April’s consumer price index has inflation pointing at 9%. With the FTSE 100 largely unmoved this year, not many of the index’s shares have managed to outperform the stock market. That being said, although 5% down this year, Burberry (LSE: BRBY) shares could be a potential hedge against inflation.

Luxurious inflation

The moat of luxury brands is their ability to thrive in high inflation environments. This is due to their inelastic demand and ability to pass on costs to customers. Higher prices are perceived as a status symbol, rather than a weight on the consumer’s wallet.

Burberry’s recent expansion in China shows how important diversification is in building a moat. While its European and Middle Eastern sales suffered last year from high inflation and Covid travel restrictions, its Chinese sales performed exceptionally well. Low inflation paired with an ever increasing number of consumer spending on luxury goods in China certainly helped the firm’s top line.

The yuan makes cents

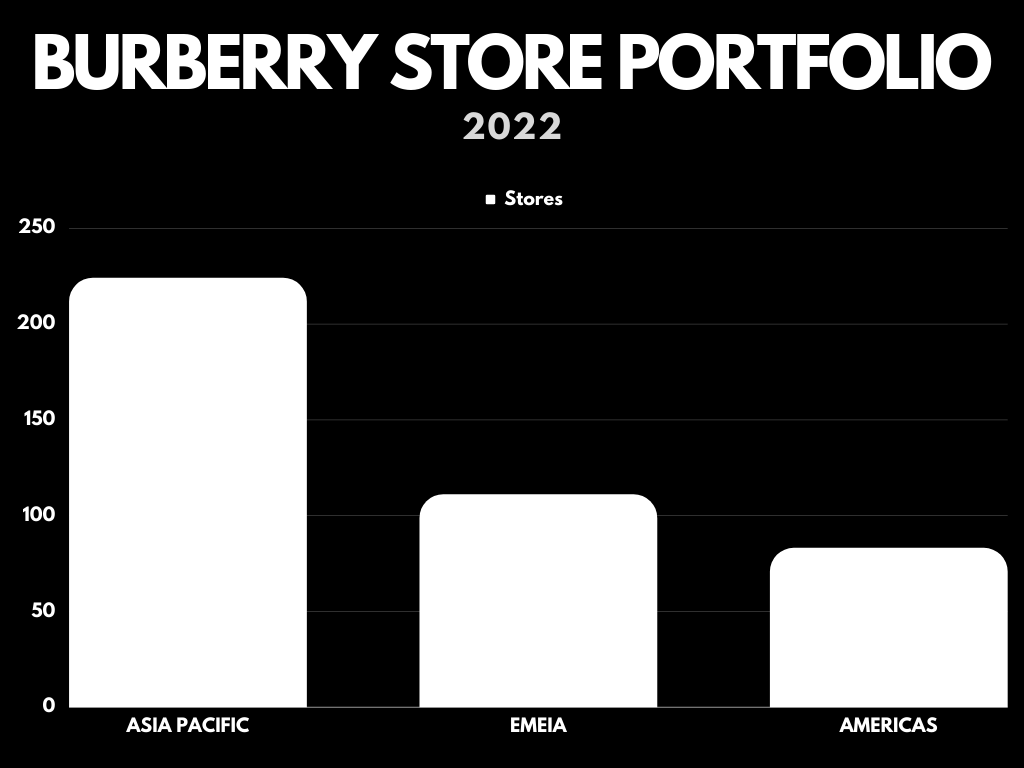

The result of Burberry’s rapid expansion in China reflects in its income statement, as China is the company’s main revenue driver — Burberry has opened 224 stores in Asia Pacific. China’s increasingly affluent population is taking a bigger share in the world’s luxury market. In fact, the share of Chinese luxury consumer spending is now 21% of the global market, up from 11% just two years ago.

On the flip side though, China’s zero-Covid policy has resulted in several city-wide lockdowns. This has made growth volatile. Chinese sales figures were affected in Q4, with further impacts expected in this year’s first half.

Nonetheless, Burberry still posted positive results for the year. Despite the slowdown in China, both the firm’s top and bottom lines exceeded expectations. Additionally, Burberry gave a rather upbeat outlook for the year ahead. It expects revenue to grow at high single-digits, albeit with uncertainty surrounding China’s lockdowns. However, as China awakes from its lockdowns, I’m expecting the Burberry share price to recover and outperform the current inflation rate.

Long runway

Even though Burberry had a stellar year, I’m still wary of potential future lockdowns that could affect its share price. In spite of that, the retailer has shown its ability to outperform without the support of the Chinese market, as Burberry’s continued investment in digital channels has been vital to its success during Covid. I believe that Burberry has got a long runway of growth ahead with plenty of tailwinds for several reasons.

- China is gradually lifting its lockdowns.

- Travel is starting ramp up globally. As the brand generates a substantial amount of sales from tourists, this should help its top line.

- The Supreme and Lola partnerships continue to attract more customers.

- It introduced 47 new stores in FY 2022 with new concepts, and a further 65 planned for FY 2023.

Given these factors, I’m confident that the FTSE 100 share could turn green very soon. A modest price-to-earnings ratio of 17 and a decent dividend yield of 2.7% makes this stock a lucrative buy for me. As such, I’ll be looking to buy Burberry shares for my portfolio to hedge against inflation.