Marks and Spencer (LSE: MKS) shares are down 40% this year. Despite that, the retailer reported excellent numbers in its most recent full-year results, with plenty of promise for the future. As such, I think a closer look at the company is warranted.

Hungry for more

After years of declining profit margins, Marks and Spencer launched its latest turnaround programme in 2020 under the Never the Same Again name. This bid to improve the brand’s image and business operations looks like it might be working. The FTSE 250 firm has posted an excellent recovery since, with improvements in customer perception of the M&S brand. As a result, M&S Food sales grew 10.8% year-on-year, while expanding its market share from 3.4% to 3.6% over a three-year period. This was also helped in part by its key partnerships with Coca-Cola‘s Costa Coffee and Ocado.

Additionally, the firm saw its operating margins improve in the second half of its financial year. Even so, I was impressed that the board is aiming to further improve its food supply chain through boosting efficiency and cutting costs. Thus, I expect its food prices to become more affordable, allowing it to expand its market share.

Getting the right fit

Marks and Spencer isn’t just its food business, however. One of the main reasons behind its poor past performance can be attributed to the company’s inability to keep up with the times, as far as its struggling clothing offer was concerned.

That being said, the Never the Same Again programme gave a breath of fresh air to the retailer’s clothing segment. Consequently, the division saw its sales figure jump 51.6% on the year and 3.8% against three years ago.

There’s also the positive effect of M&S’s investments in digital. With heavy competition from e-commerce giants and more nimble omnichannel retailers, Marks and Spencer was always going to struggle. However, enhanced investment has made its e-sales more market competitive. In fact, market penetration has almost doubled to 34%. This has been helped by around its 40 clothing brand partnerships. Moreover, the acquisition of Jaeger and The Sports Edit have added even more depth and variety to its offer.

A summer with Marks and Spencer

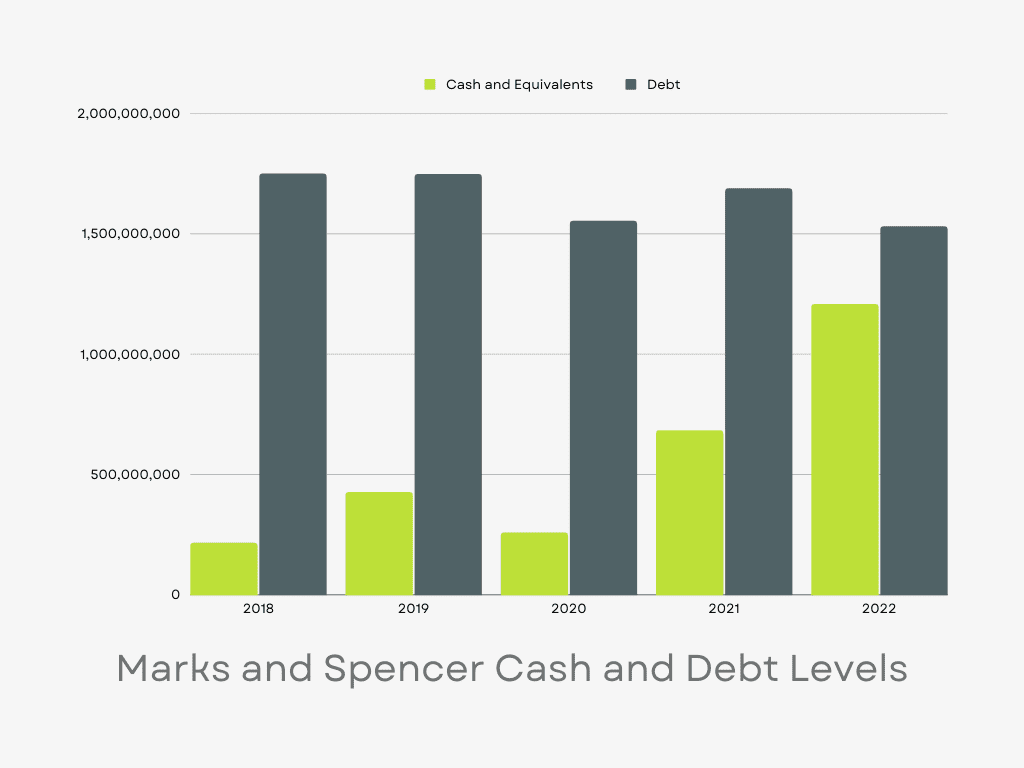

Since 2018, Marks and Spencer has reduced its debt levels by 12%. What impressed me most though, is its cash position, which has grown by a whopping 455%! Furthermore, profit margins are back to a healthier level of 2.8%, with free cash flow at £1.1bn.

Nevertheless, my concerns of a potential recession impacting sales are shared by the board. Having said that, CEO Stuart Machin stated that its market positioning and business strategy will help mitigate any slowdown. He believes that the company has a strong brand image to help it maintain its market share. He also expects strong tailwinds from travel, leisure, and weddings to keep its sales numbers strong.

Marks and Spencer shares have a price-to-earnings (P/E) ratio of 9. While it’s not seen as a traditional growth stock, it does have an average price target of £1.93. This gives it the potential to rebound by 43% over a one-year period. Therefore, I’ll be capitalising on its low share price and will buy some stock for my portfolio in July.