After an impressive run from March 2020 to mid-2021, the Royal Mail Group (LSE:RMG) share price dropped. From the most recent high of 590p in June 2021, the Royal Mail share price has fallen 44% to 332p at writing. Some investors blame the combined special and interim dividend of 26.7p. There have also been rising energy prices and high COVID-19-related absences to deal with.

Also, parcel volumes have decreased as people start getting out and about again, and COVID-19 testing kit orders fall. But, given that the Royal Mail stock price is almost half what it was at its peak, I wonder if the shares are now cheap.

Are Royal Mail Group shares cheap?

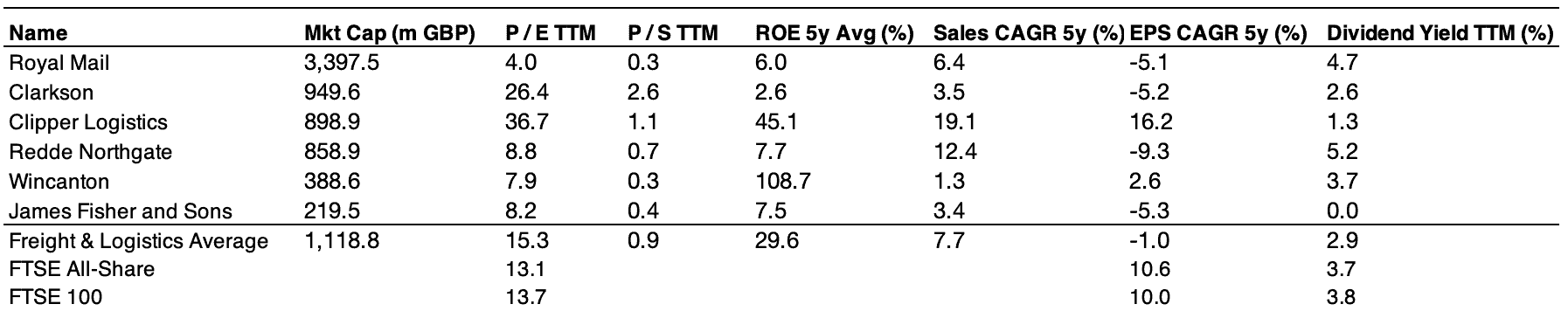

Royal Mail shares are trading at a trailing 12-month (TTM) price-to-earnings (P/E) ratio of around five. The average P/E ratios across the FTSE All-Share and FTSE 100 are 14.8 and 15.5. Across the freight & logistics industry, of which Royal Mail is part, the average P/E ratio is 15.3. On this measure, Royal Mail shares look cheap. However, the company’s shares are trading at a discount for good reasons.

Selected metrics for companies in the freight & logistics industry and UK indexes

Source: Yahoo Finance

Royal Mail’s five-year average return on equity (6%) and its five-year compound annual sales growth (6.4%) are below the average for its industry (29.6% and 7.7%). The company’s normalised compound annual earnings growth is lower than the average for its industry and indexes. Royal Mail does offer an above-average dividend yield of 4.7%.

Can Royal Mail Group deliver for shareholders?

Royal Mail collects, sorts, and delivers parcels and letters to UK addresses. Parcelforce handles express parcel deliveries. General Logistics Systems (GLS) handles the group’s European and North American operations. It has a monopoly position on letters in the UK. However, the addressed mail business is in decline.

Parcels are where the growth is, and there is evidence that Royal Mail is handling the shift to parcels, which now account for 72% of its revenues, successfully. The average revenue per parcel grew from £2.82 in the first quarter of 2019 to £3.16 in the third quarter of 2021. GLS also eeked its revenue per parcel from £4.75 to £4.77 over the same period on a constant currency basis. Overall, group operating margins increased from 2.26% in 2020 to 5.76% in 2021, and on a trailing 12-month basis, they are 8.74%. That is encouraging given Royal Mail accounts for 67% of group revenues and has a high fixed cost structure, compared to competitors, and indeed GLS. The fixed costs are mainly staffing. An upcoming pay deal with one of its largest unions will probably raise those fixed costs this year, although laying off 700 middle managers as planned will partially offset this.

On balance, Royal Mail Group is making good progress in transitioning to parcels but has to maintain its parcels market share for this improvement to carry over to the share price. Amazon is the biggest threat to Royal Mail Group’s dominant position in the UK parcels market. According to Statista, Royal Mail had about 34% of the market in 2020 compared to Amazon’s 15%. Betting against Amazon does not typically go well. However, I think that Amazon will take market share from the smaller competitors first. So, for the moment, at least, I do think Royal Mail Group shares look cheap, and I hold them in my Stocks and Shares ISA.