Rolls-Royce (LSE: RR) is most renowned for its civil aerospace division. However, its other businesses in defence and power systems also hold plenty of potential. With the company disclosing a flurry of new deals, partnerships, and innovations this week, I think Rolls-Royce shares are worth a closer look.

Innovations taking off

As defence spending ramps up worldwide in light of the Russia-Ukraine war, Rolls-Royce stands to be a beneficiary. The FTSE 100 firm unveiled a new Orpheus engine this week for its defence segment. The radical new engine can be used for low-cost, unmanned, small engine applications. Furthermore, its agile approach allows it to be built in half the time of a normal engine. This changes the way products and technologies are developed for the UK’s Future Combat Air Strategy (FCAS), and will help deliver the capabilities to fight and win in most hostile environments.

Additionally, Rolls-Royce announced a collaboration with the likes of the Royal Air Force, UK government, and Reaction Engines to develop hypersonic technologies. This is thought to be groundbreaking as the UK lags behind the likes of China, Russia, and the US in that space.

Nonetheless, the most exciting development for me this week was the announcement of the H2ZERO partnership with easyJet. The purpose of the programme is to pioneer the development of hydrogen combustion engines for aircraft by the mid-2030s. If successful, this could be revolutionary and do the Rolls-Royce share price wonders, as it’ll have first mover advantage in the hydrogen fuel space.

Cutting edge technology

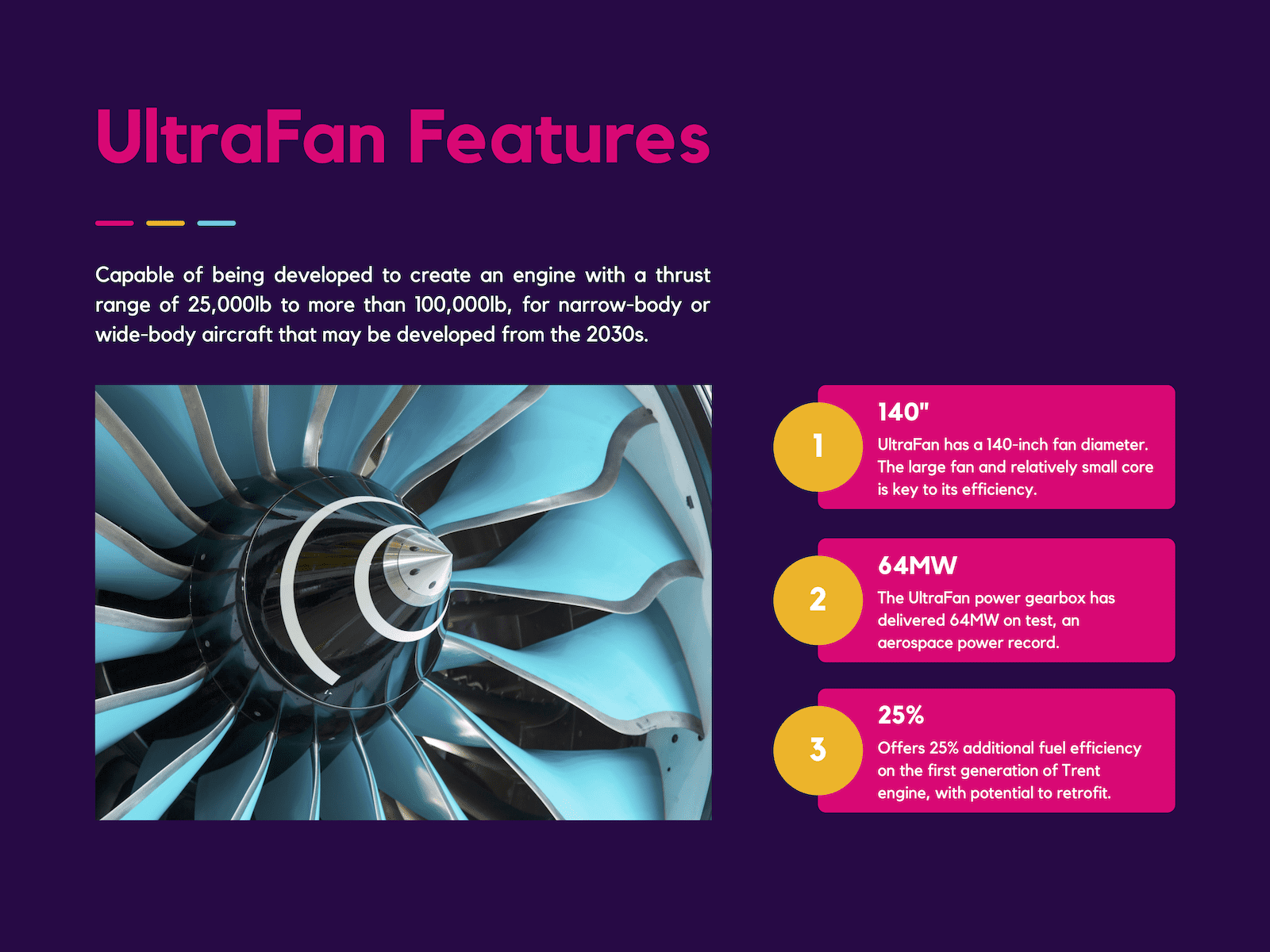

The exciting developments don’t just end there though. The manufacturer announced that it’s in the final build phase of its UltraFan programme, with tests set to start this year. The UltraFan is among the products Rolls-Royce has in its portfolio to encourage more sustainable air travel. It also boasts a suite of technologies that can be used in the group’s energy and power systems segments.

Additionally, the power and flexibility provided by UltraFan gives it the potential to power both narrow and wide-body aircraft. Given that the former is a segment of the commercial market that Rolls-Royce has no exposure to, this would expand Rolls-Royce’s market share in the aero engine space.

Total care of money

Despite all the exciting news, however, it’s crucial to note that the company can’t fund these projects if it doesn’t shore up its balance sheet. As such, Rolls-Royce will have to ensure two things. The first is to wrap up its ITP Aero sale, worth £1.5bn. The second would be to have free cash flow as soon as possible. If this can be achieved, the engine supplier should be able to start paying down its debt by 2024.

| Metrics (FY21) | Figures |

|---|---|

| Debt-to-Equity Ratio | -132% |

| Debt | £6.1bn |

| Cash and Equivalents | £2.6bn |

| Free Cash Flow | -£813m |

Nevertheless, strong tailwinds from the travel industry should help with free cash flow, while three TotalCare deals struck with flypop, Norse Atlantic, and ITA Airways should serve as further catalysts. The deals bring an additional 50 Rolls-Royce engines to the servicing line.

With all that in mind, will I buy Rolls-Royce shares? Well, this week’s developments are certainly enticing. However, I’m still wary about the company’s financials. So, until these show a concrete improvement, I won’t be buying the shares. Instead, I’ll be keeping it on my watchlist for now, and cheering on from the sides.