As a luxury stock, Burberry (LSE: BRBY) is meant to be ‘inflation-proof’. However, the company’s most recent Q1 trading update showed below average results. Nonetheless, a boost in revenue could be in the pipeline. So, is now the perfect time for me to buy Burberry shares?

Growth wearing off?

That’s what one might think when looking at the headline numbers from Burberry’s most recent trading update. Comparable store sales were flat with a measly 5% revenue growth on a year-on-year (Y/Y) basis. To make things gloomier, sales in the US and China declined 4% and 35% respectively.

| Metrics | Q1 2023 | Q1 2022 |

|---|---|---|

| Retail Revenue | £505m | £479m |

| Comparable Store Sales Growth | 1% | 90% |

However, these figures start to look a little less negative when taking a number of more important factors into consideration. For one, the decline in American sales were due to tough comparisons from the year before, as the continent lifted lockdown restrictions. On a three-year basis, sales are actually up by 62%! As for China, sales were heavily impacted by lockdowns.

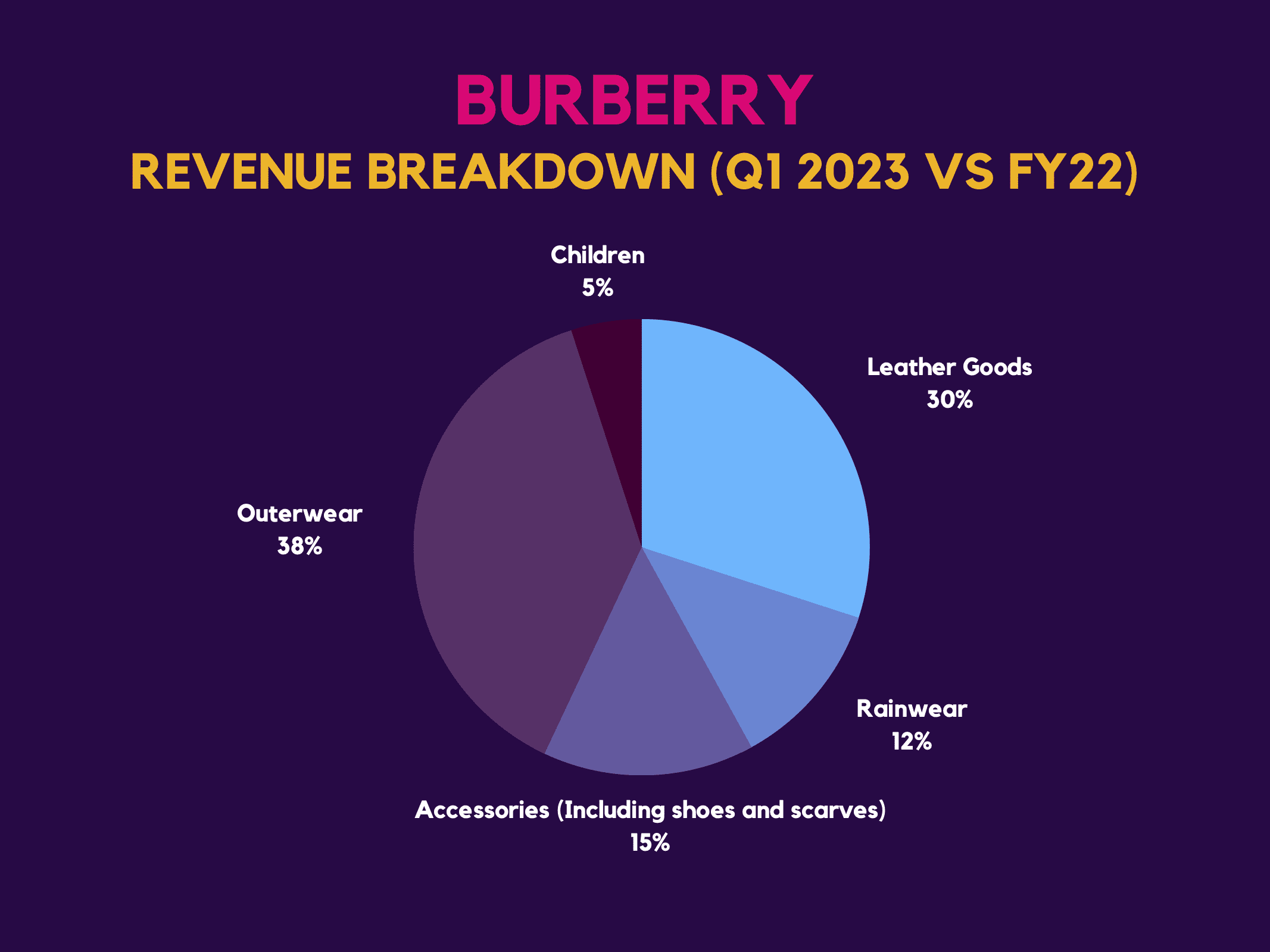

Excluding China, sales figures were actually rather impressive. They were 16% higher in Q1 on an annualised basis, with EMEIA showing an impressive 47% growth. Additionally, the company’s most profitable line of products (leather goods and outerwear) saw double-digit growth. This was helped by its partnership with Bimba Y Lola, which contributed to 21% growth in leather goods, excluding China. Moreover, continued investments in digitalisation and AR technology saw new Burberry products and collections reflect strong performances.

Profits are well coated

Despite a substandard Q1 report, management still expects a positive FY23. CFO Julie Brown mentioned that the FTSE 100 firm expects high single-digit revenue growth. She also expects the designer to achieve an operating profit of 20% through to FY24. While gross margins are forecasted to come in lower in H1, she anticipates this to be higher in H2, as a general move towards higher priced items should help margins.

In addition, a 5% increase in operating expenses should remain steady for the time being. This is due to Burberry’s long-term lease agreements protecting it from higher rental costs. As such, Burberry will still have sufficient levels of cash to expand its business with an estimated capital expenditure of £170m to £180m. Therefore, the British firm is on track to delivery 65 newly designed stores by the of its financial year, with its sales outlook remaining unchanged.

| Cost Increases | Percentage |

|---|---|

| Transportation | Double-digits |

| Commodities | Mid-single-digits, with a number of commodities in double-digits |

| Labour | Mid-single-digits, with higher figures in certain countries |

Love is in the air

Keeping everything in mind, is this an opportune time to buy Burberry shares then? Well, management is still confident for growth in sales and revenue in the medium and long term. As China stores reopen, I’m anticipating a huge recovery in sales figures in the second half of the year, provided no further lockdowns occur. Chinese Valentine’s Day is also coming up, with Singles Day around the corner as well. Hundreds of billions of dollars are spent on occasions like these, and if Burberry can capitalise on this, it should see its sales figures soar.

Having said all that, I think this is a good time to buy Burberry shares for my portfolio. The company’s business seems to be ‘inflation-proof’ as it’s been able to pass on higher costs to consumers with no resistance. And as the Chinese population becomes increasingly affluent, an increase in luxury good spending should benefit Burberry shares for years to come.