Having risen 31% in 2021, the Lloyds (LSE: LLOY) share price is on its way back down. The stock dropped below 50p in late February and is now at risk of entering the 30p-40p range. With a potential recession on the cards, this could be a possibility.

Interesting developments

In theory, bank stocks should benefit from interest rate rises. This is because they can charge higher interest rates for lending money, thus giving them higher margins. And because of Lloyds’ healthy reserves, it’s been able to keep interest rates it pays out for savings accounts at an all-time low, while charging customers more for loans. As such, I would normally expect its share price to rally. Nonetheless, the opposite has happened. So, why’s that been the case?

The roof’s caving in

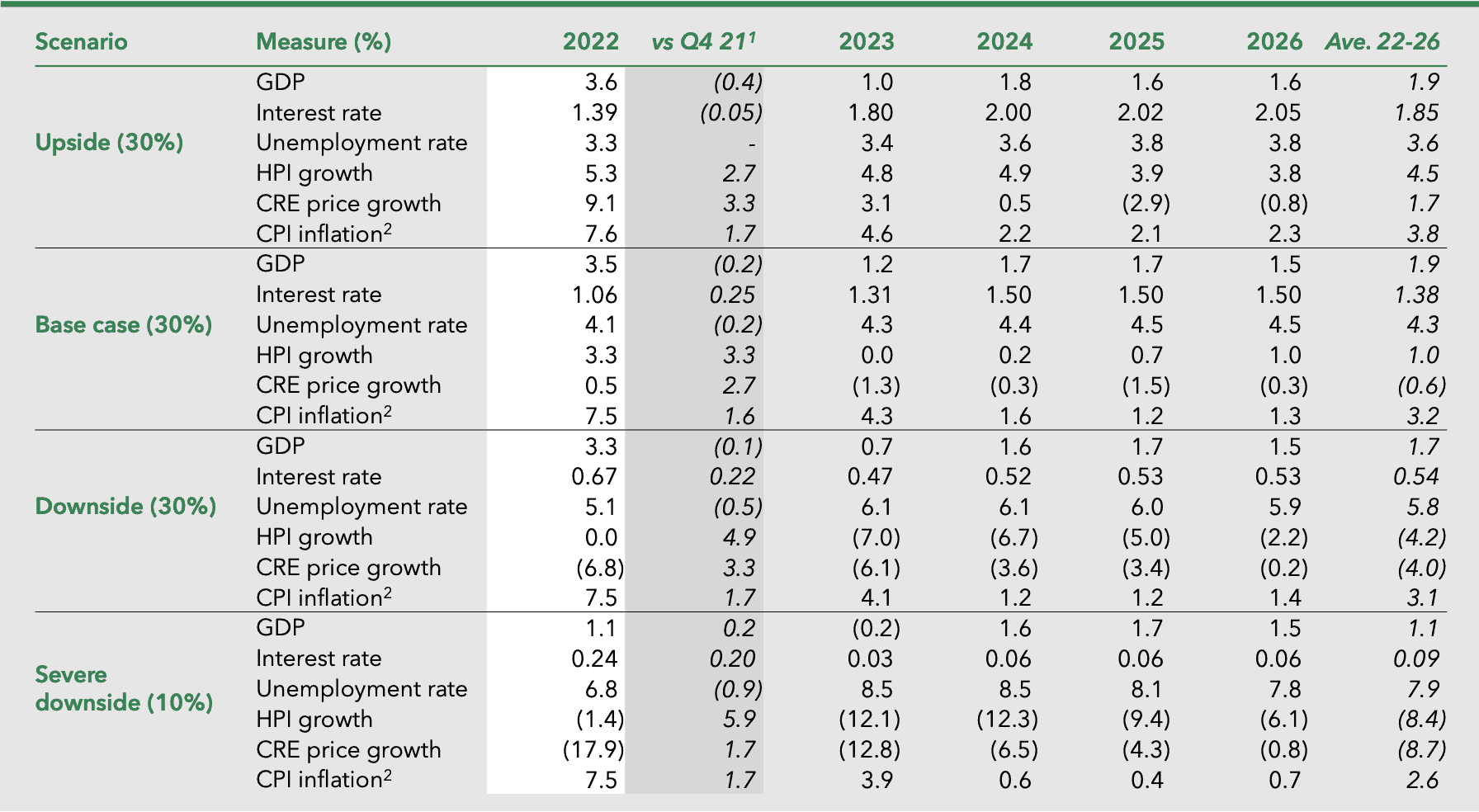

In its last trading update, the bank included a table that consisted of prudent economic scenarios. It listed several conditions that have to be met in order for the company to benefit from rising interest rates.

Based on the current economic data and forecasts, Britain’s biggest bank has some upside potential. GDP for 2022 is set to be in line with or better than its various scenarios at 3.5%. Interest rates are expected to increase by more than 1.39%, and the unemployment rate should remain below 4%. However, that’s where the positives end.

The Bank of England (BoE) expects inflation to peak at 11% this year. But more importantly, both the Halifax and Rightmove‘s house price index have indicated that house price growth is beginning to stall. If this continues, it would fail to meet Lloyds’ projections of HPI growth and CRE price growth, endangering its projections. Given that most of its revenue stems from property-related loans, a slower home loans market could offset potential gains from higher interest rates.

Handouts in jeopardy

The FTSE 100 firm currently has a dividend yield of slightly more than 4%, which is above the index’s average. If I’d bought in hopes of a bigger payment at the next declaration date as a result of better margins, I could be disappointed.

Earlier this week, the BoE released its latest Financial Stability Report. It said UK lenders appear to be resilient. Nevertheless, major UK banks would have to set aside more cash to absorb any shocks in the financial markets from next year.

Lloyds will have to raise its buffer for bad debts. The group had already set aside £178m to cover potential customer defaults in Q1, but this is set to increase due to the BoE’s guidance. Consequently, I think its dividend payments might not increase by a huge margin. I could be wrong though. Analysts are forecasting its dividend to grow by 16.1% in the coming year. This may earn me some passive income if I were to invest.

For me, investing in Lloyds is like investing in the British economy and its property market. Economic projections from the World Bank and OECD are less than bullish for the UK currently. Then there’s sky-high inflation and a potential housing market decline that won’t do Lloyds’ top line much good. For those reasons, I won’t be investing in Lloyds shares, as I think its share price could drop below 40p soon.