This FTSE 100 stock has not been popular since the Brexit vote and the share price is nearly the same as five years ago. However, Legal & General (LSE: LGEN) has been performing well and has consistently increased its dividend per share since 2011, growing at a compound annual growth rate of 11%.

In its latest trading update, we can see that Legal & General has been a beneficiary of higher interest rates, which is boosting its Solvency II coverage ratio and therefore increasing its capacity to return capital to shareholders.

This article will discuss the company’s latest trading update and a potential benefit from Brexit deregulation.

Latest trading update

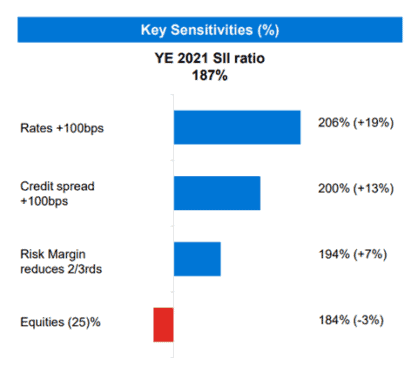

Legal & General estimated its Solvency II coverage ratio at 215% (30 June 2022), up 28% since FY2021. The increase has been primarily driven by higher interest rates and a strong operational surplus generation. The company shared the key sensitivities for its Solvency II coverage ratio in the FY2021 presentation slides. We can see that the company’s coverage ratio is positively linked to higher rates, i.e. an expected increase of 19% in the coverage ratio for a 1% change in interest rates.

As the Bank of England is expected to increase the bank rate significantly to tame inflation, Legal & General is expected to be a beneficiary of higher rates. As the company’s Solvency II coverage ratio increases, the company will have more capacity to return capital to shareholders via higher dividends.

Legal & General is one of the highest dividend payers in the FTSE 100 index, and is currently yielding 7.5%+. With higher rates boosting its coverage ratio, there is a strong possibility that it will increase dividends further.

Potential catalyst

Since Brexit, there has been an increased focus by the government to reform the legacy EU Solvency II regime, which is intended to loosen capital rules for insurance companies to release cash for investment in infrastructure projects.

Brexit deregulation might be a potential catalyst for Legal & General, as lower capital requirements will allow the company to invest more and earn higher returns. Additionally, the company might be able to return some capital to shareholders via special dividends or share buybacks.

Risks

Reforms to the EU Solvency II regime have been contentious between the government and the Bank of England. The government has been lobbying to reform Solvency II to show the benefits of Brexit and to bring an investment ‘Big Bang’ to support growth and jobs in the UK economy. However, the Bank of England has been trying to balance the risks to insurance policyholders of looser capital requirements with the benefits of higher investment in the economy.

Due to the ongoing Tory leadership election in the UK, it is not clear whether reforms to the Solvency II regime will remain a priority for the new Prime Minister.

Conclusion

Overall, Legal & General is performing well and is expected to be a beneficiary of higher interest rates and potential Brexit deregulation. As a Foolish investor, I’m therefore happy to continue holding my shares in this quality company for years to come.