Down more than 10% this year, the Tesco (LSE: TSCO) share price is trading at the £2.50 mark. The grocer gave a Q1 trading update on Friday, and its share price was largely unmoved. With a current price-to-earnings (P/E) ratio of 12 and a 4% dividend yield, Tesco shares may be great value.

Putting eggs in different baskets

In light of soaring high inflation and lower consumer spending, Tesco reported a generally decent set of Q1 numbers. Overall, group retail sales were up 2% year-on-year (Y/Y), and total sales also saw an increase of 2.5% (Y/Y).

On face value, these figures were confusing to me as I was expecting a decline. However, upon further analysis, these numbers were boosted by the company’s other segments. UK and Republic of Ireland retail sales saw declines of -1.5% and -2.4% respectively. But healthy growth in fuel (44%), Tesco Bank (39%), Booker (19%), and central Europe (9%) helped push the overall top line up.

What caught my eye most was Tesco’s Booker business, which caters food for smaller grocery stores and restaurants. It is a market leader with strong pricing power, high margins, and a growing customer base.

The subsidiary saw 19.4% growth (Y/Y) and 19.6% growth on a three-year like-for-like basis. This is impressive given that CFO Imran Nawaz confirmed that catering inflation is running higher than retail inflation. Given its higher margins, I expect Booker’s performance to hedge against the lower margins from Tesco’s retail business.

Tesco is the way to go

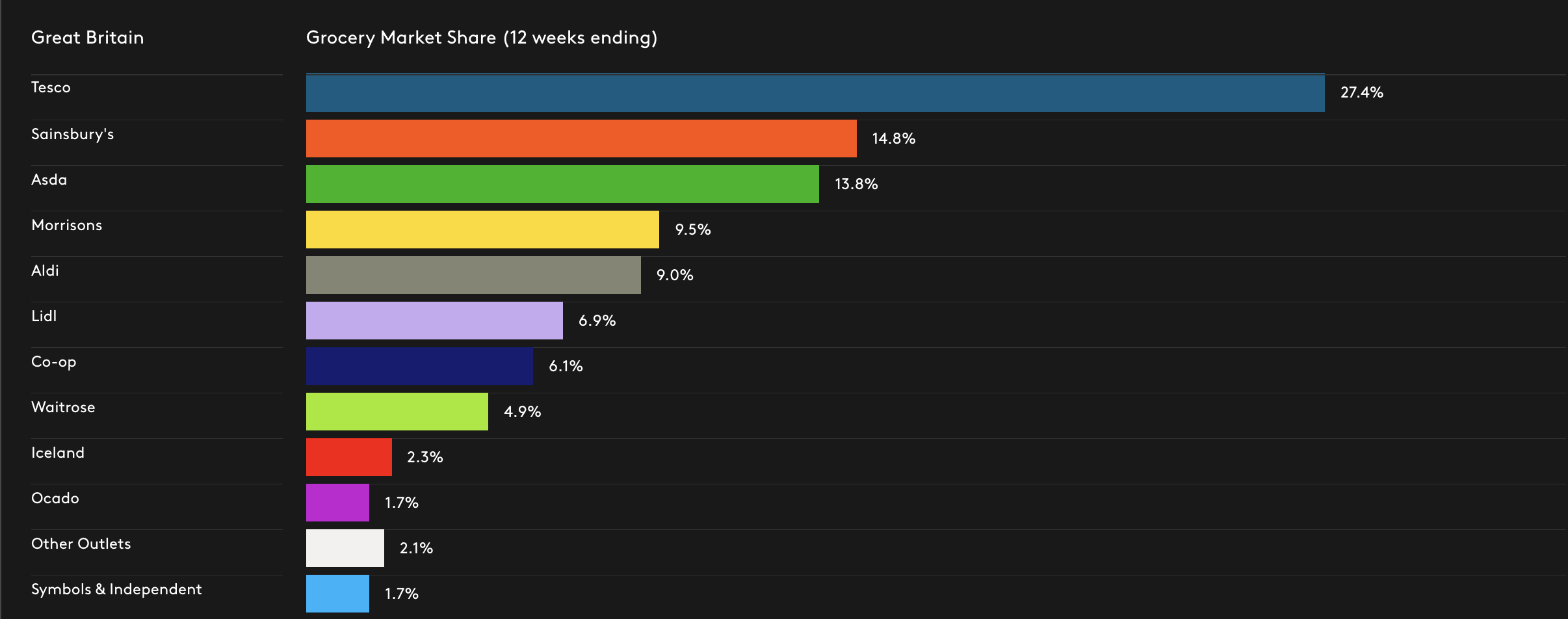

Despite a decline in retail sales, Tesco still manages to outperform the bulk of its peers. In the most recent quarter, the grocer snatched up a further 0.37% of market share, further establishing itself as a market leader. CEO Ken Murphy attributed this growth to a number of factors. These include low prices, its Clubcard scheme, supply chain availability, and shopping experience.

This is evident as Tesco increased its line of Aldi price match and Low Everyday Price products by 19% (Y/Y). Additionally, the FTSE 100 firm had the largest improvement in quality and value perception since the pandemic, showing that shoppers do enjoy shopping at Britain’s number one supermarket.

Drop the Basket

Positives aside, there’s no doubt that Tesco faces strong economic headwinds. Its CEO even went on to say, “We are seeing some early indications of changing customer behaviour as a result of inflationary environment”. As a result of this, I expect Tesco’s shares to take a further dip in the near-term.

Nonetheless, management reaffirmed the company’s retail profit guidance, which remains unchanged at £2.4bn to £2.6bn. This is largely similar to its FY22 figure, although free cash flow is expected to come in shy at £1.4bn to £1.8bn.

That being said, its balance sheet is in a modest position. Tesco boasts a debt-to-equity ratio of 47.3% with decent levels of cash and equivalents. As it continues to establish further dominance in the groceries market, I’m confident that Tesco is in a firm position to brave a potential recession. Even so, its low growth potential doesn’t fit my personal investment strategy. So, I won’t be buying Tesco shares for the time being.