International Consolidated Airlines Group (LSE: IAG) shares are currently trading at £1.15, and are down 25% this year. Given the current economic landscape, its stock could be in further trouble, and here’s why.

Excess baggage

From Covid, to inflation, and now airport disruptions, the travel industry can’t seem to catch a break, and this week has been one of the more disruptive ones. Staff shortages, technical difficulties, and rail strikes have served up a perfect dish of chaos for IAG.

On Monday, Heathrow Airport suffered a widespread problem with its baggage system. As a result, Heathrow requested airlines to cancel 10% of their flights from Terminals 2 and 3. Although IAG’s main hub is located at Terminal 5, this still affected the limited number of IAG services at T2 and T3.

To make matters worse, Gatwick Airport capped its daily operations to 825 flights a day in July, and 850 flights a day in August, due to staff shortages. This has led to delays and flight cancellations, with easyJet suffering the brunt of it. Nevertheless, I doubt IAG is spared from this as I’m expecting a number of its services to be impacted as well.

Three strikes and you’re out

Three weeks ago, British Airways check-in staff threatened to strike in July. This is because their pay has yet to return to pre-pandemic levels after salary cuts made during the pandemic. With the deadline fast approaching on 27 June, IAG is stuck between a rock and a hard place.

For one, the board could reinstate workers’ pay, but doing so would impact its already fine margins. To mitigate this, British Airways would have to increase its ticket prices, which might dampen demand and extend its route back to profitability.

On the other hand, not doing anything could be equally devastating. A lack of check-in staff might lead to further delays and cancellations, which wouldn’t be good for IAG shares. Seeing that British Airways is the group’s biggest revenue driver, a strike could impact IAG’s top line quite substantially.

Delayed departure

In its last trading update, IAG mentioned that it expects to achieve operating profitability by Q2. However, this seems to be increasingly unlikely. Apart from potentially having to fork out higher wages or lose millions in revenue, the FTSE 100 firm still has to deal with high oil prices.

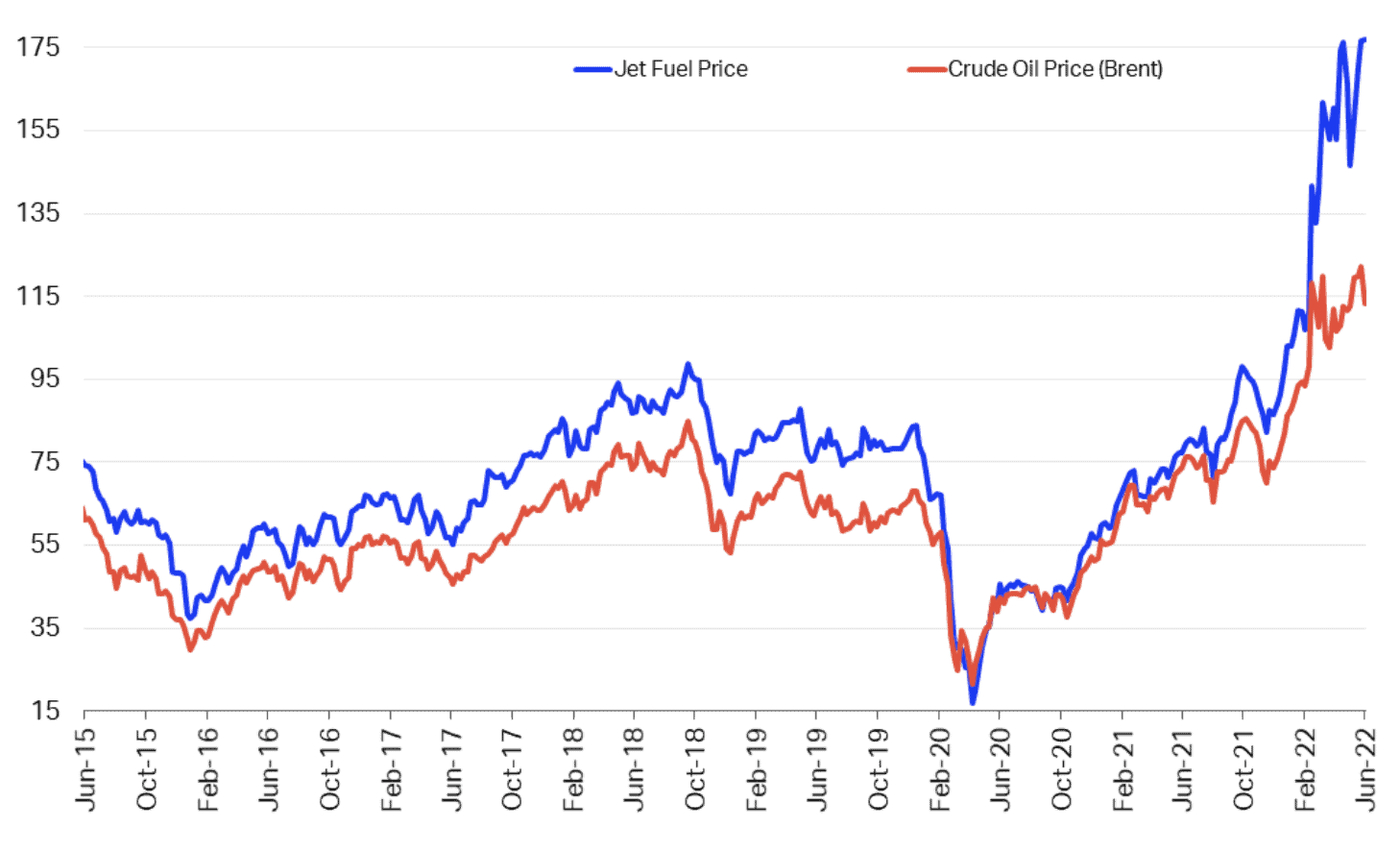

Since its Q1 update, jet fuel prices have hit fresh new highs of $175 per barrel, which isn’t going to do its bottom line any favours. Additionally, the Consumer Price Index in May continued to hit 40-year highs at 9.1%. With fears of an impending recession, this is most likely going to dissipate the travel tailwind and send IAG shares even lower.

More importantly, IAG’s balance sheet is in a terrible state. Its debt-to-equity ratio sits at a staggering 2,318%, while its short-term assets can’t cover its short-term liabilities. Not to mention, its last reported free cash flow sits at -€885m. This rings alarm bells of a company that’s in big trouble. Therefore, I won’t be investing in IAG shares. Instead, I’ll be parking my money in other growth stocks that have better financials.