Earnings results are a great way for investors to judge a company. They’re used to determine whether companies are on track with their initial guidance. These results can often radically move share prices in either direction, depending on the numbers reported. So, here’s an earnings preview for three FTSE firms reporting results this week.

The usual approach is to compare firms’ new numbers to those from prior years. But certain revenue figures may have been impacted by the pandemic, so it’s important to get context from pre-pandemic levels too. It can also be useful to consider whether a company can perform better than its previous year’s numbers, or if it can beat analysts’ annual forecasts. Analysts in the UK don’t always publish earnings previews for quarterly or half-year periods, but given their popularity, the shares covered below are exceptions. All of them have financial years that end in December.

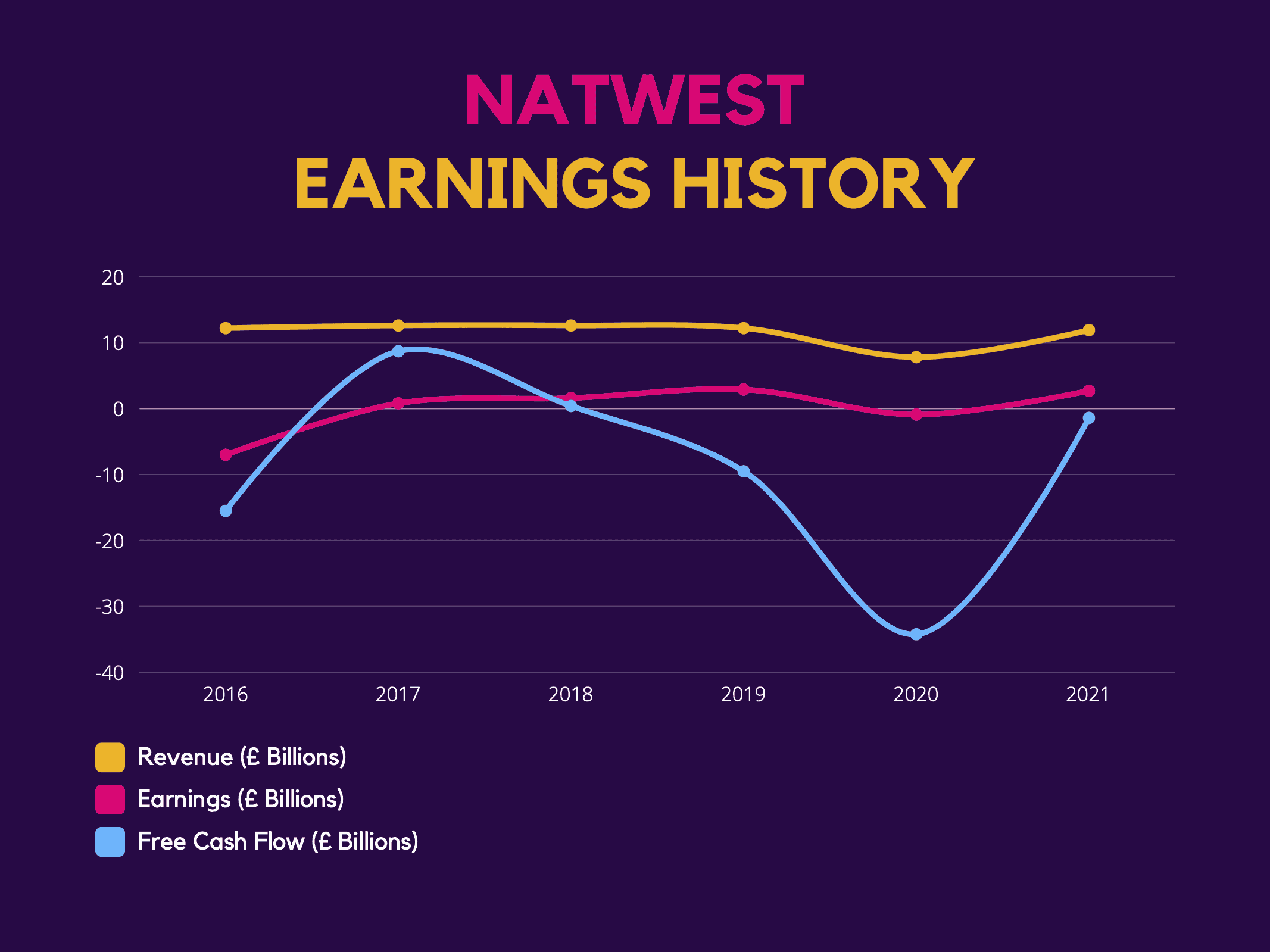

Rio Tinto (H1 Earnings)

Rio Tinto (LSE: RIO) is an Anglo-Australian multinational company. It’s the world’s second-largest metals and mining corporation. The FTSE 100 firm’s main export is iron ore. Rio is set to reveal its H1 numbers for its six months performance ending June on 27 July.

Its earnings preview seems to indicate a slowdown in both its top and bottom lines. This is most likely due to the perpetual lockdowns in China that have been limiting construction activity. China is the group’s biggest customer, hence the gloomy forecasts. That being said, a sudden change in health policy in China could see Rio edge closer to its FY21 figures and could spell a healthy jump in its stock.

| Metrics | Amount (H1 2021) | Analysts Earnings Estimates (H1 2022) | Amount (FY21) | Analysts Earnings Estimates (FY22) |

|---|---|---|---|---|

| Revenue | $33.1bn | $29.8bn | $63.5bn | $58.1bn |

| Underlying Earnings per Share (EPS) | $7.52 | $5.17 | $13.21 | $9.71 |

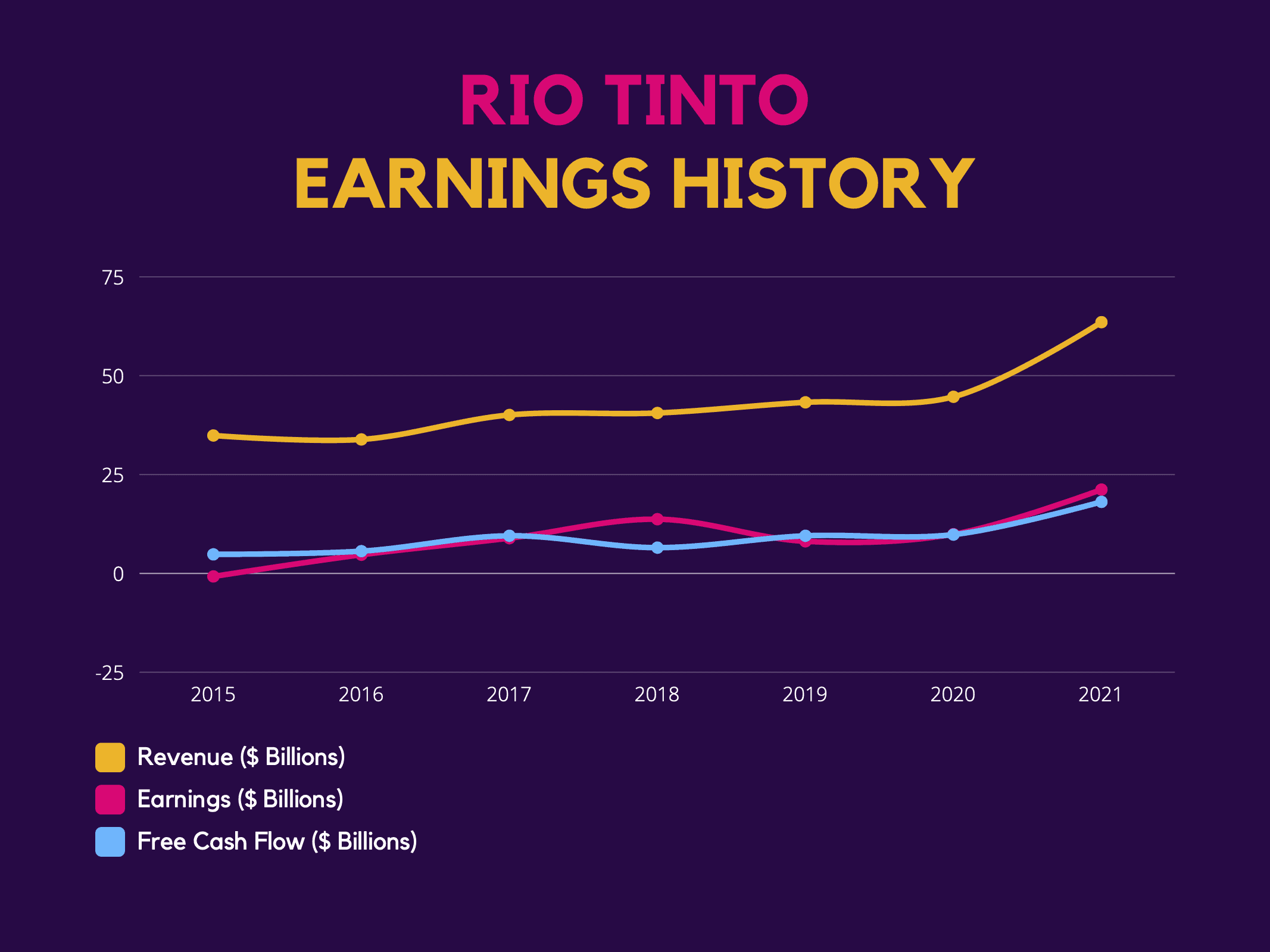

Barclays (Q2 Trading Update)

Barclays (LSE: BARC) is one of the UK’s biggest banks. It operates in many countries across the globe, and also operates an investment banking division. The bank is expected to disclose its Q2 figures for its three-month performance ending June on 28 July.

Analysts covering Barclays are expecting the bank to improve on its total income marginally this half, on a year-on-year basis. However, its most recent earnings per share estimate has been downgraded from 7.6p in the last week. The increase to its top line is most likely due to the effects of higher interest rates. Nonetheless, a decrease in investment banking activity from the current bear market is going to cause its bottom line to suffer. But if the dual-listed stock surprises investors with better than expected figures, a rally could be a possibility.

| Metrics | Amount (Q2 2021) | Analysts Earnings Estimates (Q2 2022) | Amount (FY21) | Analysts Earnings Estimates (FY22) |

|---|---|---|---|---|

| Total Income | £5.4bn | £5.5bn | £21.9bn | £24.0bn |

| Basic Earnings per Share (EPS) | 12.7p | 6.0p | 37.5p | 24.8p |

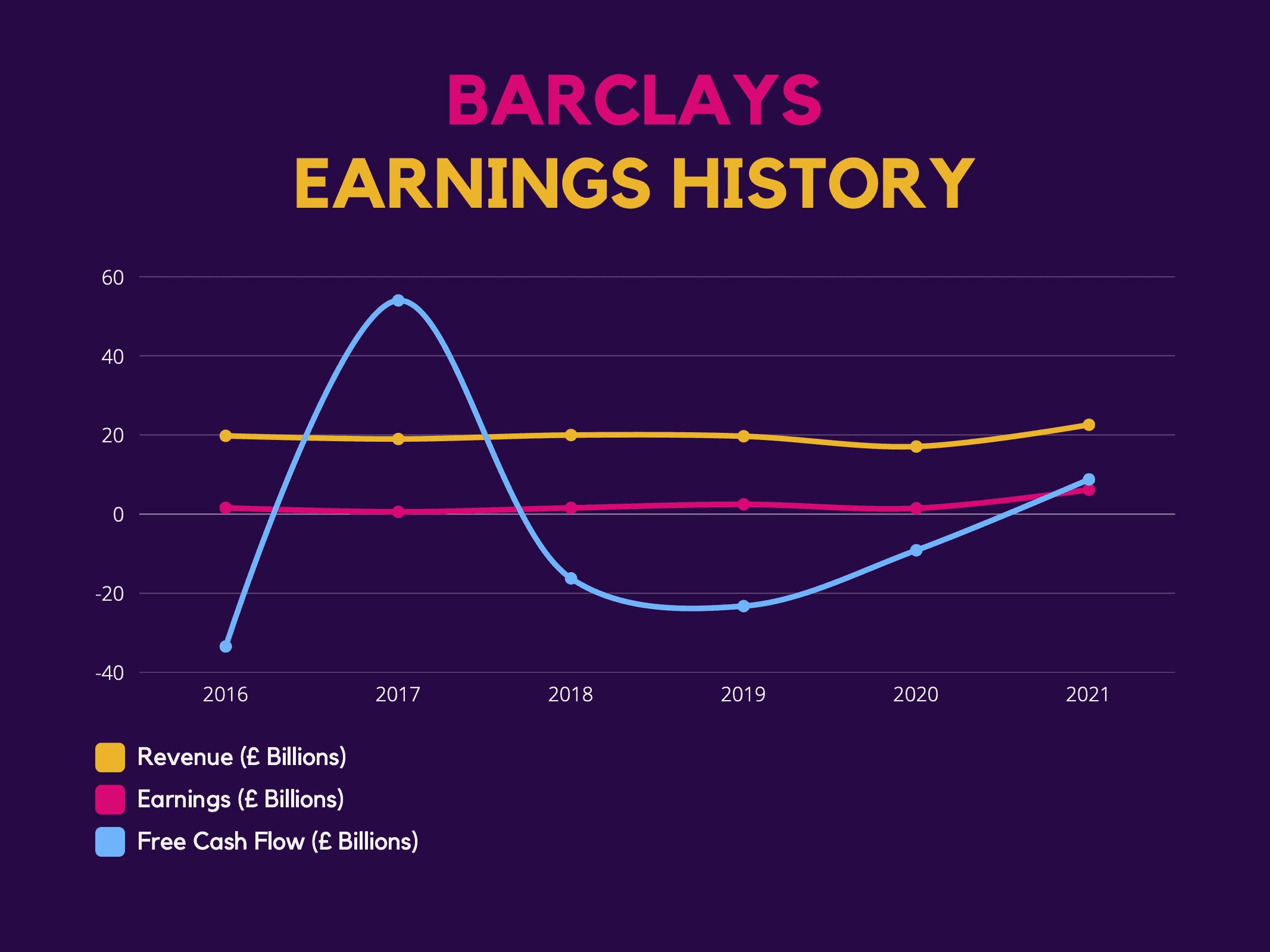

NatWest (H1 Earnings)

NatWest (LSE: NWG) is another UK bank reporting results this week. The group operates a wide variety of banking brands, offering personal and business banking, private banking, insurance, and corporate finance. It’s scheduled to unveil its H1 earnings for its six months performance ending June on 29 July.

Just as is the case with its sector peer, analysts are expecting the same trend. Alongside that, investors in its shares and the wider stock market will be paying attention to its remediation figure and number of late-stage loans to determine whether the UK is heading for a recession. The former is essentially the amount of money allocated as a buffer to cover potential defaults from customers.

| Metrics | Amount (H1 2021) | Analysts Earnings Estimates (H1 2022) | Amount (FY21) | Analysts Earnings Estimates (FY22) |

|---|---|---|---|---|

| Total Income | £5.3bn | £5.9bn | £10.5bn | £11.7bn |

| Basic Earnings per Share (EPS) | 15.6p | 13.6p | 25.4p | 23.0p |