The NIO (NYSE: NIO) share price has been on a downward spiral for almost all of 2021. Peaking at $63 in January, the shares have fallen almost 55%. Much of this action has been in the past 30 days, where the shares have fallen 29%.

So, what’s going on?

In a nutshell, NIO has found itself in the middle of a few big problems.

No surprise, the first is the pandemic and the effect it has had on vehicle production and delivery. This has been an ongoing theme for the Chinese electric vehicle (EV) manufacturer. Between April and March this year, the firm had to halt production of its vehicles, which translated to a $60m loss. More recently, supply chain issues caused a 65% reduction in month-on-month car deliveries for October. What worries me here is the new threat of the Omicron variant. NIO cannot afford to fall behind in an ever increasingly competitive EV landscape.

This brings me to my second concern for the company – competition. The EV landscape has heated up over the past few years, and this trajectory is only expected to continue. Analysts at Bank of America have predicted that EV IPOs could raise $100bn by 2023. Whilst NIO is facing competition from up and comers, its also competing with some of the most established automakers in the industry. For example, Ford and General Motors have set aside a combined $38bn dollars for EV R&D.

The third main problem driving down the NIO share price is the looming threat of inflation. Inflation erodes the value of future earnings. This heavily weighs down on high-growth stocks such as NIO, which often rely on bullish forward earnings figures to entice investors. Rising inflation is usually remedied by central banks increasing interest rates. If this is the case, it can magnify company debts, of which NIO has just under $3bn.

Why the NIO share price could rise

Although the NIO share price has been falling, the firm is still growing at an astounding rate. As my fellow Fool Stuart Blair points out, 2021 Q3 deliveries rose 100% year-on-year at 24,439. Not many companies can boast stats like that.

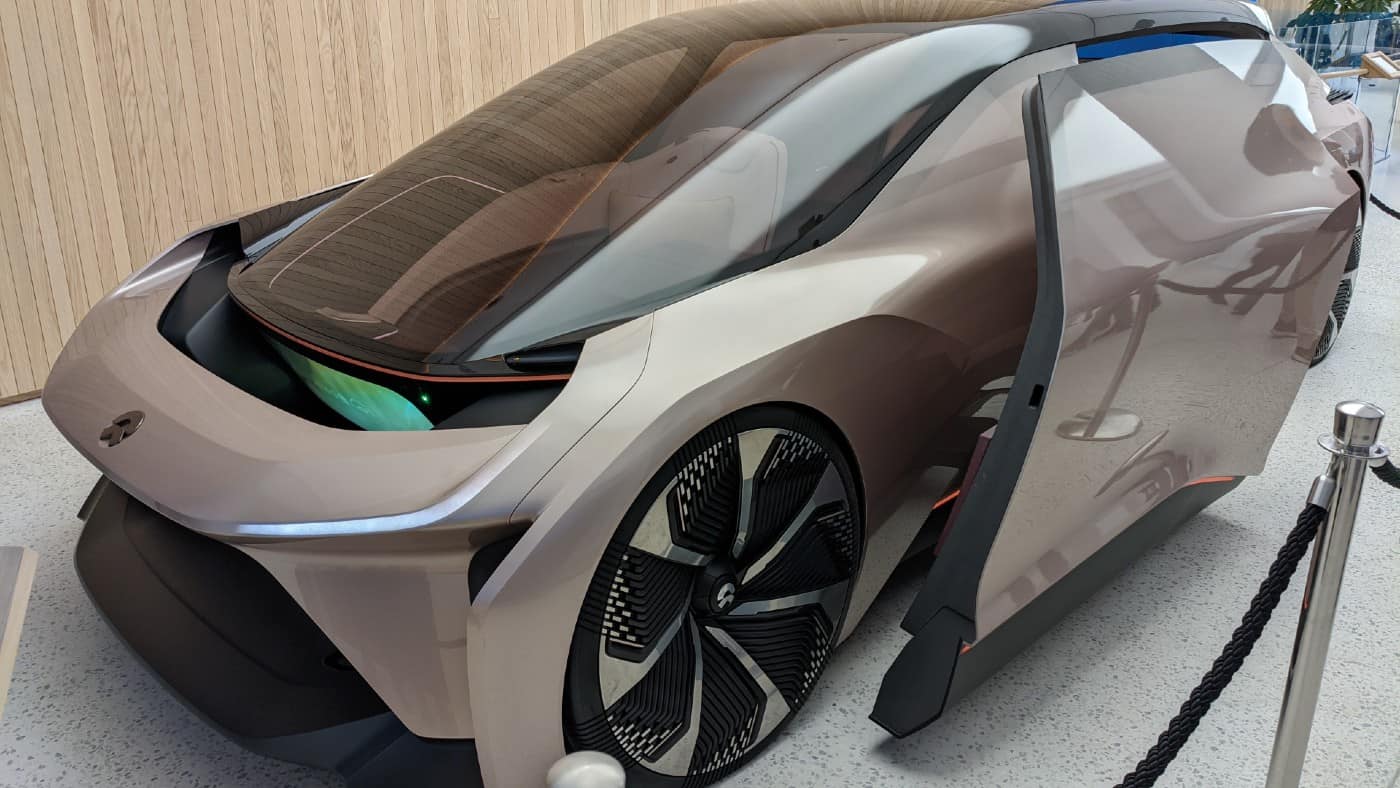

What’s more, on December 18 NIO announced it was releasing a new ET5 sedan model. Due to start deliveries in September 2022, NIO has partnered with Chinese start-up Nreal to provide new augmented reality glasses for the car. I like the fact that the firm is embracing new cutting-edge technology, and I think moving forward this will be critical to set NIO aside from its competition.

Would I buy?

In fact, I have been a holder of NIO shares for some time now. Having covered the stock many times over the past year, I have often reached a bullish conclusion. The stock is currently trading at an encouraging price to sales ratio of 10. This does look cheap to me, especially considering the firm’s high growth. However, at present, it seems that the various problems NIO is battling are getting the better of the share price. I think NIO could have further to fall and, as such, I will wait before adding any more shares to my portfolio for the time being.