Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as company news due to their complex nature. Nonetheless, here I’m breaking down this week’s director dealings for three of the FTSE 100‘s top firms.

Lloyds

As Lloyds (LSE: LLOY) continues its share buyback programme, the British bank has seen its stock price increase by 3% this week. A hawkish Bank of England has been stoking uncertainty surrounding Lloyds’ future. This arguably led to a number of director dealings happening this week.

Most notably, Lloyds’ CFO William Chalmers and Chief of Staff Janet Pope purchased a large number of shares. However, Group Corporate Affairs Director Andrew Walton and Scottish Widows Chief Executive Antonio Lorenzo also sold a substantial number of shares.

- Name: William Chalmers (Chief Financial Officer)

- Nature of transaction: DRIP shares

- Date of transaction: 20 May 2022

- Amount purchased: 168,865 @ £0.44

- Total value: £74,409.46

- Name: Antonio Lorenzo (Chief Executive, Scottish Widows and Group Director, Insurance and Wealth)

- Nature of transaction: DRIP shares

- Date of transaction: 19 May 2022

- Amount purchased: 884 @ £0.43

- Total value: £383.86

- Name: Antonio Lorenzo (Chief Executive, Scottish Widows and Group Director, Insurance and Wealth)

- Nature of transaction: Disposal of shares

- Date of transaction: 20 May 2022

- Amount sold: 250,000 @ £0.44

- Total value: £110,062.50

- Name: Vim Maru (Group Director, Retail)

- Nature of transaction: DRIP shares

- Date of transaction: 19 May 2022

- Amount purchased: 31 @ £0.43

- Total value: £13.46

- Name: Janet Pope (Chief of Staff and Group Director, Sustainable Business)

- Nature of transaction: DRIP shares

- Date of transaction: 19 May 2022 and 20 May 2022

- Amount purchased: 85,633 @ £0.44

- Total value: £37,735.00

- Name: Stephen Shelley (Chief Risk Officer)

- Nature of transaction: DRIP shares

- Date of transaction: 19 May 2022

- Amount purchased: 1,563 @ £0.43

- Total value: £678.70

- Name: Andrew Walton (Group Corporate Affairs Director)

- Nature of transaction: Disposal of shares

- Date of transaction: 19 May 2022

- Amount sold: 184,216 @ £0.43

- Total value: £79,986.68

IAG

The IAG (LSE: IAG) share price is up about 4% this week as the group announced a share buyback programme on Tuesday. Apart from that, a number of big director dealings occurred at IAG. Chairman and Iberia CEO Javier Sanchez-Prieto and CFO Nicholas Cadbury made the headlines. The latter had already received 1,473,207 shares as a part of IAG’s executive share plan, which will be vested in three tranches annually. Despite that, Cadbury still purchased more shares.

- Name: Javier Sanchez-Prieto (Chairman and CEO Iberia)

- Nature of transaction: Transfer of shares from one nominee account to another nominee account with no change of beneficial ownership

- Date of transaction: 23 May 2022

- Amount transferred: 181,014 @ Nil

- Total value: N/A

- Name: Nicholas Cadbury (Chief Financial Officer)

- Nature of transaction: Acquisition of shares

- Date of transaction: 24 May 2022

- Amount transferred: 254,979 @ £1.23

- Total value: £312,604.25

SSE

SSE (LSE: SSE) reported a decent set of numbers in its FY22 earnings this week. The firm generated profits of £1.5bn last year, and expects to make even more this year from high energy prices. But a windfall tax from the British government soured investor sentiment, sending the SSE share price down by almost 10%. Still, outgoing non-executive director Dame Angela Strank acquired a respectable number of shares.

- Name: Dame Angela Strank (Non-Executive Director)

- Nature of transaction: Acquisition of shares

- Date of transaction: 25 May 2022

- Amount transferred: 483 @ £18.49

- Total value: £8,929.14

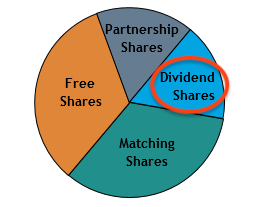

Types of shares in a SIP

To provide context, there are a few types of shares within a company’s share incentive plan (SIP). A SIP is an employee plan for companies within the UK to flexibly award equity to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

In this article’s instance, Lloyds’ director dealings used the dividends they received on SIP shares to reinvest into further Lloyds shares. It should be noted, though, that dividend shares must normally be held in the trust for at least three years to get full tax relief. On the other hand, IAG’s CFO received free shares as part of his compensation package.