The Centrica (LSE: CNA) share price has, perhaps unsurprisingly, been on something of a rocket path lately. As gas prices have continued to rise, it’s up almost 85% over the last year.

Now, I’m not fond of buying shares after a such great run. After all, while market timing is not a smart game to play, neither is ‘buy high, sell low’!

But here’s a couple of great reasons why I believe that Centrica’s share price run might not yet be over.

Will Centrica restart paying dividends?

Will it or won’t it restart paying a dividend? We’ll know on Thursday, when Centrica declares its first half results. But certainly the expectation is yes, and that’s got to be a good thing for the Centrica share price.

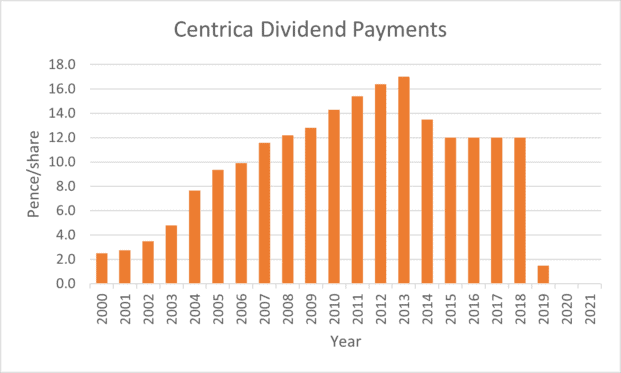

Like many others, the group, perhaps still better known as British Gas to most, suspended its dividend back in 2020 while pandemic uncertainty was at its highest.

Previously, though, it had been a reasonably consistent dividend payer, with a smooth growth rate throughout 2000–2013:

If things go as expected on Thursday, analysts expect Centrica’s chief exec, Chris O’Shea, to confirm an interim dividend of 1p and a final yearly dividend of around 3p-3.5p.

That would give a forecast yield of around 3.5%. Which while not exceptional, it’s certainly back in contention with other popular shares like Lloyds. But I think there’s even more potential for upside on the Centrica share price.

Can Centrica profit from winter gas price volatility?

It’s hard to escape from the news that this winter could be tough on the energy front. With the Russia/Ukraine war continuing to impact gas prices it’s only going to get tighter as demand goes up later this year.

Previously, energy traders would use gas storage to monetise volatility in the gas markets. The closure of Rough, the UK’s main gas storage facility, back in 2017, pretty much took that option (pun intended) off the table.

The closure was driven by cheap energy prices (remember those?!) and ever-rising maintenance costs making it uneconomical to run. Clearly, it’s a different picture these days, with prices sky-high as Russia continues to threaten to cut gas supplies to Europe.

With a UK Government keen to increase energy security, it will make for an interesting conversation with Centrica on how much they are prepared to pay to help support the reopening of Rough.

Are Centrica shares a risk worth taking?

As with all predictions, they may or may not come to pass. Pressure on the government, whoever ends up leading it, to “do something” may well see more painful decisions for Centrica. It’s not impossible to see rises ahead for the new Energy Windfall tax introduced earlier this year, for example.

But overall, I think there’s some real positive potential behind the Centrica share price for the first time in a long while. I’ll be keeping a close eye on them when it comes to my next share purchase for sure.