the average annual rate of return that stock markets have delivered during the past 50 years. It’s a figure that I think could, with regular investment and a Buffett-style investing strategy, help me to make spectacular long-term wealth.